I'll not bore you with the email again, but as you know, over a week ago (Saturday June 22) in an email discussion with a member as to what the catalyst could be (the signal was already there, it just needed a spark), I had said I thought it would be some F_E_D leak picked up by the unofficial mouthpiece of the F_E_D, the WSJ's John Hilsenrath. To my surprise, I didn't know the degree to which I was on the right track as three F_E_D hawks that opposed QE came out and sounded like doves making the taper that Bernie laid out in May 22nd's speech, but more importantly the F_E_D minutes released the same day. You may recall May 22nd as being the day the market put in a very serious 1-day Key Reversal, the market hasn't been able to hold above that close for more than a day.

So not only were we right on a strong move (of which it seems there's more available), but we were right on to a degree I didn't even imagine regarding the catalyst, days before the move started.

If this was just the F_E_D trying to unwind some of the volatility the "Taper-Talk" created, that would be understandable, but the one thing I can't dismiss as coincidence and I can say about the market is, apparently they knew as the divergence was in place at least a week in advance and the market rarely does anything without a reason.

With volatility this high and the market seemingly well aware of what was to come last week on the last day for Window Dressing (Thursday June 27th), it seemed to me to be more about what I said in the email from that Saturday than anything else and that was (paraphrased), The F_E_D would rather give the market a bone than have to bail them out and we already know they have a "special relationship with institutional money as the minutes were emailed to 154 of Wall Street's largest firms almost a day and a half before they were released, allowing these firms to trade inside information (not a single firm let the F_E_D know about their supposed mistake) and since when does the F_E_D email minutes to WS investment banks as if they were clients? The idea is we all find out at the same time, if that idea held any water, than an email would lag the release of the minutes and in a High Frequency market, that would serve no purpose. I think you know where I'm going with this.

OK, so we got through last week on the right track, that leaves the immediate future ahead. As I said the week before last and often, WS rarely does anything without a reason and those reasons often require extreme moves to achieve their goals. The divergences (positive) for a larger move than we have already seen, were in place. As you know Thursday we saw some negative divergences and expected a move to the downside, conveniently as ES futures hit a high for the week just hours before, two F_E_D speakers came out and discreetly reversed the message delivered earlier in the week that sent the market up, in fact one of the pre-market F_E_D speakers contradicting what was said earlier in the week was the same speaker who had been pushing a different tune earlier in the week.

We ended the week with the F_E_D's Williams offering a slightly more optimistic (market view) much like the first 3 speakers early in the week, which was interesting because we typically see op-ex pin Fridays stay in a range (I think if the two pre-market F_E_D speakers didn't say what they said, the market would have been above the ideal pin as it hit new highs on the week overnight, only brought down once they spoke) until after 3 p.m. when most contracts are settled, I have no way of proving any of this, but it seemed convenient that his message was "Back on message" only after the majority of Options were settled as we typically see every Friday.

Just as a quick re-cap of some "over the weekend events"...

Jim Rogers gave an interview, a part I found interesting...

Jim Rogers "When asked about the explosive riots occurring in Brazil, Jim warned to prepare for much more, in that,

“This is the first time in history where you’ve had all the central banks in the world printing money at the same time. Europe, Japan, America, and the UK, all, are frantically trying to debase their currencies…I’m afraid that in the end, we’re all going to suffer perhaps, worse then we ever have, with inflation, currency turmoil, and higher interest rates. As I say, this has never happened before, it’s never been a good policy in the long run, so I’m afraid we’re all going to suffer for the rest of this decade from this crazy, crazy money printing.”

As a final comment to investors looking to protect themselves from these impending disasters, Jim said,

“The way to protect yourself is to own real assets... because that’s the only thing which will protect you as currencies debase.”

The two highlighted areas are both ideas I have talked about and agree wholeheartedly with. First the market and the world have no idea of how this will play out, how bad it could be (which can still be a great opportunity for us) because as I have pointed out time after time, the world has never been so connected, global economies have never been so inter-dependent and the CB QE policies with nearly 600 cuts around the world since 2008 are simply unprecedented. There's no precedent we can look to to try to understand what's ahead of us and the one thing we usually lack is imagination and the ability to think in unreasonable terms as that is the way the market typically acts, we come up with what we think are reasonable targets and they are always blown away.

The Second, is something I do believe in, although I think with an edge trading can be very lucrative, but real, tangible assets. Rental housing would be one, but I think BlackRock and other major players in this area are about to unwind their positions (as they simply aren't making what they projected) so that's one that may be great in the futures, but I wouldn't want to mess with it now.

Not that this is a market story, more of a Human Interest, but I thought it was interesting that Reuters reported that the first AA Prez who visited S. Africa this weekend to celebrate the life of the terminally ill, Nelson Mandela, didn't receive quite the open arm greeting one might imagine, in fact police had to use Stun Grenades against protestors that weren't happy with our foreign policy, especially the "D" from above strikes.

Then as you know, I've asked and written two articles both linked on the member's site, whether the Bank on Japan lost control with the Godzilla of all QE's, doubling the monetary base in two years as a part of Abe-enomics.

It seems Eric Sprott had a similar question, but a lot closer to home...

"Recent comments by the Federal Reserve Chairman Ben Bernanke have shocked the world financial markets. It all started on May 22nd, 2013, at a Testimony to the US Congress Joint Economic Committee, where he first hinted at tapering the Fed’s quantitative easing (QE) program. Then, on Wednesday, June 19th, during the press conference following the FOMC meeting, the Chairman outlined the Fed’s exit strategy from QE.

The chaotic reaction by market participants and the corresponding increase in yields now risks destabilizing this very fragile equilibrium. It is yet unclear whether or not the damage control from the other Fed Presidents will put a lid on yields and market volatility, or if the damage to the Fed’s (poorly executed) exit strategy is permanent."

Now as for what we can see with regard to what's right in front of us and what we might find to be overwhelming probabilities.

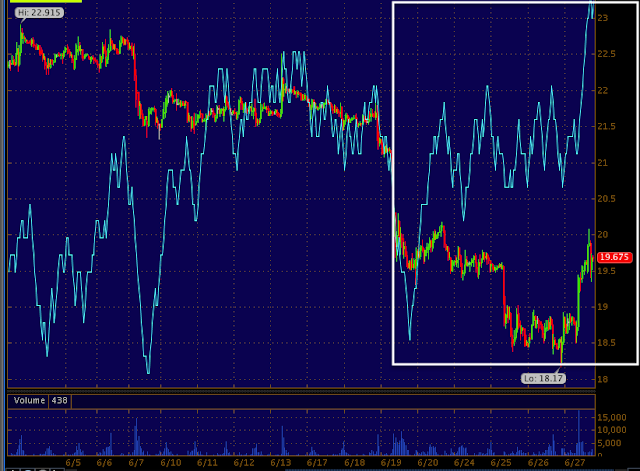

As for what Technical Traders see, from the 6/18 failed breakout of the SPX triangle (roughly 5/24-6/15) which they would have expected to break out to the upside and which Technical Analysis Dogma calls for a reversal of positions (from long to short) on the failed breakout. As for what technical traders see, first a rejection of prices at the SPX's base that it created from 6/20 to 6/26 with another "seemingly" failed breakout on 6/27 as the market hit overhead resistance.

They also see a 61.8 Fibonacci retracement from the 6/18 to 6/24 move.

They also see the SPX reject resistance perfectly at the 6//27 intraday highs at the 50-day moving average (with a closing candle with a longer upper wick-bearish). They also see the 1- and 20-day moving averages rejected and act as resistance Thursday. These are all basic tenants of Technical Analysis, they use to work pretty well before the year 2000 when everyone came rushing in to technical analysis, but since have been used more and more as ways to use technical analysis against traders.

Friday it initially looked like we'd break down and see the downside move reflected in the charts short term on Thursday, from the continuos ES trade perspective, we did in fact see such a breakdown as we came off the highs of the week overnight and opened to a much lower level, but from the average's perspective, Friday (until the close), did not look like the pullback I saw hints of Thursday, it looked like a day that was pegged for an options expiration pin as I said Friday.

So in my view, the downside move I saw 3C telegraphing Thursday, has not been fulfilled, in fact until late Friday, I wouldn't even say it started.

Very short term here are some of the negatives still suggesting we haven't seen the start of the downside move that showed up in Thursday's charts yet.

Candlesticks and Resistance beyond the areas I already mentioned above.

Anyone versed in the basics of candlesticks would look at this move (strongest 3-day move of the year or not) and see the candles on the move up as having very small bodies (not bullish), Thursday would have been a larger resistance zone of the actual triangle in addition to all the other very obvious ones mentioned above and most importantly, retail traders typically won't take a position until they have price confirmation first. Thursday set up an Evening Doji-Star reversal candle with a long upper wick, almost long enough to be considered a "Shooting Star" so the downside reversal signal was there (candlestick reversals really have to targets beyond the immediate future unless you are seeing the same pattern on a 5-day chart, then it obviously has bigger implications). The confirmation they'd need would be a close lower the next day which we saw Friday, this would be what retail shorts need to enter and the more confirmation, the more confidence they have. We already know from sentiment updates that retail was WILDLY bearish Friday, so the charts are giving them what they want, I believe Wall St. (to get what it ultimately wants) will give them what they want to see as well and retail WILL chase prices lower unlike us.

The candlestick chart taken with any of the other resistance areas I mentioned above would be a very tasty technical short set up (for retail).

Some of the Leading Indicators short term also are in line with a very near term expected move down (I try to set some expectations ahead of time so people don't panic, as I said last week, when I say "Pullback", I don't mean a little dip, this market is way too volatile for that and moves need to be SOLD, they need to be convincing).

***Leading Indicators are always compared to the SPX (green) unless otherwise noted***

HYG, High Yield Corporate Credit which is a SPY arbitrage asset (meaning it goes down and it has a very powerful pull on arbitrage players to sell the market) was in line Thursday, but fell out with the SPX Friday suggesting a near term move lower for both or at least the SPX.

The very illiquid High Yield Credit shows some negative divergence with the SPX on Friday at intraday highs, but I would draw your attention to the fact they are relatively mold as the liquidity in HY credit is so low, it is usually one of the first to panic and panic big which it is not doing here- translation, I'd expect the chart to signal a near term move to the downside. but it seems smart money is not worried about that move to the downside right now.

Commodities have not been supportive in large part during most of this move, this can't be taken as near term bullish.

Yields near term have clearly deteriorated and moved to lower lows as the market moved up, they "should " move together, but when there's a dislocation like this, Yields tend to pull the

SPX toward them like a magnet, again suggesting near term downside.

Currencies (not that they have been that influential - at least these two) have really lost any near term market support as the $AUD above gave out Friday in a pretty big way after supporting the move up earlier in the week.

The Euro, well it is what it is...

FCT as a sentiment indicator has given out vs the SPX, again the caveat would be it hasn't put in a severe divergence and very clear sentiment shift, the chart's implication being that the short term expected move is down, but again they seem to know something beyond this move that hasn't spooked them, for instance, that a large move to the upside is probable after the near term decline which may in fact look very bad, but to those in the know, the move following it to the upside would be much stronger and the relative performance of each can't be known by us until after it is done, but again, that is what this chart suggests.

HIO is similar, it doesn't look that concerned at all.

TLT (20+ year Treasuries) are in line at the green arrow, moving up in near term concern at the yellow and moving up as the SPX see an EOD Friday nasty close.

Futures...

ES 15 min shows a clear in line move on the way up, starts to see distribution and now is leading negative. I've noticed that since volatility has picked up a 15 min chart that might have represented say a 2 % 3 or 4-day move can now represent a 2% 1 or 2-day move, meaning the move up or down is still similar, but the timeframes are now much more compressed so don't be too quick to apply methods to these charts that were appropriate in a totally different market climate.

As an example from the averages, the IWM...

IWM 3 min with a large positive and a negative in to Thursday/Friday

IWM 10 min with another large positive (meaning I think large enough that it has plenty more room to move to the upside once the near term trade is taken care of) with a negative relative divergence Thurs/Fri.

The Dominant Price/Volume Relationship for all 4 major averages on Friday was "Price Up/Volume Down) which is the most bearish of the 4 possibilities and it was as I said, Dominant. This is not how the averages themselves closed, but how all of the component stocks making up each average closed, we look for dominant relationships among the 4 possibilities and among all the averages. The relationship most often serves as at least a 1-day overbought condition (whether truly overbought or not) and almost always shows a close lower the next day and Monday opens tend to be extra volatile.

OK, I think that's pretty much enough to make the point, I could go on and on, but I think we get it.

Now to look at the other side...

First Leading Indicators....

Commodities themselves I don't think can be taken as a bearish signal as they are just acting the way they are supposed to vs the $USD as seen above.

I showed you a very zoomed in view of the low-liquitity High Yield Credit, but looking at the normal view, this often "much more panicky asset) is sitting right in line as if it doesn't care what happens the next few days, someone apparently is not willing to part with the shares right now.

HYG Credit which would have to move for the SPX to pullback because of its arbitrage status, doesn't look at all like it's worried about any moves lower (not to say they won't come), the 30 min chart has a huge positive divergence.

For that matter...

So does High Yield Credit (3o min)

And Junk Credit, 30 min. *If the credit leads the market and we were able to get the best 3-day move of 2013 with barely any of the positive base here used, imagine the possible upside. It seems someone (and only institutional money trades Credit like this) is expecting something big on the upside very soon, this is why I'm not too concerned about any pullback.

Yields I showed you were near term, but in the trend they are still well above the SPX so it seems the SPX at some point in the very near future (I'm guessing some point this week) owes quite a bit of upside before regression to the mean is reached. The move last week didn't even get us half way there and these always tend to overshoot.

The ES 2 hour chart has stayed very positive on an extremely long timeframe.

The NQ 1 hour is also very positive, these timeframes almost don't care what a 15 min chart does, they are in such a different class.

And TF futures 1 hour as well.

And our IWM example...

The 30 min has a large positive with a lot more gas in the tank that is perfectly in line

As does the 60 min.

I think this is probably enough to flesh out the picture I'm seeing as of now and this is pretty much no different than what we started to expect Wednesday and pretty clearly by Thursday. I didn't want to get too involved in too many short term positions when we are getting closer to the real prize (I don't want the distraction), but this is the reason I closed a number of short term long positions Friday and Thursday and entered some short term UVXY Calls (expecting a near term decline).

***I also have some pretty good expectations for the gold and silver call/long positions, I'm guessing the miners too. Take a look at the Silver and Gold Futures, the short term charts look good too.

Silver 15 min looks ready to go, same as the ES 15 min chart (different direction) so I think we see some nice action this week.

Silver 390 min looks great as far as what's in the tank.

Gold 30 min, the silver 15 min should launch both at the same time, that's impressive.

And the gold 60 min. It really looks like someone has been stocking up for a big move here.

I don't know exactly how all of this fits, but... I think the extremes in the charts above and the data below may make for an extreme that does well by our long positions.

COMEX Gross Gold Shorts at record All Time Highs!

Comex Net gold longs at the lowest for a decade.

And... COMEX gold inventory at lows not seen since 2008.

Sounds like an interesting week for gold and silver.

Well that will do it for now, I'll check in on the a.m. futures, I wish everyone a happy, healthy , safe and profitable week ahead.