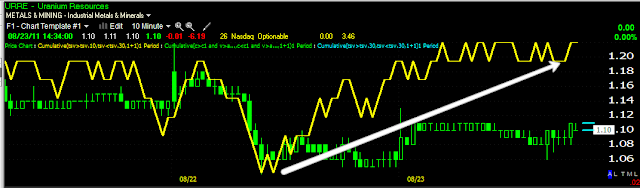

I was surprised, really nearly shocked when I ran my scan and looked at the Price/Volume relationships. Remember, there are 4 and it's only meaningful if there is a dominant theme. Take a look at these and see if you can spot the dominant theme.

The Dow -30

The NASDAQ 100

All NYSE Stocks

The Russell 2000

The S&P-500

It shouldn't have been too hard, yes it was Price Up/Volume Up. This is not only the dominant theme, but VERY dominant. This theme also happens to be the most bullish of the 4 price/volume relationships in just about any market. This shows there was appetite for risk, traders were willing to bid up stocks and didn't back away from higher prices, of course this all has more to do with Wall Street then anything.

It's also an interesting relationship considering where we are right now. Remember earlier today I mentioned we are still in a lateral range and it is in lateral ranges we most often see accumulation and distribution.

We are also near the breakout point of that range...

And all of this despite bad economic news today in the Richmond Fed Survey and New Home Sales. This is the kind of market action, ignoring the news, that is typical of Wall Street running a play as I speculated about last week.

Here's a look at the influential sectors needed to move the market higher.

We can see Industrials, Tech and Energy are strong, only Financials needs to pick up some steam.

Here's a look at some various Financials

XLF 15 min 3C

FAZ (BEAR Financials) 10 min 3C

IYF 5 min 3C

IYF 1 min 3C

FAS 1 min 3C

FAS 2 min 3C

UYG 2 min 3C

The recent 3C strength in a spectrum of financial ETFs seems to be suggesting financials will be in rotation shortly.

I'm off to look at more charts.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago