Today was one of those days I've spoke of recently in which objective evidence has to trump emotion or gut feeling and while it wasn't easy to understand right off the open as signals that didn't make a lot of sense had not had the time to mature, it called for an immediate decision which was to not close the IWM call position opened yesterday and added to today and not to re-open shorts/puts that had been closed the last 2-days in favor of preserving profits and re-opening them at better levels with more appropriate expiration dates. My concern is not so much with taking profits on the IWM calls at the open as no damage is done should they run more tomorrow, but more in entering new put positions too early and not getting the best risk:reward ratio and making all of that earlier navigating of the market this week an exercise in futility.

Nothing that happened within the EuroGroup's Finance Minister's teleconference today was news, in fact Merkel had set the tone of news flow and market rumors yesterday in saying that no decisions or negotiations with regard to Greece will take place before their July 5th referendum as to whether to support the bailout program or vote against it. Merkel and others have been consistent and clear on the matter, which is part of the reason an oversold bounce made sense this week as there would be little in the way of risk news flow that could go against a bounce position and the EuroGroup Fin-Min's teleconference did nothing to change that.

We had some pretty decent gains today, one could ask, "Isn't that the oversold bounce?". The fact is, Wall Street doesn't do anything without a reason and they rarely do it half-heartedly. An oversold bounce should create a sense of questioning one's positions, wondering if it's really a good idea to sell or short in to such a strong move. If the move doesn't move traders' emotions, it's not likely to move their positions and if there's no movement in their positions, there's very little for Wall Street to gain, thus these counter trend type moves tend to be extreme looking and emotionally convincing. Despite today's +.30 to +.90% gains, that wasn't the move.

The Chinese stock story is another event altogether with the Shanghai Composite giving back all of yesterday's gains overnight with a -5.2% loss. This has meaning as the Global stock market is more interconnected than ever and will certainly play a role in global markets when we look back on this period, but for now, the story is Greece.

The meme that stocks are rallying on hopes of a deal is absolutley ridiculous. If anything, stocks are rallying so hedge funds and institutional money can exit positions at better prices and enter shorts at better prices. It's not about risk on, it's very much about risk off, but that's too complicated for the average CNBC viewer who needs a 30-second summary as to why the market did what it did so they feel there's some sense or logic to the market that they can understand. The truth is far beyond most people's capacity to understand or deal with. In my nearly 4 years of teaching Technical Trading and starting every class with the same video, the one of Cramer on the Street.com talking about how he and everyone else manipulated and manipulates the market sent students in to a near depression. I'm serious, you never saw someone's demeanor change so fast as it did when you put someone familiar in front of them telling the truth about the market. They had a look of hopeless despair, but we had to break the lie to find the truth and it can't be done in a 30-second sound-bite.

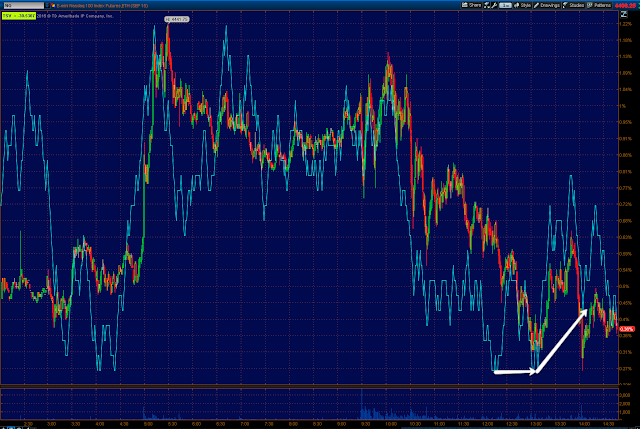

In my last post I said I'd show you how we ended the day, considerably better looking than the way we started it or at least the way it went after the open.

Despite whatever the intraday charts looked like earlier today, this is how they closed...SPY 1 min leading positive

Despite whatever the intraday charts looked like earlier today, this is how they closed...SPY 1 min leading positive SPY 3 min leading positive

SPY 3 min leading positive Even the 5 min chart saw positive migration of the divergence

Even the 5 min chart saw positive migration of the divergence IWM 3 min at a new leading positive high for the last 2-days

IWM 3 min at a new leading positive high for the last 2-days QQQ 3 min leading positive

QQQ 3 min leading positive QQQ 5 min positive

QQQ 5 min positive

And QQQ 10 min leading positive with strong migration all the way out to a 10 min timeframe. These charts don't look like they are finished, but just getting started.

And even though HYG saw distribution earlier today and by the looks of HYG vs the SPX, diverged away from the SPX's price, it closed like this showing the lever is still being used or ready to be used to push the market higher, at least short term.

HYG intraday 1 min

HYG intraday 1 min

HYG 3 min leading positive.

As shown earlier today, if VIX futures were not confirming, it didn't seem likely that today was all the market had. While only a 3 min divergence, VXX was not confirming...

3 min leading negative, just as we saw in VIX Futures 3C charts and the early tip off that something wasn't right with the sell-off from the open.

While oil /USO didn't break the $19 support level I was hoping for today, it did hit 11-week lows.

And on volume as stops were run right at the $19 level

And where were the short squeeze levels set-up for a head fake/counter trend/oversold bounce set up?

At the psychological levels as usual such as the Dow's 200-day moving average and long term trend line.

At the psychological levels as usual such as the Dow's 200-day moving average and long term trend line. Or right at the SPX's 150-day moving average

Or right at the SPX's 150-day moving average

Or the psychological whole number and better than centennial number, millennial number in the NASDAQ of $5000.

As for Leading Indicators...

Our VIX Inversion Buy signal was triggered Monday and Tuesday

Our VIX Inversion Buy signal was triggered Monday and Tuesday You can see it has been very effective in the past as a buy signal as each signal (white) has at least bounced.

You can see it has been very effective in the past as a buy signal as each signal (white) has at least bounced.

However our custom SPX:RUT Ratio Indicator is showing a divergence vs. the SPX so I have little doubt any bounce which we had suspected by Monday afternoon, which is the reason we started taking put gains off the table, will be short lived as the indicator is already negatively divergent vs the SPX.

You can see the market needed some help today as it was a Whack-a-VIX short term market manipulation day...

Both the VIX above was whacked (Note SPX prices are inverted as the two trade opposite each other so you can see the normal correlation-to the left) helping the market head higher and...

Both the VIX above was whacked (Note SPX prices are inverted as the two trade opposite each other so you can see the normal correlation-to the left) helping the market head higher and...

Short term VIX futures were also pounded lower, this to boost the market in to the afternoon. Why would traders be selling volatility in front of tomorrow's day in advance (because of Friday's closed market), extremely important Non-Farm Payrolls at 8:30 a.m.? The only reason I see for it is to facilitate a bounce, the NFP can be discounted on the way back down.

And what of our Pro-Sentiment Indicator that has been leading the SPX lower since its head fake/false or failed breakout we forecast?

Pro Sentiment vs the SPX on a 30 min chart leading the market lower since the SPX's head fake move (yellow) back in May, with extreme leading negative lows before this week's slice through SPX 150 sma support.

Pro Sentiment vs the SPX on a 30 min chart leading the market lower since the SPX's head fake move (yellow) back in May, with extreme leading negative lows before this week's slice through SPX 150 sma support.

Very near term , for the first time since May, our Pro Sentiment indicator is positive, leading the SPX short term on this 1 min chart, indicating the bounce we have been calling for.

And High Yield Credit...

Which has also been leading the SPX lower ever since the failed head fake/false breakout in the SPX (yellow) with an exceptionally deep leading negative divergence just before this week's plunge lower on Monday.

Which has also been leading the SPX lower ever since the failed head fake/false breakout in the SPX (yellow) with an exceptionally deep leading negative divergence just before this week's plunge lower on Monday.

It too is leading the market positive very short term on a 1 min chart indicating a bounce as well.

We can keep on going and going with 3C chart after 3C chart, all of the evidence points to a more extreme bounce and then a new lower low on a primary trend basis, with the next major event to occur at the October lows with the market eventually making a lower low. It's all about following the signals right now, taking our long position off at the right time, re-entering our puts and some core shorts at the right time. We've managed to navigate the market extremely well with multiple positions closed this week at double digit gains and core shorts at nice gains as well. I have little doubt we'll have any problem navigating the next move and the end of the bounce where we'll set up new shorts and puts at the best price and lowest risk as has been the plan since we started closing them late Monday and Tuesday.

Remember, the major pay here is on the downside, I'd stay patient and just open new shorts/puts rather than enter longs if you are the least bit uncomfortable, they are meant for a VERY short term trade, will likely be closed on an intraday basis and are speculative. Our core shorts which were up 7% Monday alone and 14% over the last week with no options leverage at all, are the positions that are going to do the best over the longer haul and bigger picture.

Have a great night!