Yesterday I really thought we'd see a pullback today, however from the charts it seemed to me to be a constructive pullback, you may even recall me mentioning that smart money doesn't often buy in to strength. I expected to see positive divergences during the pullback, thus far we have those too.

Although I can't say for sure how long a pullback may continue, I want to be looking at buying long positions (speculative in size and risk because the primary trend in the market is bearish) in to price weakness.

I wanted to check the risk asset layout and make sure there wasn't something we weren't seeing that was creeping in the wrong direction. So to sum up, this appears to be as I suspected, what I would call a constructive pullback.

CONTEXT for ES is fairly in line, there are no major divergences here.

High Yield credit is pretty much in line with the SPX today.

HY Credit on a longer term view shows dramatic improvement from the Mid-May decline that put HY credit out of sync with the market; only High Yield Corp. Credit kept the market in line with credit, so this change is welcome as far as our outlook on the sub-intermediate trend. Right now I would call HY credit as being in line with the SPX right now.

High Yield Corporate credit has shown a little better intraday momentum.

Longer term in the trend, HYC credit is leading the SPX, this is the kind of signal we want to see during a "constructive pullback" in the market. Credit tends to lead the equity markets so this looks good as a bullish divergence.

Yields intraday are not doing much

Longer term there's been a lot of volatility, but right now we are what I would call, in line, which is fairly supportive of the market moving forward.

The $AUD is one of my favorite leading indicators among the currencies and gives us some information about Carry trades and China as well.

Longer term, just as $AUD was positive divergent at the June 4 lows, it is in a positive divergence again, not huge, but it could be a lot worse.

The Euro intraday and the SPX are tracking pretty well, which means the market and the Dollar correlation is tracking pretty well.

Longer term, the Euro was positively divergent at the SPX lows, it is now negatively divergent. This is one of the few indications that don't look supportive of the market. The recent announcement of the ECB's balance sheet suggests the Euro should be significantly lower. However there is a huge short position in the Euro and I would think, if it is possible, FX smart money will try as hard as they can to effect a short squeeze. IF you want to read about market manipulation and especially how it relates to short squeezes, just read about Phil Falcone and the recent charges by the SEC as he created a Jesse Livermore style short squeeze, it's interesting and tells you more about how the market truly operates everyday; in the words of Cramer (regarding manipulating the market), "It's fun; if you aren't willing to do it, you shouldn't be in this business" (somewhat paraphrased, but accurate).

Commodities today don't look too hot, oil and precious metals are under pressure.

Longer term though, there's an interesting trend in commodities, they keep making higher highs and higher lows even as theI wonder if there may be an election surprise in the way if QE?

Energy sector intraday looks pretty good, remember oil is only part of the Energy sector.

Longer term Energy has finally made it to a position that is in line with the SPX.

Financials are similar to the market intraday

Longer term Financials are showing a little better relative momentum vs the SPX.

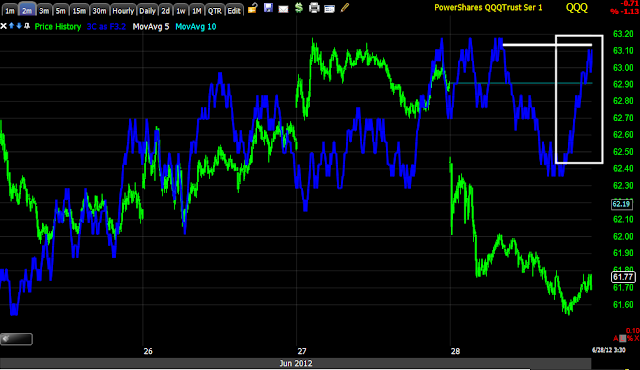

Tech is getting crushed today as well as yesterday

Longer term, this isn't a pretty chart in Tech.

Sector rotation today, Financials are obviously down, surprisingly is the relative strength in the Energy sector as well as Basic Materials and Industrials. The flight to safety trades have kicked in, nothing interesting there, healthcare dipped late morning, but has since recovered some ground. I am a little surprised to see Energy, Industrials and Basic Materials looking as good as they do.