It's the 22nd Consecutive week of outflows from Mutual Funds which leaves the net retail investor having taken out $76 Billion dollars out of the market. While the S&P-500 rallied 8.76% in September, if you count the last day of October (5.64% in September alone), during the same period, $20 billion dollars were pulled out of domestic stock funds.

The action since July looks like a time-bomb ticking ever closer to detonation.

Add to that insider selling, this week alone accounted for $414,489,481.00 in 67 stocks while insider purchases accounted for $177,064 in 2 stocks. ORCL insiders alone have sold $358,302,300.00-that's over $358 million in two weeks.

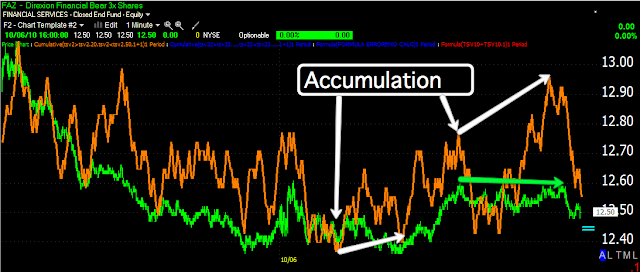

Here's this week's chart...

Yet the market heads higher yesterday. Forget about what smart money is doing, retail and insiders alone could have easily crashed this market without the Fed's POMO program. If POMO was meant to draw investors back into the market, it's clearly not working. If more likely it's meant to give insiders a sort of “golden parachute” then it's doing a marvelous job. If it's meant to simply avert disaster, whether that means keeping the market at status qua or trying to move it higher, it's done a pretty good job, but at a hefty price tag.

At some point the music will stop. Look around, if we get better then expected initial/continuing claims, it's almost surely because people who have exhausted their benefits drop from U3 reported numbers in the report to U6 unreported numbers. Their still there, their still jobless or underemployed, they just aren't counted in the headline number.

Banks are entering a whole new mess, the foreclosure “get it done, no matter how you have to do it” mess. I lost count but I'll try to find it, of just how many states are considering a moratorium on foreclosures sales, etc. The liabilities here including lawsuit, legal fees, fines, etc could very well lead to the next wave of banking financial crisis. It's always the one you didn't see coming that gets you.

We haven't talked about pension funds in awhile, but the problems there on all levels from city, county, state, federal , corporate, are in deep, deep trouble. This has roots that extend everywhere from consumer confidence to GDP.

If you believe that smart money sees value at these levels and are accumulating, I'd like to hear the reasons. The Fed/s have done a lot to prop up the markets in anticipation of things getting better. You heard the rosy predictions of what the stimulus bill would do for unemployment and the credit markets and everything else; none of it has come to pass. Things have not gotten better, yet the market continues to whistle past the graveyard. Even if we assume that the market is in the process of putting in the H&S top that's on the charts of the major averages, still it's way over inflated.

The question is, when does the music stop and who is holding what when it does?

3C has shown this type of market action -the real market action- for quite some time. The first signs of trouble were October 2009, about the same time we started forming our current H&S top.

The way I see it, you have two choices, one is to not take any risk and exit the market completely and sit in cash-CASH IS A POSITION and it's an edge you have over Wall Street. The other is to take risk, the market pays you to take risks. You have to decide whether you want to be long or short this mess. If you believe the Fed will continually pump this market and can keep it aloft as other disasters begin to explode-like the ones I've mentioned above, and you believe that their priority will be on the market rather then throwing resources at these disasters I've mentioned, then you may want to go long.

3C has been showing institutional money and probably other money, exiting the market in droves.

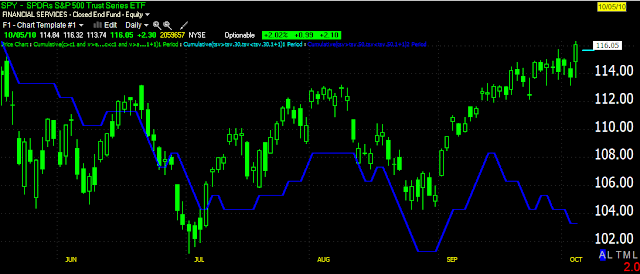

I want to show you just how dislocated the 2010 era has been

The Dow 30 Daily 3c chart. Note the sharp drop during 2007 at the market top, before that it was making higher highs confirming the trend. I told you that the first signs of trouble were in October of 2009, that's around the time the H&S top pattern(like the 2007 H&S) started to for. The recent rally has 3c sharply lower.on a weekly chart, we can see confirmation to the left with the green arrows-higher highs with price, then the 200 tech melt down. We see the accumulation in 2002/2003 that kicked off the next bull market and again at 2007 the negative divergence, 3c refusing to follow price higher. The next white arrow shows the accumulation starting the 2009 rally, but look how sharply 3c has fallen off recently in the current top formation. This leads me to believe we are going to see a sharper, more dramatic move down then we have seen in either of the two previous tops. 3C is near where the 2009 rally kicked off, prices are 65% higher. This is a serious dislocation.

The NASDAQ 100 1 day chart, showing the 2007 top, accumulation at the 2009 bottom/rally and a serious trend of distribution throughout. I've called this a bear market rally the entire time, just like the first bear market rally we saw after the 1929 crash. If you are surprised by the distribution line sloping down like that, don't be. The point of a bear market rally is to sell inventory, not to buy into it. On this chart, 3C is at new lows, even considering the price highs of 2007.

The NASDAQ weekly rally, look at the confirmation at the green arrow of the massive secular bull market, the top here happened quickly so the red arrow is small, it was like a peak. You can see the 2002/2003 accumulation for the next bull market, where housing was a big leader as well as oil, this is why the NASDAQ didn't have the same performance and shows earlier distribution into 2007. The S&P did make it to the 200o highs, the NASDAQ wasn't even close to making it to the 2000 highs, so this is to be expected. You also see the 2009 accumulation and the vertical drop of 3C currently hitting lows not seen since the 1980's-AGAIN, a serious dislocation in the markets.

The S&P-500 daily chart, the 207 divergence is not marked but it is clear as 3C did not make the higher highs price did in 2007. Look at the relative position of 3C during 2009, we're 65+% higher, but 3C on the daily is near the same levels as the 2009 lows. Another serious dislocation.

The S&P-500 weekly chart. You can see the 2000 top, the accumulation at 2002/2003, good confirmation during the bull market from 2003 until 2006/2007, signs of trouble started. So you see, 3C can also call confirmation, in essence saying this is a good, strong rally, making higher highs with price. If you look close, the higher highs at the 2009 low are apparent-this is accumulation. Now we see an almost vertical trend down making new lows beyond anything on the chart.

This is how serious this situation is. I do believe we are on the edge of a cliff that may be worse then 1929. After that, I think it's likely we'll see something most people have never seen, a secular bear market.

So as we look at the SPY from day to day wondering when the current month long rally will end, keep in mind the larger picture. Perhaps something amazing will happen in our economy in the next few years, but the trends developing are worsening, it's not just a housing/credit crisis anymore. I think some of the extremes that we see are caused by interventionist policies that allow smart money to exit the market as the Fed drives it higher. I think there will be a cost to pay for that, but it won't be Smart money on Wall Street that pays the price.

You can say I'm fear mongering or whatever else you like, but I have used and posted this indicator on every major crash we've had since 1929. We've seen some ugly readings that led to the crashes, but never have I seen such a serious dislocation of the indicator. Even without the indicator, lock me in a closet for two years, tell me what's going on in the US and the world and ask me to guess where the stock market is. My guess based on the fundamentals would be, "we are in a serious bear market". What would your guess be?

I'll try to get some new trades up tonight, it's been a long, long day, but if anything interesting pops up, I'll put them up. PLEASE set alerts for these trades, there are already a ton and you could miss a great trade b not knowing it triggered. As I said, there are free resources to do this. If you need help finding one that works for you, please email me. The fact is, there are a lot of stocks taking a dive right now, despite what level the SP-500 is at. It's easy to manipulate these averages with a few stocks, even when the majority are going down.

This chart alone, of the NASDAQ Advance Decline Ratio sows clearly that trend.

as does this one

or this one...

The point is, there are trades working now, you don't have to wait for the SPY to turn down, there are plenty of big name stocks already well on their way.

I'll run some scans... til then, always think RISK MANAGEMENT FIRST. That's why the link to the risk management article is at the top of the site. You can never read it too many times.