Interesting chart today...

1 min chart saw almost perfect confirmation until 2:45, the negative divergence went into a more important leading negative divergence

More importantly the 5 min chart did not confirm any of today's action, this is considered a leading negative divergence

The 10 min chart is now negatively divergent as it could not produce a new high with price

Here's where it's a bit strength, the 15 min chart looks fine which I'm suspicious of...

Being the 30 min chart is negatively divergent on a relative basis

Clearly the outlook on the daily chart is negative. However the Q's remain in a well defined bear flag. When this flag was identified this week, my assumption was that we would see the same behavior we almost always see when a very popular price formation like this pops up, a big, scary false breakout to the upside proceeded by a downside reversal.

The SPY ended the day HORRIBLY on the 1 min 3C chart.

On the 1 min chart, I can only go back 2.5 days of historical information, but I know for sure this is the lowest 3C reading on the 1 min chart for that period and I'm willing to bet that it goes back further. THIS IS NOT A LITTLE E.O.D. PROFIT TAKING! This is a serious divergence. Because it was so late in the afternoon, it doesn't show up on the 5 min chart as much, but there is a slight negative divergence there. This is strictly a matter of timing as 3C has a look back period so enough time needs to pass to effect the longer charts.

The DIA had a similar close

The divergence in the DIA happened around the same time. The light blue indicator at the bottom is a custom indicator like 3C, I rarely use it because it is not very sensitive, but when it does show a negative divergence like it is now, then it's pretty serious.

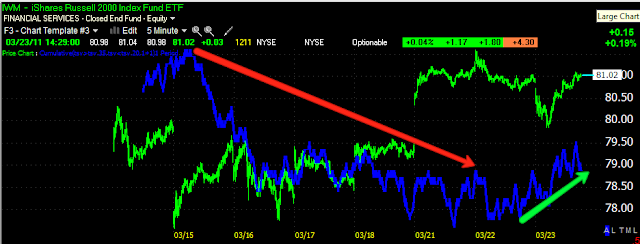

The IWM which had looked the worst today, also got nailed at the end of day.

This is the lowest reading in 2.5 days as well and the most prominent divergence, a leading negative, which tends to lead price down with it.

This does not look like the EOD setup positions market makers and specialist take for the next day's open, this looks like something very serious was being discounted and sold. I can only assume this had something to do with Portugal, but it doesn't make a lot of sense being we already had seen the negative divergence in the Euro yesterday as the vote was anticipated to be a no.

Take a look at the action in theVIX short term futures

1 min

5 min- a leading positive divergence E.O.D. (note that the VXX trades inversely to the market).

Here's how GLD ended the day

Again the blue indicator nose-dived.

SLV began to show more weakness today as it is now exposed to the possibility of a false breakout/bull trap

1 min SLV

5 min SLV-notably going negative into breakout highs

And now the 10 min also going negative.

USO

Based on the closing action, the daily candle and the resistance zone of the March highs, this is an ideal spot for USO to pullback a little, it wouldn't endanger the uptrend and would be good to wring out any excesses.

I wouldn't be surprised to hear some unexpected news tomorrow. Today's end of day action wasn't at all typical.