We had another out of character development today when I looked at the Price/Volume relationships after the close. We have been seeing Close Up and mostly Volume down. Today differed in that Close Down entered the picture, it wasn't dominant, but shared a co-dominance, the two for the NYSE were Close Down / Volume Down and the second place, Close Up and Volume Down.

Only the Dow-30 and S&P-500 had actual dominant P/V relations and both were Close Down and Volume Down. This is reflected in the daily closing charts...

The Dow's price candle today could be called a Doji or at least a star, both candles represent indecision, especially n a trend that has been as strong as this one has been the last 5 days; this is another change in the character of the trend. Note volume for the Dow was significantly off today.

Technically speaking, the S&P-500 formed a Harami reversal pattern today, but only by pennies. A nice looking Harami reversal would have seen today's narrow bodied range fall about in the middle of Friday's wide body range so I don't consider the particular signal to be significant.

My interpretation of today's price/volume action is exactly that of what the charts suggest, indecision. When a trend goes from very strong to indecision over the course of a trading day, something significant has changed. Some might attribute it to window dressing, but Friday was July 1st and the quarter was over, we still had a strong price day.

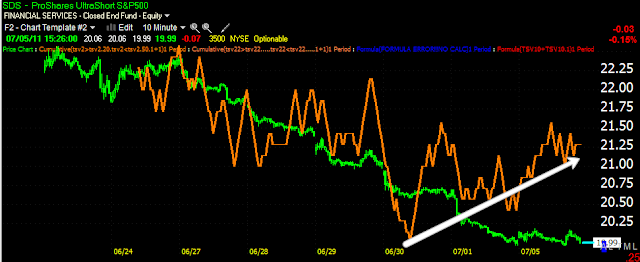

The other option to consider is resistance in the area as you can see by my trendline. I think today showed several issues that have the trend in doubt, but even if this is a 100% guaranteed change in trend, Wall Street still plays the game and the game is to make as many people wrong as possible at any one time.

From this point I would not be surprised in the least to see a false breakout above the respective resistance level now that the shorts have apparently capitulated and covered their positions, it's time to sucker in the longs and set a bull trap, a breakout above the resistance area I drew in would do the trick. In fact many of the shorts who just covered at most likely a significant loss, would probably switch sides and go long on a breakout making them potential two time losers. We know from experience that very rarely does a trend change without some gaming first and a head-fake / false breakout would be and has been what we have come to expect as watchers of the market. It seems to work every time as those in the retail technical analysis market still have not adjusted to Wall Street's gimmicks.

If indeed we do get a false upside breakout (which can be confirmed with the help of 3C), it would be an excellent place for those who like to get in very early on a short position. Others may want to wait until a false breakout is confirmed by price falling back below the trendline, it's just a matter of preference.

The real strength of this move and what has had me convinced that we would see a move higher over the last month (and there were some very precarious days in which the market could have dropped to new lows and a new downtrend any day) has been the strength in the 30-60 min 3 charts. Today we saw the first sign of change n the 30 min chart.

(at the red arrow)

So that which has held my faith in this bounce occurring over the last month is now starting to slip, which is also what was expected, "a bounce to a significant area where shorts could be well positioned".

I think you probably get the gist of my opinion as the uptrend starts to show signs of unravelling.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago