Today was an odd-ball day, but much of what we were looking for last night, did happen.

SPX futures saw the narrowest trading range for the day in 6 and a half years, the range was 5 points high to low and 1 point open to close during regular hours. As expected, volume was super thin.

Also as expected, Treasuries did rally, 10 and 30 year, but I can't get a good feel on whether there's a trend there or not, it seems a bit noisy.

Gold pulled back to fill the gap from 12/26 and then some, volume was higher, but there was no bullish reversal candle, just a narrow daily range. I think it's too soon to consider Gold a buy, which means perhaps tomorrow we see accumulation and a reversal candle, but that's a best guess.

I showed several times how there was an effort to Pin short term VIX futures, but I also showed that there was accumulation in VIX futures, this led to an attempt that may have slowed VIX futures, but traders were obviously seeking protection and the hammer support candle from last Thursday at the bottom of the Bollinger Bands of spot VIX, HELD and acted as they should which puts the VIX BB squeeze back in play, remember the market moves opposite the VIX for the most part.

VIX's reversal Hammer held and protection was bid despite an effort right in to the close to slow or pin VIX futures.

Based on some other things seen today and VXX, my best guess is that we get a bounce attempt tomorrow, this is essentially the exact same thing I was looking for last night, except the schedule has been stretched so rather than have a bounce the first half of today and a probable short opportunity the second half, it looks to be the same idea, just stretched over what may be 1 day (completed tomorrow) or two days (completed Thursday).

As expected, most carry pairs today continue to lose their correlation to ES.

Leading Indicators show sentiment indicators turned south, VXX was outperforming the SPX correlation handily, Yields are starting (thanks to T buying today as expected last night) to diverge negatively and they lead the market quite well.

High Yield Credit which has no arbitrage correlation to the market also sold off today as it's definitely institutional risk off in larger markets.

All in all, I can't say that I'd change my views of what I expected in last night's post except the time horizon. I added AAPL as a long hedge for a short duration move to the upside, but did so with a very nervous hand, this was the best looking asset I could find and it wasn't great looking by a long shot, in fact AAPL will likely bounce right in to a short sale opening.

The major averages were able to hold on to the intraday positive divergences, however as posted earlier today, all of them are intraday positives within larger leading negative, I showed one intraday of XLF and then showed it in the trend and you could barely make out the intraday positive as the leading negative trend was so much bigger. Usually when I see these, they are bounces on a short term (I'd call it intraday, give or take) and then they resume the leading negative distribution and price follows the stronger negative divegrence, again, this could be and most probably is to finish the year strong as many funds are counting on it.

With such low volume though, I was truly surprised that the market couldn't put together a strong move or even an end of day ramp, the IWM actually fell near the close, but again managed to hand on to the intraday positive.

As was obvious, I had a lot of difficulty finding anything to use as a shirt term hedge for the short positions already in place and they look infinitely better than any positives, like night and day.

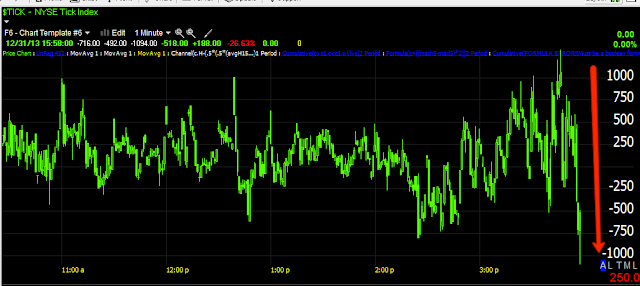

Leading Indicators are also in line or moving in the anticipated direction, Breadth indicators didn't have much to say and I imagine that's because there was so little movement today (as mentioned ES saw the narrowest daily range in 6.5 years), sometimes that's because of accumulation or distribution, but record setting with such poor divergences, it seems to be something else and not anything bullish.

Probably one of the clearest signals of major underlying action (and we are rarely out this far as futures move around a lot and don't migrate the same way equities do), is the 60 min ES chart (or others).

There's a large overal relative negative divergence from left to right, then there's a 60 min negative in to the pop on the F_O_M_C and right after Quad Witching, there's a leading negative move, also well below where it should be on a relative basis even without the leading negative move. Very recent 3C action has been pretty fierce, moving a lot in a single day on a very long term timeframe.

Just like the old days before I used 3C (except now I use 3C to get the same information), I use to run through a number of charts and I'd have a feel for whether there were more bullish or bearish set ups and that was always a good barometer of the market. Well the same thing was VERY evident today in my struggle to find one decent hedge and even with that one (AAPL), I was quite unsure of it and have a number of price alerts set.

There's no Dominant P/V relationship across the averages and if there was, I'm not sure I'd trust it with this holiday volume.

So that will do it for now, I'd like to have seen more data today, but the best I saw was what I expected to see, an attempt at some accumulation on mostly an intraday and short term basis, within much larger leading negative trends.

If anything interesting pops up in futures overnight, I'll let you know. Thus far the only thing of real interest is how dull such a low volume environment has actually been, quite the opposite of what we normally would expect.