Good Morning,

Again as a reminder, we will be transitioning to the new website at www.Wolf-on-WalStreet.com TODAY. This first post is just a reminder.

I hope everyone had a fantastic weekend.

Last Friday in the "Week Ahead" post, the charts look horrible, what I'd call jumping off the screen or "screaming", the kind of divergences that I don't ignore. However I also said in the second sentence,

"My best guess would be that we see a head fake move early in the week, likely Monday, but this is almost exclusively based on concept, but a strong concept."

I'll get a bit more in to this below, but it's really about how obvious the market is at times , how many traders are leaning to one side of the boat and how Wall Street does all it can to make the most number of traders wrong at any one given time as a general rule of thumb.

Honestly seeing this morning's Bank of America sentiment research that put the ratings of sell side analysts at a bullish factor of 52 for the 4th consecutive month reminds me of the contrarian bearish levels from the October lows when I had said something like a monster rally was coming. A reading of 52, which is taken as a measure of sell side analysts opinion on the last trading day of the month is still overall bullish, but well below the long run 60-65% and acts as a contrarian indicator.

As I said on Friday about the Week ahead (excerpt above), the idea that we see some early price strength this week is almost entirely based on concept, not a contrarian indicator like that of BofA's above because I didn't even see that until this morning, but a similar contrarian concept that we've seen many times over in price patterns, the Igloo/Chimney top that finishes a cycle before transitioning to the final stage of a cycle, stage 4 decline.

It's a lot easier to see on charts...

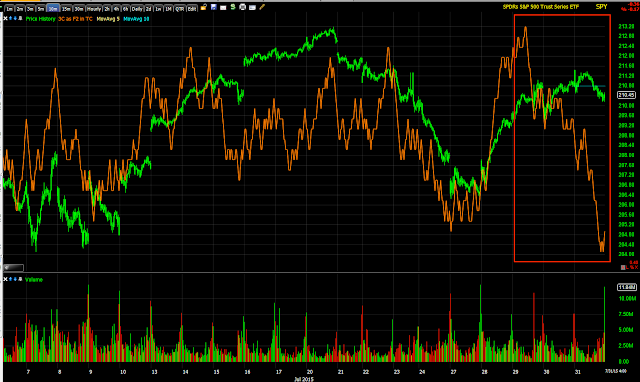

This is the 5 min S&P futures' (ES) 5 min chart which has seen the indicator diverge from price to the downside. This is a prerequisite for me to open any short position as not only price has lost upside momentum, but you can see why as the underlying trade has seen selling through the bounce.

The 10 min chart which shows 3C in line with ES as it declined off the 7/10 bounce to the left side of the chart is price confirmation, but again to the right at last week's bounce, you can see the indicator clearly not following along and negatively diverging which is what I want to see.

However the entire concept behind the excerpt above from Friday's Week Ahead is based entirely on concept...what is easy to see is usually going to be turned on its side or the "Head Fake" a false move that isn't intended to hold, but throw traders off.

Looking at the same chart as above with some of my fantastic drawing, this is what I meant in saying,

"My best guess would be that we see a head fake move early in the week, likely Monday, but this is almost exclusively based on concept, but a strong concept."

The loss of momentum on last week's bounce as there was distribution in to it caused a rounding top that looks pretty obvious as to which direction it's heading, this is where we most often see a head fake and I generally estimate that to be about 80% of the time before a price reversal whether it's a reversal from a downtrend to up or here, a bounce to down.

That's why we have the concept, based on observation, of a price top called an "Igloo with a Chimney". The rounding portion you see above being the Igloo and a vertical pop in price that exceeds the highs of the Igloo forming a chimney, usually a quick move as the powers that be just need to get traders to move, to get shorts to cover or longs to chase price which gives them an opportunity to sell or short in to those higher prices/demand and then the reversal to the downside finishing the structure.

That's what I meant in last week's "Week Ahead" post.

As for the rest of the world, it's like "Second verse same as the first". China is still unable to close green, commodities all around have been hit pretty hard as a result of the Chinese economy, and Europe is just as broken as ever with the Greek stock market opening today after a 1-month closure to a bloodbath with a opening that dropped -22% right off the bat with bank stocks going limit down at -30%, the last I saw it had pared some losses and was down around -16%.

As for the market this week, the "Week Ahead" was strictly my "Gut" feeling based on concept, but as you know I like objective evidence before taking any action so we'll do as we always do and let the charts guide us, but I can't say I'd be upset with a pop higher early in the week as bad as the overall charts look, that's opportunity.

I'll see you in a few minutes. remember at the new website, www.Wolf-on-WallStreet.com

If you have any questions or issues, please send emails to Support@Wolf-on-WallStreet.com

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago