As I said in the post last night, futures are very ugly right now including or specifically Index futures. If today's short squeeze sponsored gap fill was about letting market makers and specialists unload inventory held at Friday's levels on a fundamental surprise out of China last night, then it is entirely conceivable that they have unloaded inventory and the next break may not be so lucky as to get a gap fill.

Honestly I expected a bit more upside or at least range bound lateral trade tomorrow before any downside, but futures, even though 1 min which is a short timeframe over a long night, as I said last night, are very ugly like last night leading to a very ugly pre-market and open this morning followed by an almost immediate positive divegrence, I don't think this was the buy the dip crowd, I think it was institutionally sponsored and my best guess is that it was done to let market makers and specialists alleviate themselves of rather larger losses if they were holding a pretty decent supply of inventory as usual from Friday's closing levels.

The USD/JPY also looks at risk, not only because of the 3C chart of the pair, but because of the $USDX short term and the macro negative $USD trend as well as the macro Yen positive trend.

The only thing that doesn't quite fit yet is treasury bonds (30 year) look like they could pullback a bit more.

I won't rush to judgement, but as many of you know, I've been comparing the market to a nice pier over the ocean, beautifully appointed on the deck, but below the pilings holding the pier up are rotten to the core and all it will take is some energy like a wave to take the whole structure down. The market's breadth, Leading indicators and 3C indicators all suggest the same analogy for the market.

As for futures...

USD/JPY positive divergence this morning at the lows of the week (plus) with a positive divegrence and a negative divegrence forming now.

$USDX 1 min negative.

The EUR/USD is positive looking on the same timeframe, Euro strength would cause additional $USD weakness.

$USDX 30 min larger trend (say after a bounce or consolidation), continues to look like the macro trend of a lower $USD is still in the works and not far off.

$USDX 4 hour macro trend from a positive/inline up trend in the $USDX and 3C to a negative divegrence suggesting the $USD see downside as part of a macro trend.

The Yen 1 min is in line, but it was in line last night too and gained in the overnight session, sending USD/JPY lower.

The 30 min Yen futures (/6J) looks to be the exact opposite of the 30 min $USDX , also suggesting a larger macro trend of $USD/JPY down which

would be in line with massive de-leveraging of the carry trade. Interestingly as noted Friday, CITI believes the Yen is due some significant upside as one of the most overcrowded short trades out there. Again, this would suggest USD/JPY weakness and de-leveraging of the carry cross- not good for the broad equity averages.

And the 4 hour Yen macro trend, is the opposite of the $USDX

a very clear, strong Yen 4 hour positive divegrence, again in line with $USDX macro weakness and USD/JPY de-leveraging.

ES 1 min is ugly, like last night- to the left is the positive divegrence off the intraday lows in the a.m., it's not that large.

TF/Russell 2000 futures 1 min is also quite ugly right now with the same intraday low positive divegrence sending it higher with the help of HYG and then a short squeeze among the Most Shorted Stocks, now a deep leading negative divegrence in to the overnight session.

NQ in line with the 3C trend down in the overnight/early a.m. session with a positive divegrence during the cash market lows and a deep leading negative divegrence that has been in effect since this afternoon.

Looking to the 5 min charts for additional guidance, ES shows the very negative trend of late last week/last night, the positive divegrence at the lows and an in line signal at the green arrows, not positive, not negative, simply in line for now, but the 1 min could migrate to the 5 min and turn it to a more clearly negative divergence.

NQ/NASDAQ 100 futures 5 min with the same negative Friday in to last night and the same in line signal now, not leading positive or negative, simply in line.

TF/Russell 2000 futures is the one 5 min chart that IS leading negative tonight.

ES 7 min with a sharp leading negative last week in to this week and simply in line since, no positive at the lows as this is a stronger timeframe.

Once again TF/Russell 2000 futures 7 min are leading negative, while NQ 7 min is inline just like ES. This TF chart (1-7 minutes) suggests overnight downside in to tomorrow.

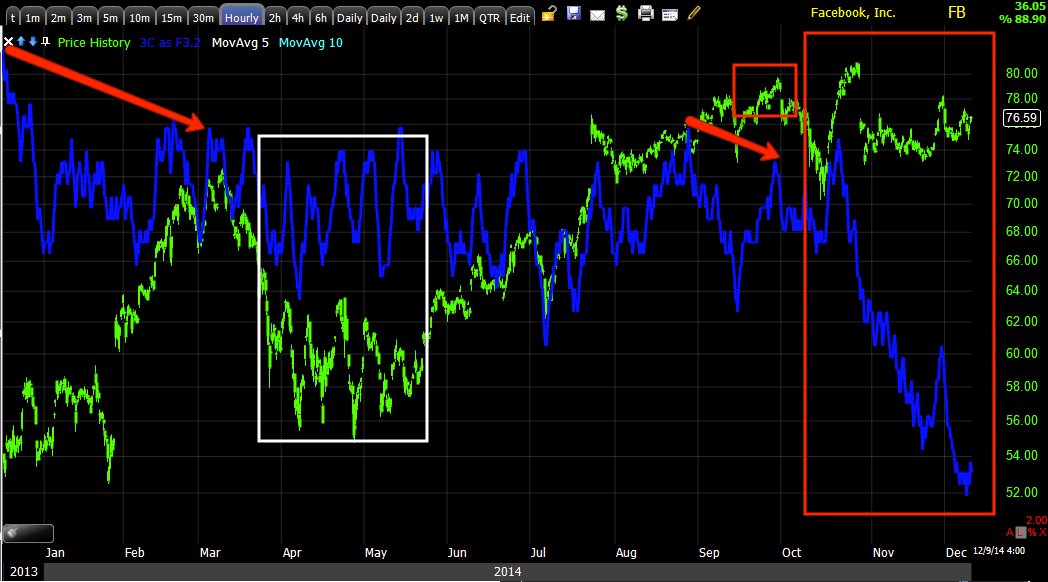

ES 60 min leading negative, this is the change in character I have talked so much about recently and that change in character leading to

changes in trends as the SPX sits at a head fake high just on top of a large broadening / megaphone top which it broke under on the open today.

I'll update futures as they develop...