This a.m. the possibility was raised here (raised yesterday in many venues) of Kocherlakota having seen a leaked NFP release from 8:30 this a.m. As Morgan Stanley said, "It's impossible, only the Fed chair sees the numbers the night before and wouldn't share it with other governors, much less regional bank presidents". Now the issue of Bill Dudley of the NY Fed having seen the same leaked material is floating around. The issue centers on his speech which was embargoed at news outlets, there was only and hour and a half between the time he could have filled in the NFP numbers for today which were mentioned and that time drops substantially when the fact that the speech was already at news outlets and embargoed so it is likely that he too saw the leaked numbers presumably from Bernanke.

It seems to be a question of semantics and who really cares if a regional Fed president sees a NFP release a day early. However, the more concerning question is the honesty and integrity of the news outlets like for example, CNBC who hold the embargoed speech in their grubby hands. Most of these guys are Wall Street alumni and you know as a reporter, being the first to break a story is a big deal. So whose to say they don't reach out to their former colleagues/golfing buddies on Wall Street with a little quid pro quo?

That's the reality of our markets. That was always the first issue I raised on the first night of my technical analysis classes, I showed them video coming from Cramer's own mouth of how he manipulated the market as a hedge fund manager and how others do routinely and best of all, his warning to all aspiring and current hedge fund managers, "If you're not willing to do it, you shouldn't be in the game".

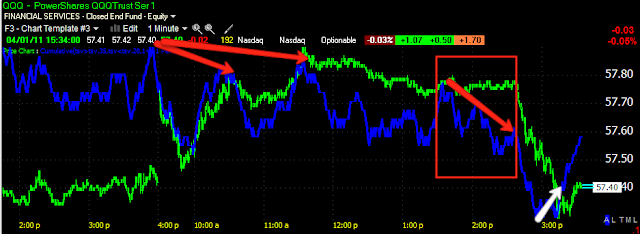

This is why I follow the charts, I don't watch CNBC, and I use my time building indicators that help me understand what Wall Street is doing, why they are doing it is a question that won't be answered until it doesn't matter anymore.

Just to remind you, in the recent past, others such as PIMCO's Bill Gross have had some brilliant predictions the day before an economic release was due out so there's many roots to this garbage, although I suspect Gross is a lot closer to the trunk of the tree then down in the root system.