A few minutes ago in an after market post I just said that the character of divergences this week is unique and that obviously means something.

You've seen it many times, a divergence starts on a 1 min chart as a new divergence and as it grows stronger migrates to longer timeframes, this is the healthy or standard strengthening of a divergence and tells us to some degree what we can expect in the near future. However this week has been different, we have had negatives and positives, but no migration. I don't think there';s a single divegrence that is stronger on the positive side today than it was on Friday when I put out my preliminary trend/price expectations for this week, that's odd.

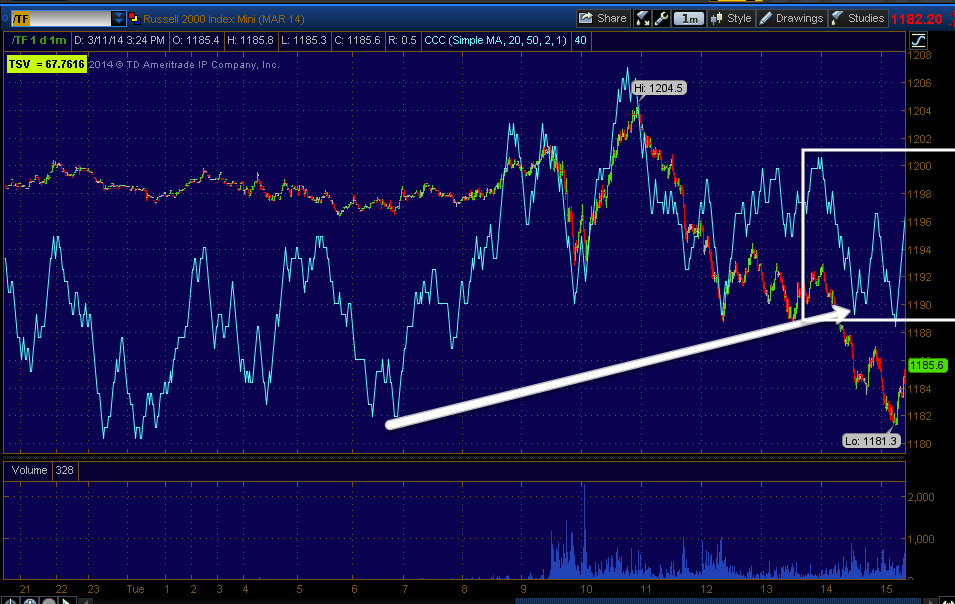

Looking at the charts intraday I can see why there's no migration and thus we have no 5 min positives as we normally would 2 days in to a new cycle. What the charts show intraday are a series of positive and negative divergences, there are steering divergences that keep the market from moving too much in either direction, but the fact they are mixed and negatives are present has prevented the normal migration of a divegrence, but that isn't to say the market is just spinning its wheels.

I've seen this from time to time although not often, I would call it an accrual. Imagine you put $10 in a piggy bank and then take out $5, then replace it with $7 and take out $3, then replace that with $4. This concept is pretty easy as most of us live this way, we deposit a paycheck or earnings and we pay bills, maybe make some discretionary spending decisions and after a period of time we have either saved money, live paycheck to paycheck or live beyond our means and spend more than we make. 3C is no different in this manner, we are tracking the trend of divergences, money flow in to or out of a stock, this is why I say, "When you can't find a trend on the short term charts, move to the longer term charts, " which is like saving money in your account one month, maybe coming up short the next, but if you look at all of this over the period of a year you smooth out the fluctuations and understand the trend of your financial status, 3C is doing the same thing except we are trying to determine the trend of an asset's underlying money flows and follow that.

Most often Wall St. sets up these cycles in advance, whether it be a small one like now or the set up that took place from Jan 27th to February 6th that led to the massive february rally, the point being, "PRICE IS NOT AS RANDOM AS MOST BELIEVE, THERE ARE FLOWS THAT ARE INTENTIONAL AND/OR GROUP THINK".

We usually can tell if there's an accumulation or distribution cycle under way through migration or strengthening of a divergence whether positive or negative, but this week has been odd in that manner as the positive hasn't moved much further if any further than what we saw the last two hours of Friday.

However following my own advice I went to the longer charts and what I found wasn't migration, but accrual, a trend or flow accruing on a longer chart meaning a heavier flow.

Here's the 1 min intraday SPY, note the positive relative divegrence toward the end of the day, it actually starts around 2:30 through the close, now you saw the AUD/JPY post...

This is the Yen, I posted the chart earlier today as a negative divegrence set in as the Yen headed higher and the carry trades, especially AUD/JPY all got slammed, remember a higher yen means a lower carry trade (yen based) which means lower index futures, this is why the 15, 30 and 60 min Yen positives are so important to near term trend pivot to the downside.

However in the short term you know I've been looking for some market upside to allow for the VIX futures to give us a short term signal being the intermediate and long term are already in place, this is the market pivot signal with VXX being used as a proxy for the market.

Note the time of the negative divergence in the Yen, it's strongest around 2:30 through the close. Not only does this change the prospects for the AUD/JPY carry trade and the others such as USD/JPY, but near term prospects for the Index futures and thus the market itself.

Looking at the $AUD futures alone we have a positive divergence in them that starts around, you guessed it, 2:30. A positive or upwardly mobile AUD and a downward move in the Yen sends the carry trades up and can lift the index futures, something that failed to happen last night as they were all flat.

Here we see the SPY since Thursday, but today is my focus, there are at least 2 clear negative divergences, one a leading negative of some size for intraday and then a late day positive around 2:30.

The point is there's a mix, in the short term you might think of them as steering divergences, but I discovered something else in addition along the lines of accrual.

The 3 min trend is not getting better, it's getting worse, but we still have to go out a bit further to eliminate noise and reach pure trend.

At the 10 min chart the chart has been in leading negative position about as long as you'd expect considering distribution starts in to higher prices, but it's today's action that is interesting which is in its own red box, note the 10 min chart in a full on negative leading divergence that just hit a new low on the chart for the entire month of March, February and the last 10 days of December, that is happening right now, even though there's no migration as it seems we need one thing to happen short term while something else has already set up and continues to do so longer term.

I found this on the 10 min chart which makes sense for 2-3 days, if it were a 60 min chart I wouldn't hold the same opinion, but it seems the process we are seeing is distributing more shares than accumulating over the longer period of 3 days while intraday charts have some recent positives, this tells us something we already suspected to be very high probability about the market, I think it also bolsters the case that we are near a transition or pivot moving us from a mature stage 3 top for the Feb. rally or cycle and moving to stage 4 decline as we originally envisioned days before the rally even started.

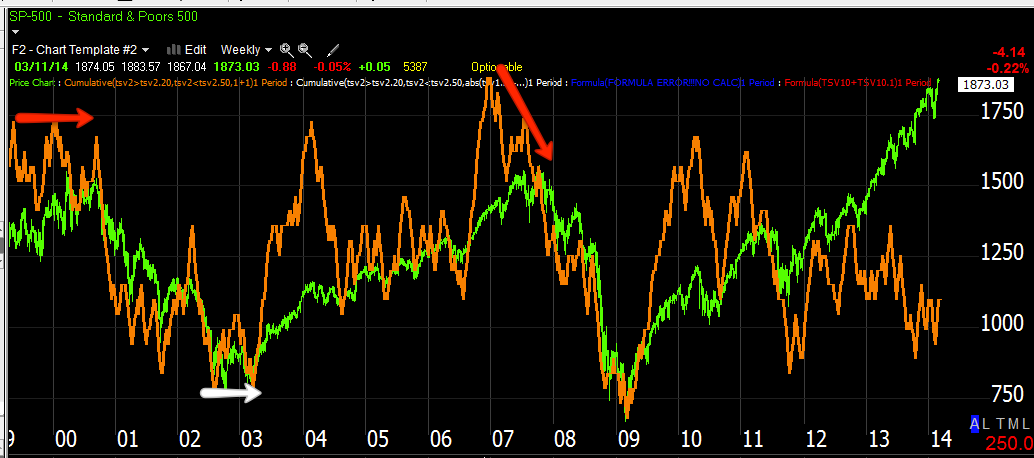

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago