Here's an example...

The bull market starting from the 10/10/02 lows that ran to the 10/120/07 highs is roughly 5 years, all of that was retraced and then some in a mere 18 months, most of the damage was done from 5/21/08 to the 2009 lows which is about 11 months.

The point is FEAR IS STRONGER THAN GREED and the proof is right above.

This is why I think we sometimes get these unbelievably vertical VXX divergences that I don't see in any other asset. The fact that we didn't have anything like that for so long during the period above I showed you is why there were no VXX trades during that period, luckily things have changed.

This is a 1 min chart which we normally use for intraday trade signals, but 3C is a cumulative indicator so the trend of the 1 min chart is full of information as well and that's a very vertical signal at what looks like a textbook reversal process/rounding bottom. Of course we often see a head fake move just before the asset takes off, but if there's 1 asset in which we don't need to see it as often, it's VXX and again, I think that's because of fear, who needs to play games for a little better position when they're in a panic?

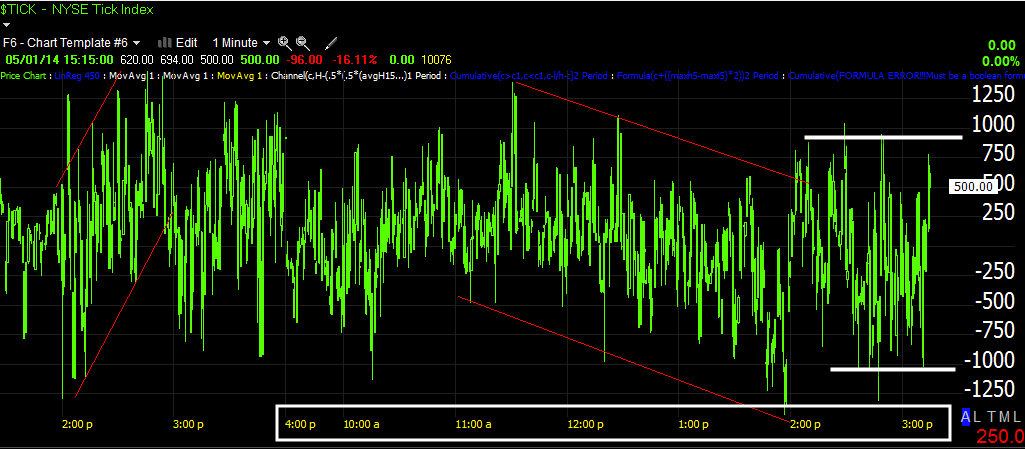

This is an intraday look at the 1 min chart, there's a chance that this was a head fake move earlier today in the a.m. session, whatever it was, it generated a very positive divergence.

Now, this 5 min chart (which is where I really take signals very seriously), is a good example of a "Flying divergence", I don't see these in any other assets and given the Index futures charts Revisiting Targets Again & Market Deterioration Moving Fast, that might explain the signal-especially the momentum today.

Here's the 10 min chart and the reversal process I almost always look for as reversals are almost always a process rather than an event (which would be more "V" shaped"). The fact that this chart pushed to a new leading positive high as well on very strong intraday momentum (just look at today's move) makes me feel pretty good that I added to this position earlier today, Trade Idea: Adding to VXX May 17th $43 Call Position

I'm not sure what tonight's Index futures hold in store for us or what the 8:30 Non-Farm Payrolls is going to do, but there's already deterioration in the intraday 3C signals for the futures after hours, just as it started last night.