Nearly the entire session the SPY Arbitrage model composed of TLT, HYG and VXX showed the levers being pulled to no avail, I showed you the VIX futures being pushed around to no avail, I also showed you HYG earlier as well to no avail and ending the day at session lows.

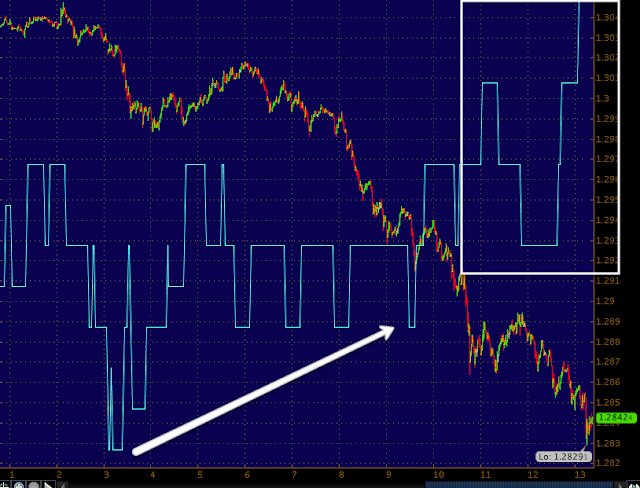

Here's TLT being pushed around with intraday distribution holding it down and trying to keep rates from falling even further.

TLT 2 min intraday distribution to keep this flight on the ground...

However the flight is fully loaded and ready for take-off, this has been clear for a while.

In addition to the normal (but this time extraordinary ) catastrophizing (*verb, to mess up a task that is seemingly painfully simple; to exacerbate a situation that has gone slightly wrong with catastrophic consequences.) the Troika pulls on every bailout (talk about being a Mullins), the Dutch Finance Minister, Dijsselblom (pronounced Diesel-Boom) who is also the head of the Eurogroup held a formal, on-the-record joint interview with Reuters and the FT today, saying that the messy and chaotic Cyprus solution is a model for future bailouts.

This did the markets in despite damage control, ES travelled 20 points from highs to lows, the SPX lost it's gain and nearly new high to close red along with the other 3 major averages.

Before we even get to the market, two things-First thank you to EVERYONE who have sent such incredibly supportive and productive messages to me and my wife, I sent a kind of collage with excerpts from each mail (I didn't include any information that would disclose your identity or email). Thank you again, I'm floored every time this group comes out to give support.

Second, those of you who have been with me for a while know I have covered every EU bailout or mechanism/scheme they've tried to hatch, each one was easily torn to pieces by someone of my intellect within the first day. At first I thought I must be making a fool of myself in tearing apart these seemingly ludicrous plans, but as time went on and we saw the weaknesses and foolishness of each plan actually come to pass and make a bad situation worse, I began to realize, I'm not dumb or a fool, I'm not a genius or rocket scientist either, these plans are simply and obviously that painfully horrible that they can be torn to shreds as soon as the details emerge.

Now if last weekend's announcement that the Troika was going to impair / levy depositors in all Cyrpus' banks, whether they had $1 Eur or $1 bn, wasn't obvious enough as a catastrophic mistake (being the EU-wide $100k deposit protection was just violated-which they had to back peddle on this weekend as it would have and may still cause a pan-European run on the banks), these fools who were really going after Russian deposits from wealthy oligarchs with an initial 9.9%, then up to 40% and then even a total loss, the idiots left the barn door open all last week!

That's right, if you were an average Cypriot and went to take money out of the ATM, the levy was already in place, but for the rick oligarchs that the EU was after to fund this bailout had other means, MANY other means. According to Reuters during the last week of chaos:

" No one knows exactly how much money has left Cyprus' banks, or where it has gone. The two banks at the centre of the crisis - Cyprus Popular Bank, also known as Laiki, and Bank of Cyprus - have units in London which remained open throughout the week and placed no limits on withdrawals. Bank of Cyprus also owns 80 percent of Russia's Uniastrum Bank, which put no restrictions on withdrawals in Russia. Russians were among Cypriot banks' largest depositors.

German Finance Minister Wolfgang Schaeuble said the bank closure had limited capital flight but that the ECB was looking closely at the issue. He declined to provide figures.

The withdrawals by Russians over the last week means that the two Cypriot megabanks are now likely drained of capital and that the levies on those who still have unsecured deposits of over $100k with the two banks will have to be bigger to compensate, in fact so big it will likely mean a complete wipeout of all deposits. In true Mullinsed style, the EU went after the rich Russian oligarchs, ticked Russia off in a huge way that they WILL pay for come next winter as the EU imports most oil and natural gas from Russia's Gazprom who will gladly slow the flow just like they did to the Ukraine and in the end, the targeted Russians take the EU for a ride and caught in the middle is Cyprus which will see no more high end visitors in their hotels, sales of luxury cars or any of the money rich Russians spent to keep their economy alive and they will no longer have the only thing that they had going for them, a financial hub-banking center as the EU has dismantled it!

As for the market, I showed you EU Financial Credit and what happened to financial stocks there shortly after credit diverged negatively, now it's time for the US's financial credit...

Look familiar?

Oh boy...

I've been warning about Financials as well as the broader market and carrying a FAZ long position for Financial short exposure, hopefully (I think there's a decent chance) we get a nice bounce to short in to because most of the Financials don't look very good, GS, MS, JPM, WFC, etc.

As noted, ES dropped 20 points from overnight highs to the comment that let all of the EU now what was in store for them.

ES just managed to claw it way back to VWAP by the close.

As noted during the day today, the Yen popped 1.4% higher as the carry seemingly was covered in a hurry, much to the dismay of Abe and the BOJ.

The carry pairs, EUR/JPY and USD/JPY obviously moved, that's what moved the single currency futures of the Yen above.

I mentioned several weeks back, "In a world where everyone is trying to devalue their currency, the currency that gets bought is the $USD).

The US Dollar Index has gained 4.25% since the start of February, the SPX is in red, this is not the normal correlation, stocks usually go the opposite of the $USD, perhaps this is part of the reason the SPX can't make that new high even when it's only 25 cents away!

As all of this was happening today, the yields on 10-year US paper were headed back to last week's lows (yields move opposite bond prices), the flight to safety is not on again, it never stopped, despite the market trying to make this new nominal SPX high.

The SPX is in danger of losing the Friend found in the trend...

I can almost see it from here, a new closing high, a surge, an upside channel buster and all heck breaks lose to the downside, assuming anyone is brave enough to bid the new nominal high.

As for the futures, right now they aren't looking so hot on an intraday basis, but that rarely holds through the morning...

ES 1 min

ES 5 min has a little hope as noted earlier...

At 15 min where bigger funds flow, back to the rot in the market.

Every breadth indicator I track declined today, that tells you something about what ISN'T happening in the market.

The only saving grace other than the DIA positive divergences and the ES 5 min positive, is the Dominant Price/Volume Relationship today; all 4 major averages closed out the day with a dominant P/V relationship of Close Down/Volume Up, I know this sounds bad to most people, but most people have forgotten the art of volume analysis in leu of the newest, trendiest indicators out there that promise to be the next Holy Grail of Technical Analysis,

The implications of this P/V relationship are that of "Short term" or 1-day oversold, most times when I see this relationship the market is up the next day, think of it as mini-capitulation, all the sellers have thrown in the towel in the short term for now and there's room for demand to drive prices up, although I'm sure they'll need the levers.

The most disturbing thing about traders right now is they look at the market as being bullish, does this look bullish?

That's 2 trading weeks (10 days) of the SPX not able to follow through and move a fraction of a percent to make a new high even with manipulation of credit, rates and volatility among other things.

What I look at when I see this chart is a market desperately trying to climb a wall of worry to make it to 1 objective and I very much doubt from the flight to safety trades, the distribution, the carry trades being closed, etc that this market will have any will to fight when and if it reaches the new high, sure maybe a little algo buying spree that pulls dumb money in, but this has the potential of being one of the biggest, ugliest bull traps ever set, just look at the last time they did it in 2007, that was the top and from there we lost 5 years of a true , healthy bull market in 18 months plus an additional 15% knocked off and most of that damage happened in the span of 8 months.

We have so much less ammunition to hold the market together, a wildly large F_E_D balance sheet that has to be unwound and a true Global epidemic in the markets and we have never really seen what a nasty bear like the 1929 bear would do to a market that is co interconnected globally, just imagine Cyprus, the smallest and meekest of countries that most people can't find on a map, "Could" be the Lehman of 2013.

Be very careful in how you look at this market, price is the most deceptive thing in the market, more so than any central bank.