It' ironic that PCLN has held up better than a lot of tech stocks that look like they have a decent chance to bounce, yet the underlying trade is worse than all of those stocks. PCLN is looking very much like a decent short idea.

These have been the best two places to short PCLN, if the tech sector rallies, PCLN could put in a new high, I would be looking to add on any such move, but rally any strength back toward those two area would interest me.

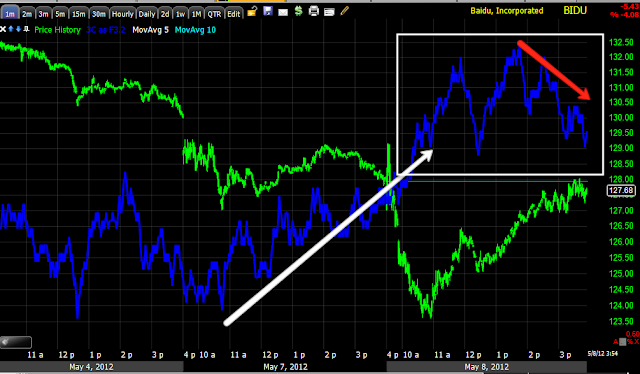

Even on a short term basis, PCLN's 1 min chart doesn't look nearly as good as many others.

The 2 min chart never even went positive, it was just in line and saw a negative divergence at the EOD.

The same story with the 3 min chart, except the negative divergence was worse.

Even the 5 min chart is the same, no signs of intraday accumulation.

The 15 min chart is leading negative, it looks really bad compared to the rest of the market, yet price wise PCLN has held up better than the rest of the market. I would guess there's a decent market maker filling sell/short orders for some large funds.

The 30 min chart looks worse than some other 30 min charts that already look bad, like AAPL.

And the 60 min chart is horrendous.

I have PCLN near the top of my list of shorts I want to add to, it's in decent position to add or initiate a position right here if you left enough room in your risk management to account for a move higher which looks like would only occur if PCLN floated with a strong tech move.