I still don't see any strong objective evidence other than if you were taking the 30, 60 min and 1-day leading negative charts and entering a position on those, but I think we'll likely get better timing. As to the close today though, there's nothing that points to "Picking up where we left off".

I see no reason to take unnecessary risk.

Have a fantastic weekend!

Friday, May 29, 2015

TLT Update

This is an excellent example as to why I stick to objective evidence which are the probabilities or high probabilities offered by the charts.

Earlier today as the TLT position went again our put since the overnight session on a small 1 min , 1.5 hour divergence, I posted the charts and the reason I said, "The TLT June 19th Put position is still in place, today has been an interesting bit of movement, but I am not concerned about it." Posted today in the: TLT Position Update

Since then, the short term charts have fallen in line with the longer term , higher probability charts which is the exact same concept I just explained in The Week Ahead,

"Just remember, the 30, 60 min and 1-day ES charts in the post linked above from last night and earlier today are the highest probability resolution and they are calling for a drop in the market and not the corrective kind either."

As for TLT...

It looks like the 3, 5 and 10 min highest near term probability charts are winning out as the 1 min intraday chart quickly went negative as TLT tried to make additional upside gains and then came plummeting down to what is now just above yesterday's close.

I'm still not worried about TLT puts...

Earlier today as the TLT position went again our put since the overnight session on a small 1 min , 1.5 hour divergence, I posted the charts and the reason I said, "The TLT June 19th Put position is still in place, today has been an interesting bit of movement, but I am not concerned about it." Posted today in the: TLT Position Update

Since then, the short term charts have fallen in line with the longer term , higher probability charts which is the exact same concept I just explained in The Week Ahead,

"Just remember, the 30, 60 min and 1-day ES charts in the post linked above from last night and earlier today are the highest probability resolution and they are calling for a drop in the market and not the corrective kind either."

As for TLT...

It looks like the 3, 5 and 10 min highest near term probability charts are winning out as the 1 min intraday chart quickly went negative as TLT tried to make additional upside gains and then came plummeting down to what is now just above yesterday's close.

I'm still not worried about TLT puts...

The Week Ahead

Earlier today I posted the Preliminary "Week Ahead" with my opinion of what looked likely to happen, this is largely based on concepts we have seen work over and over in different timeframes and different assets.

The gist was that this week's expected "Rounding/Igloo top" with the typical last move seen before a reversal , the head fake "Chimney", was judged too earlier to have taken place as the natural rounding over pattern was distorted by Tuesday's losses, thus the price pattern originally expected to play out this week, finishing the rounding top, actually likely took place. You can read the entire post here, Preliminary "Week Ahead". However the revised price pattern looks like this...

Note how the price pattern looks much more like a rounding top when Tuesday's decline is taken as part of the pattern rather than the end of the pattern. Furthermore the head fake "Chimney", which is where I want to enter watch list shorts that look more ready now than they have in some time as the market has been in an exceptionally tight range, never took place.

I would normally consider entering some short term trades based on the expected move to the upside and then close that out, enter the trend shorts and some longs and let the market take care of the rest, but as seen in this market update...Market Update, you can see why I'm so loathe to enter anything at the moment as there is no objective evidence or overwhelming objective evidence supporting the theory above, that's not to say it won't develop early in the week, but until it's there, I don't see the advantage in taking a gamble.

For every chart that suggests a trade, there's another in the same average or a different average that negates it, at least for now.

However a quick look at leading indicators and there are some hints that the theory above for next week's action may see the market give it a shot. I believe if it takes place with a head fake move above the rounding top (the Chimney), it will likely be finished before Friday so it would likely have to happen fast unless somehow Greece achieves what they haven't been able to all year and get a deal with the Troika as the looming IMF payment is Friday, there's no more money and if it is missed, they are in default.

I don't see traders as willing to stick around to see how it plays out.

Granted, these are not charts that are blaring sirens for the scenario above, but they do suggest an attempt, whether successful or not, I believe we'd have to see charts improve rapidly early next week or manipulation on a scale we haven't seen and that's a tall order.

Some of the Leading Indicators...

The SPX:RUT Ratio custom indicator (red) vs the SPX is not confirming the SPX's price move lower today, this has been a reliable short an medium term indication at divergences with the averages.

We haven't seen Yields act as a leading indicator for months which is a shame because they were so effective, but this week they seem to have acted exactly as that , they gave up their correlation with the market and have led it like the magnet they use to act like.

If I'm correct on TLT coming down, that means yields up and if yields are, at least for now once again acting as a leading indicator, they'd lead the market to the upside as they have led it to the downside this week.

Finally, as I often say, "The first lever they reach for to manipulate a market is High Yield Corp. Credit"

This is HYG which has been in line short term with the SPX in green for the week, but notice the higher highs in HYG vs the SPX.

Again, these aren't smoking guns, but they are some unusual standouts in this week's/today's market and the "Igloo/Chimney Top" concept has been a solid one.

At present I don't see anything that's reliable enough or even close to take any risk over the weekend, but I'll continue to look in to the close and we'll see first thing Monday if it develops.

Just remember, the 30, 60 min and 1-day ES charts in the post linked above from last night and earlier today are the highest probability resolution and they are calling for a drop in the market and not the corrective kind wither.

The gist was that this week's expected "Rounding/Igloo top" with the typical last move seen before a reversal , the head fake "Chimney", was judged too earlier to have taken place as the natural rounding over pattern was distorted by Tuesday's losses, thus the price pattern originally expected to play out this week, finishing the rounding top, actually likely took place. You can read the entire post here, Preliminary "Week Ahead". However the revised price pattern looks like this...

Note how the price pattern looks much more like a rounding top when Tuesday's decline is taken as part of the pattern rather than the end of the pattern. Furthermore the head fake "Chimney", which is where I want to enter watch list shorts that look more ready now than they have in some time as the market has been in an exceptionally tight range, never took place.

I would normally consider entering some short term trades based on the expected move to the upside and then close that out, enter the trend shorts and some longs and let the market take care of the rest, but as seen in this market update...Market Update, you can see why I'm so loathe to enter anything at the moment as there is no objective evidence or overwhelming objective evidence supporting the theory above, that's not to say it won't develop early in the week, but until it's there, I don't see the advantage in taking a gamble.

For every chart that suggests a trade, there's another in the same average or a different average that negates it, at least for now.

However a quick look at leading indicators and there are some hints that the theory above for next week's action may see the market give it a shot. I believe if it takes place with a head fake move above the rounding top (the Chimney), it will likely be finished before Friday so it would likely have to happen fast unless somehow Greece achieves what they haven't been able to all year and get a deal with the Troika as the looming IMF payment is Friday, there's no more money and if it is missed, they are in default.

I don't see traders as willing to stick around to see how it plays out.

Granted, these are not charts that are blaring sirens for the scenario above, but they do suggest an attempt, whether successful or not, I believe we'd have to see charts improve rapidly early next week or manipulation on a scale we haven't seen and that's a tall order.

Some of the Leading Indicators...

The SPX:RUT Ratio custom indicator (red) vs the SPX is not confirming the SPX's price move lower today, this has been a reliable short an medium term indication at divergences with the averages.

We haven't seen Yields act as a leading indicator for months which is a shame because they were so effective, but this week they seem to have acted exactly as that , they gave up their correlation with the market and have led it like the magnet they use to act like.

If I'm correct on TLT coming down, that means yields up and if yields are, at least for now once again acting as a leading indicator, they'd lead the market to the upside as they have led it to the downside this week.

Finally, as I often say, "The first lever they reach for to manipulate a market is High Yield Corp. Credit"

This is HYG which has been in line short term with the SPX in green for the week, but notice the higher highs in HYG vs the SPX.

Again, these aren't smoking guns, but they are some unusual standouts in this week's/today's market and the "Igloo/Chimney Top" concept has been a solid one.

At present I don't see anything that's reliable enough or even close to take any risk over the weekend, but I'll continue to look in to the close and we'll see first thing Monday if it develops.

Just remember, the 30, 60 min and 1-day ES charts in the post linked above from last night and earlier today are the highest probability resolution and they are calling for a drop in the market and not the corrective kind wither.

The Financials Story...

I try to (and don't have to try hard) to make it a habit not to listen to CNBC, there's a very good reason for that. However every once in a while like on F_O_M_C days I'll tune in to listen to the policy statement or the press conference and I invariably end up hearing more than I intended to, usually because I'm too busy to turn off the TV on those days.

This story that rate hikes will be good for financials is about as bunk as they come. Are we talking about extra income from nonexistent mortgages? Loans for Cap-Ex spending when no one is spending on Capex during 6 years of ZIRP? I'm not even sure the banks know what their business model is anymore once trading dried up.

In any case, Financials have been one of my favorite long term core shorts and I fail to see how a 25 basis point hike or even a 100 basis point hike is going to turn things around for them after watching the way they use add backs and the such for reporting earnings that stink to high heaven.

In any case, most of that is opinion, that's not what I'm about, the charts are what matter. When I write the third section (final) post in the "Understanding the Head Fake Move", I suspect XLF/Financials will be one of the example charts that ties it all together.

Like the SPX and other of the major averages, this is as close to perfect as you get in creating a head fake pattern as every technical trader knows what a triangle looks like. The head fake move would be above the apex (yellow) and there it is.

To confirm though, we need the charts...

This is the 2 hour 3C / XLF chart, I think the signal at the breakout/head fake is pretty clear.

The 60 min chart is a very strong timeframe, but more detailed. Once again, it's pretty clear to see what happened.

And the 15 min chart is more detailed, not a drop of confirmation, in fact the exact opposite.

Coming back around from the short term charts' trends...

The 1 min trend not only negative at the false breakout but perfectly i line on the downside with any counter trend corrections shot down.

The 2 min trend needs no commentary.

However, as I said back then on April 2nd, what I find interesting is that these price patterns that are so well known, were not naturally occurring...

This 5 min chart shows distribution at the top of the triangle trendily to make sure it doesn't go above and small accumulation at the lower triangle trendily to make sure it doesn't go below. These were not random;ly or naturally occurring, they were put there for a reason and that reason is on the first chart above in yellow.

For this and numerous other reasons, Financials are one of my favorite core short/trend short positions.

This story that rate hikes will be good for financials is about as bunk as they come. Are we talking about extra income from nonexistent mortgages? Loans for Cap-Ex spending when no one is spending on Capex during 6 years of ZIRP? I'm not even sure the banks know what their business model is anymore once trading dried up.

In any case, Financials have been one of my favorite long term core shorts and I fail to see how a 25 basis point hike or even a 100 basis point hike is going to turn things around for them after watching the way they use add backs and the such for reporting earnings that stink to high heaven.

In any case, most of that is opinion, that's not what I'm about, the charts are what matter. When I write the third section (final) post in the "Understanding the Head Fake Move", I suspect XLF/Financials will be one of the example charts that ties it all together.

Like the SPX and other of the major averages, this is as close to perfect as you get in creating a head fake pattern as every technical trader knows what a triangle looks like. The head fake move would be above the apex (yellow) and there it is.

To confirm though, we need the charts...

This is the 2 hour 3C / XLF chart, I think the signal at the breakout/head fake is pretty clear.

The 60 min chart is a very strong timeframe, but more detailed. Once again, it's pretty clear to see what happened.

And the 15 min chart is more detailed, not a drop of confirmation, in fact the exact opposite.

Coming back around from the short term charts' trends...

The 1 min trend not only negative at the false breakout but perfectly i line on the downside with any counter trend corrections shot down.

The 2 min trend needs no commentary.

However, as I said back then on April 2nd, what I find interesting is that these price patterns that are so well known, were not naturally occurring...

This 5 min chart shows distribution at the top of the triangle trendily to make sure it doesn't go above and small accumulation at the lower triangle trendily to make sure it doesn't go below. These were not random;ly or naturally occurring, they were put there for a reason and that reason is on the first chart above in yellow.

For this and numerous other reasons, Financials are one of my favorite core short/trend short positions.

Market Update

Here are the charts from the last intraday post, but I think in them, you'll see why I'm not too terribly excited about entering short term positions at the moment.

IWM

This morning's 1 min small, positive divergence at the capitulation lows, again 45 minutes before any Greek news hit the wires. To the right, the leading negative divergence is obvious.

This has sense migration or strengthening to the 2 min IWM chart

And the 5 min chart as well.

QQQ

1 min intraday negative to the far right as just posted...

as well as on the 2 min chart.

These are not huge divergence in and of themselves, more or less intraday movement.

However...

This QQQ 5 min is clear reason as to why I'd be very careful about going long anything without the proper chart support, if anything it looks quite negative.

SPY

1 min intraday with a small positive at the lows and a leading negative hitting new lows right now.

The 3 min chart is in line.

There's a very small 5 min SPY positive, but with the other timeframes so mixed and the other averages, I would never consider this high probability.

As for the intraday internals, the NYSE TICK shows the market breaking down since this morning's intraday lows...

You can see the channel (up) off the intraday lows has been broken on the downside.

Furthermore...

Our custom TICK indicator shows the intraday flameout around 10:45 at the yellow arrow, about an hour before the Greek news. However since, the intraday internals have deteriorated at the white arrow as well.

Again, I think you can see why I am patient here in not chasing any trades as there's little to no objective evidence to support a short term position, although the evidence supporting the longer term trend trades is there, we just need the timing charts to fill in which I suspect happens before Friday's IMF payment is due. This is based on charts.

IWM

This morning's 1 min small, positive divergence at the capitulation lows, again 45 minutes before any Greek news hit the wires. To the right, the leading negative divergence is obvious.

This has sense migration or strengthening to the 2 min IWM chart

And the 5 min chart as well.

QQQ

1 min intraday negative to the far right as just posted...

as well as on the 2 min chart.

These are not huge divergence in and of themselves, more or less intraday movement.

However...

This QQQ 5 min is clear reason as to why I'd be very careful about going long anything without the proper chart support, if anything it looks quite negative.

SPY

1 min intraday with a small positive at the lows and a leading negative hitting new lows right now.

The 3 min chart is in line.

There's a very small 5 min SPY positive, but with the other timeframes so mixed and the other averages, I would never consider this high probability.

As for the intraday internals, the NYSE TICK shows the market breaking down since this morning's intraday lows...

You can see the channel (up) off the intraday lows has been broken on the downside.

Furthermore...

Our custom TICK indicator shows the intraday flameout around 10:45 at the yellow arrow, about an hour before the Greek news. However since, the intraday internals have deteriorated at the white arrow as well.

Again, I think you can see why I am patient here in not chasing any trades as there's little to no objective evidence to support a short term position, although the evidence supporting the longer term trend trades is there, we just need the timing charts to fill in which I suspect happens before Friday's IMF payment is due. This is based on charts.

Quick Market Update

Since this morning's flame-out/short term, intraday selling event we've seen pretty steady upside, however that is now turning intraday and I suspect shortly we will be seeing a turn back to the downside. How big of a turn depends on how much larger the intraday divergence is allowed to become. It looks pretty close to turning soon though. I'll have example charts up in a couple of minutes...

TLT Position Update

The TLT June 19th Put position is still in place, today has been an interesting bit of movement, but I am not concerned about it.

Here are the charts for TLT/30 year Treasuries which if you recall, on a larger trade basis, I believe will make a counter trend rally, but we'll have to confirm that upon a decline first before entering the position in any size.

You might think the move in 30 year treasuries this morning was based on the GDP second reading, but unless it was leaked and I'm not even sure why that would matter because it came in better than consensus even though reduced to a negative print, there was a small 1 min positive divergence after the close yesterday, not really looking like much , but moved 30 year treasuries through the entire overnight session, not simply at what you might expect, the 8:30 GDP release.

The 1 min TLT chart shows a similar positive divergence, although quite small in to the last hour and a half of yesterday. Today it's simply in line.

However I'm not concerned about TLT coming down as it is the more serious, stronger timeframes that the idea is based on and there's not much gas in the tank of a 1.5 hour 1 min divergence.

The 3 min TLT chart with the base I suspect that will lead to an eventual counter trend move, however first there's a strong negative divergence to the far right and that's what the TLT put position is based on. Nothing there has changed.

The same leading negative divergence is on the 5 min chart as well which is even stronger.

And on the stronger 10 min chart.

This is a closer view of the current divergence on the 10 min chart.

What I'd be looking for to enter/add to a TLT counter trend long trade would be the pullback/decline that the charts above are forecasting and look for signs of accumulation of a constructive pullback in to the decline, then I'd feel a lot better about a second, longer term TLT long trade, but that depends on this first one wrapping up which I am not too worried about it doing.

Here are the charts for TLT/30 year Treasuries which if you recall, on a larger trade basis, I believe will make a counter trend rally, but we'll have to confirm that upon a decline first before entering the position in any size.

You might think the move in 30 year treasuries this morning was based on the GDP second reading, but unless it was leaked and I'm not even sure why that would matter because it came in better than consensus even though reduced to a negative print, there was a small 1 min positive divergence after the close yesterday, not really looking like much , but moved 30 year treasuries through the entire overnight session, not simply at what you might expect, the 8:30 GDP release.

The 1 min TLT chart shows a similar positive divergence, although quite small in to the last hour and a half of yesterday. Today it's simply in line.

However I'm not concerned about TLT coming down as it is the more serious, stronger timeframes that the idea is based on and there's not much gas in the tank of a 1.5 hour 1 min divergence.

The 3 min TLT chart with the base I suspect that will lead to an eventual counter trend move, however first there's a strong negative divergence to the far right and that's what the TLT put position is based on. Nothing there has changed.

The same leading negative divergence is on the 5 min chart as well which is even stronger.

And on the stronger 10 min chart.

This is a closer view of the current divergence on the 10 min chart.

What I'd be looking for to enter/add to a TLT counter trend long trade would be the pullback/decline that the charts above are forecasting and look for signs of accumulation of a constructive pullback in to the decline, then I'd feel a lot better about a second, longer term TLT long trade, but that depends on this first one wrapping up which I am not too worried about it doing.

Preliminary "Week Ahead"

Unless I see something that causes me to revise this post before the close which may be the case to a small degree, but I don't think to a very large one, this is more or less what I'm expecting.

After looking around at the watch list assets, there are charts that I have been waiting to see movement on, entering the trades before now would have just been dead money in most cases. Transports are one that I'd like to get another crack at, we've had two entries in core shorts for transports, if we can get some price strength, a final one would be nice considering how ugly they are.

Taken with last night's Futures update in the Daily Wrap and what I'm looking for in different assets including the $USD, I think this is the most probable outcome for early and later next week. I think we are finally at the cliff's edge.

Last night's futures update had a lot of multiple timeframe analysis charts, but in Index futures, the short to intermediate term charts were sloppy and scattered, it was the trend charts that were very clear, making it hard to know what to expect in the very short term, perhaps continued chop, perhaps a pop higher with the $USD setting up nice watch list short entries in to better prices and lower risk.

What does seem clear is that massive trend damage is done (Breadth reflects the same) as was posted in last night's futures update linked above, the 30 and 60 min Index futures via ES, but there's one even worse that was not posted, the 1-day which is the strongest underlying trend timeframes.

ES 30 min leading negative as posted last night...

ES/SPX E-mini futures 60 min leading negative as posted last night, but sometimes I assume you remember what the 1-day chart looks like, this is the most important and I shouldn't assume so here it is...

ES 1-day with massive underlying trend damage done through 2015 on a worsening basis.

Looking at the price pattern for this week, I was expecting (from last Friday) a rounding /Igloo top, then the head fake Chimney. It seemed with Wednesday's decline that the Igloo portion or rounding portion was cut short, but the Chimney never materialized.

Standing back with a couple of days more perspective, I suspect this entire week has been the rounding top/Igloo price pattern...

The area right at the SPX triangle's resistance is just about right. If we include the earlier damage and today, we get the exact rounding top I would have expected. The Chimney/head fake portion would fall to the far right and I suspect early next week.

It's not the charts that bolster this view, in fact it's the lack of strong charts in the 1-15 min timeframe of futures that bolster this view with a very strong set of resolution signals on the 30, 60min and 1 day charts.

The normal logic would be, "go long" for early in the week until the transition where we enter core/trend shorts, however while I think this is a probability, I'd preface that by saying I think the probability is the attempt, not necessarily success in the head fake/Chimney portion.

If I see strong intraday charts develop that support this view and make a trade worthwhile, then I'll post that, but I don't make trades based on gut feelings , I make them based on objective evidence and so far there's little to support strong, successful short term upside trades.

I see the probabilities and the strength in shorting in to any attempted price strength next week or individual trade signals. Just because a market will likely try something, doesn't mean it will succeed. I'd feel much better about short term longs if there were strong short term signals to back up those trades and as I showed last night and am telling you now, there aren't many at all that I'd even consider speculative.

We do have some time left in the day and perhaps they develop early next week, but the SPX chart above is what I believe will be the highest probability with the attempted chimney head fake move being the last event before a drop to the downside which lines up well with the $USD analysis from last night too.

More to come as I uncover it...

After looking around at the watch list assets, there are charts that I have been waiting to see movement on, entering the trades before now would have just been dead money in most cases. Transports are one that I'd like to get another crack at, we've had two entries in core shorts for transports, if we can get some price strength, a final one would be nice considering how ugly they are.

Taken with last night's Futures update in the Daily Wrap and what I'm looking for in different assets including the $USD, I think this is the most probable outcome for early and later next week. I think we are finally at the cliff's edge.

Last night's futures update had a lot of multiple timeframe analysis charts, but in Index futures, the short to intermediate term charts were sloppy and scattered, it was the trend charts that were very clear, making it hard to know what to expect in the very short term, perhaps continued chop, perhaps a pop higher with the $USD setting up nice watch list short entries in to better prices and lower risk.

What does seem clear is that massive trend damage is done (Breadth reflects the same) as was posted in last night's futures update linked above, the 30 and 60 min Index futures via ES, but there's one even worse that was not posted, the 1-day which is the strongest underlying trend timeframes.

ES 30 min leading negative as posted last night...

ES/SPX E-mini futures 60 min leading negative as posted last night, but sometimes I assume you remember what the 1-day chart looks like, this is the most important and I shouldn't assume so here it is...

ES 1-day with massive underlying trend damage done through 2015 on a worsening basis.

Looking at the price pattern for this week, I was expecting (from last Friday) a rounding /Igloo top, then the head fake Chimney. It seemed with Wednesday's decline that the Igloo portion or rounding portion was cut short, but the Chimney never materialized.

Standing back with a couple of days more perspective, I suspect this entire week has been the rounding top/Igloo price pattern...

The area right at the SPX triangle's resistance is just about right. If we include the earlier damage and today, we get the exact rounding top I would have expected. The Chimney/head fake portion would fall to the far right and I suspect early next week.

It's not the charts that bolster this view, in fact it's the lack of strong charts in the 1-15 min timeframe of futures that bolster this view with a very strong set of resolution signals on the 30, 60min and 1 day charts.

The normal logic would be, "go long" for early in the week until the transition where we enter core/trend shorts, however while I think this is a probability, I'd preface that by saying I think the probability is the attempt, not necessarily success in the head fake/Chimney portion.

If I see strong intraday charts develop that support this view and make a trade worthwhile, then I'll post that, but I don't make trades based on gut feelings , I make them based on objective evidence and so far there's little to support strong, successful short term upside trades.

I see the probabilities and the strength in shorting in to any attempted price strength next week or individual trade signals. Just because a market will likely try something, doesn't mean it will succeed. I'd feel much better about short term longs if there were strong short term signals to back up those trades and as I showed last night and am telling you now, there aren't many at all that I'd even consider speculative.

We do have some time left in the day and perhaps they develop early next week, but the SPX chart above is what I believe will be the highest probability with the attempted chimney head fake move being the last event before a drop to the downside which lines up well with the $USD analysis from last night too.

More to come as I uncover it...

Quick Market Update

Interesting... at 11 a.m. we had identified a likely bottom that had taken place about 10 minutes earlier.

The TICK confirmation we were waiting on came shortly after...

By 11 a.m. TICK had confirmed, but the intraday lows and move up off them is being attributed to a Greek claim that next week's IMF payment will be made with no mention of how and a full 45 minutes later!

The sheeple of the market can't stand anything more than a 30 second soundbite to make the market seem understandable and less frightening. In any case, someone needs to lose for someone to win so that's fine.

As for the market itself, I think last night's Futures forecast was more valuable than even I might have first thought, see last night's Daily Wrap at the bottom for the full report on Futures.

It seems quite a bit of what was posted from futures analysis last night fits well with the watch list assets that I'm looking for entries in as longer term core positions rather than these short hit and run trades. There has been a good deal of movement these last 2 days which also fits with the forecast from last Friday, Igloo/Chimney.

QQQ intraday. This doesn't appear to be an accumulated stop-run, but it sure felt like one.

very short term timing charts are saying, "hold", be patient , but not for too much longer.

If the small amount of damage from last Friday could do what it did Tuesday, then this additional , much larger damage is looking like our spot.

QQQ 15 min as another example.

Again if there are decent , worthy looking short term trades, we'll take what the market offers, but this is looking much more like the big opportunity we have been very patiently waiting on as most traders seems to not be sure which way is up right now, not only from comments I've been sent from other sites via email, but the AAII Investor Sentiment from last week shows the exact same, bulls and bears the most confused they have been...

The TICK confirmation we were waiting on came shortly after...

By 11 a.m. TICK had confirmed, but the intraday lows and move up off them is being attributed to a Greek claim that next week's IMF payment will be made with no mention of how and a full 45 minutes later!

The sheeple of the market can't stand anything more than a 30 second soundbite to make the market seem understandable and less frightening. In any case, someone needs to lose for someone to win so that's fine.

As for the market itself, I think last night's Futures forecast was more valuable than even I might have first thought, see last night's Daily Wrap at the bottom for the full report on Futures.

It seems quite a bit of what was posted from futures analysis last night fits well with the watch list assets that I'm looking for entries in as longer term core positions rather than these short hit and run trades. There has been a good deal of movement these last 2 days which also fits with the forecast from last Friday, Igloo/Chimney.

QQQ intraday. This doesn't appear to be an accumulated stop-run, but it sure felt like one.

very short term timing charts are saying, "hold", be patient , but not for too much longer.

If the small amount of damage from last Friday could do what it did Tuesday, then this additional , much larger damage is looking like our spot.

QQQ 15 min as another example.

Again if there are decent , worthy looking short term trades, we'll take what the market offers, but this is looking much more like the big opportunity we have been very patiently waiting on as most traders seems to not be sure which way is up right now, not only from comments I've been sent from other sites via email, but the AAII Investor Sentiment from last week shows the exact same, bulls and bears the most confused they have been...

May Have Hit an Intraday Low

This is very interesting activity for an op-ex Friday, it seems the macro economic data is being taken very badly indeed, everything either missed this morning or came in poorly despite not technically missing. Ironically GDP which received quite a downgrade, came in above consensus.

The real Greek default D-Day is June 5th, it seems a little early or perhaps late to be de-risking for that event, I suspect this has more to do with month end Window Dressing.

In any case, it looks like an intraday bottom may have been made.

The volume and candlesticks we look for to indicate an intraday flameout or selling event (mini capitulation) in the SPY...

The Q's

And IWM.

Confirmation should be found in a break above the NYSE intraday TICK index's channel which looks like it's coming.

I'm not sure I'd fade this move quite yet, lets see what, if anything tradable develops.

The real Greek default D-Day is June 5th, it seems a little early or perhaps late to be de-risking for that event, I suspect this has more to do with month end Window Dressing.

In any case, it looks like an intraday bottom may have been made.

The volume and candlesticks we look for to indicate an intraday flameout or selling event (mini capitulation) in the SPY...

The Q's

And IWM.

Confirmation should be found in a break above the NYSE intraday TICK index's channel which looks like it's coming.

I'm not sure I'd fade this move quite yet, lets see what, if anything tradable develops.

Early Update

Well can you believe that, the second revision of Q1 GDP comes in and nothing reacts except some bonds, which I suspect will be a limited reaction. Of course the F_E_D has already inoculated itself from any and all Q1 GDP weakness as transitory and the actual print of -0.7 was better than consensus of -0.8 down from +0.2%. Just remember, if there's a second consecutive quarter of negative GDP, the US is in recession. I highly doubt the data massagers will allow that by a long shot.

Things look a little more exciting this morning than the usual Friday options expiration, but I suspect they'll calm down soon, as far as the averages go, keep a close eye on volume/candlesticks for the intraday flameout as well as the TICK intraday channel.

Oil bouncing on a weaker $USD right now is no surprise, this update from Tuesday night had called for exactly that, USO / Crude Update.

If you saw yesterday's The $USD and USO / Oil then you probably know I don't believe oil's move to the downside is over, I see this as more of a gap fill before heading lower.

Gold is also gaining some traction, but showing some interesting mixed charts so I may take some trade management steps or may just let things smooth out a bit, we;'ll see how they develop.

It does look like the $USD is weakening a bit more, it may be that it does until later today or Monday with a final push before rolling over.

Right now things feel very transient (this morning), as I'm writing I see TLT is already coming back down and SPY/IWM look to be losing downside momentum and will likely start turning lateral within the hour.

I'm going to take this time to continue going through some watch lists, I have alerts set so if anything interesting pops up I can get to it quickly.

What an economy and we are looking at hikes? I know there have been a lot of answers to this question, but I can't stop asking it, "What is the F_E_D really afraid of?"

Things look a little more exciting this morning than the usual Friday options expiration, but I suspect they'll calm down soon, as far as the averages go, keep a close eye on volume/candlesticks for the intraday flameout as well as the TICK intraday channel.

Oil bouncing on a weaker $USD right now is no surprise, this update from Tuesday night had called for exactly that, USO / Crude Update.

If you saw yesterday's The $USD and USO / Oil then you probably know I don't believe oil's move to the downside is over, I see this as more of a gap fill before heading lower.

Gold is also gaining some traction, but showing some interesting mixed charts so I may take some trade management steps or may just let things smooth out a bit, we;'ll see how they develop.

It does look like the $USD is weakening a bit more, it may be that it does until later today or Monday with a final push before rolling over.

Right now things feel very transient (this morning), as I'm writing I see TLT is already coming back down and SPY/IWM look to be losing downside momentum and will likely start turning lateral within the hour.

I'm going to take this time to continue going through some watch lists, I have alerts set so if anything interesting pops up I can get to it quickly.

What an economy and we are looking at hikes? I know there have been a lot of answers to this question, but I can't stop asking it, "What is the F_E_D really afraid of?"

Thursday, May 28, 2015

Daily Wrap

I'm going to keep tonight's post a bit short because 1) the market has acted exactly as we expected since last Friday's "week Ahead" forecast and 2) I've given you just about everything as it has happened. The signals now are paramount and how the $USD reacts is going to be very telling, although you probably know what my opinion is already on that subject, The $USD and USO / Oil.

I was expecting the market to either pin roughly in place or to see some slight gains as posted in last night's, Daily Wrap...

"Note the second squeeze took place just after we closed the VXX puts, but had waited before entering any assets that would count on market downside as the charts simply were not confirming in enough timeframes to justify such a trade "

and perhaps more telling were yesterday's internals...

"The Dominant Price/Volume Relationship saw 17 Dow stocks, 55 NASDAQ 100, 899 Russell 2000 and 271 SPX 500, a strong Dominant reading and all in Close Up / Volume Down, THE MOST BEARISH OF THE 4 POSSIBLE READINGS.

Also in a polar opposite to yesterday's internals, 8 of 9 S&P sectors closed green with Tech leading at +1.89% and Energy lagging at -0.18.

Even more so, of the 238 Morningstar groups I track, a full 222 of 238 closed green.

As much as yesterday's internals were at a 1-day oversold condition that as I said last night, "This CLEARLY suggests a next day close in the green on a very strong 1-day oversold condition.", today's internals are the strongest form of the EXACT opposite, typically seeing a next day close in the red."

Traders simply don't give enough (if any) credibility to all that volume can tell you.

The averages today stayed fairly well correlated except for weakness in Transports again...

The major averages on the day today with transports in salmon lagging...

The major averages the last 2-days , staying within yesterday's range and all closing red as internals suggested.

And the averages on the week, not much progress with transports slipping more.

Although it seemed like the internals and the gut feeling I had about the market's price action today was based in some objective evidence such as Internals or scattered short term 3C signals, certain other indications seem to show that today's close in the red for all of the averages was not due to the lack of trying...

The same EUR/JPY carry that lifted the market yesterday was in force again today (EUR/JPY CANDLESTICKS VS. ES PURPLE).

HYG, High Yield Corporate Credit was also in lock-sync with the SPX today like yesterday, although both closed red. See last night's Daily Wrap fir the bigger picture with HY Credit leading the market significantly lower.

However on the other hand, there's serious signs of deterioration that are not every day occurrences and in most cases are worse than the 200 or 2007 tops.

For one, the Dow Theory confirmation signal between Industrials and Transports has fallen off a cliff.

Rather than just compare the two averages, I created a custom Histogram on a daily basis showing you the deterioration between the two averages that should confirm each other which is the centerpiece of Dow Theory. Obviously the red histogram crossing below neutral (zero) is the difference between Industrials and Transports... I use to think it wasn't as relevant anymore since the US has transitioned from an Industrial to a services economy, but apparently I was wrong and a lot of those services still require shipping, take something as simple as DHL document deliveries.

In any case, the charts do the talking and as you may recall in recent years, Transports were a high beta momentum group so the fall-off there alone is noteworthy. By the way, our longer term Transports core short is nicely in the green.

As for Breadth Indications which have been steadily sliding for over a year now, in many cases much worse than the 2000 and 2007 tops...

YESTERDAY FOR THE FIRST TIME, THE NYSE ADVANCE/DECLINE LINE WITH A TREND-LINE DRAWN FROM THE 03/09/2009 LOWS TO THE SECOND POINT AT 11/15/2012 DIP AND THE THIRD POINT MAKING THE TREND-LINE MUCH MORE RELIABLE AT THE 10/13/2014 LOWS HAS FOR THE FIRST TIME SINCE 2009 BROKEN BELOW THE TREND-LINE!

This is the first time this has happened since this 6 year trend-line has been in effect.

AS ALWAYS, "CHANGES IN CHARACTER LEAD TO CHANGES IN TRENDS"

I like to update breadth charts every now and then because they aren't open to interpretation, they are math, they are as honest as you get in the market. There's no interpretation, there's no special circumstances, just pure, hard and sometimes cold facts...

*I display the breadth indicator in green vs the comparison symbol (usually the S&P-500) in red unless otherwise noted. The basics of breadth are the same as volume, a rising market should see rising breath indications to match, when there's a divergence between the hard number count of breadth and the market, there's something not right.

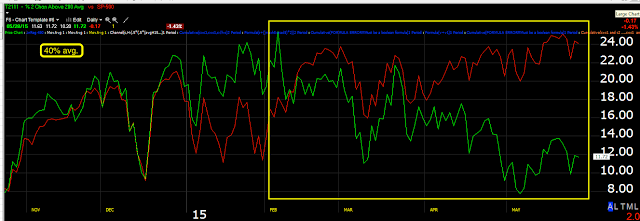

The Percentage of ALL NYSE Stocks Trading ABOVE Their 40-Day Moving Average (in green ) vs the SPX (in red). As you can see earlier in the market's trend when internals were still strong, this breadth indicator averaged highs around 80+%. In to 2013 that fell slightly to 80% and in 2014 it fell to a still respectable, but obviously weakening market of 70%. Since 2015 there has been a notable decline in which breadth never recovered from the October lows and the current reading is 42% meaning LESS THAN HALF OF NYSE STOCKS ARE TRADING ABOVE THEIR 40-DAY SIMPLE MOVING AVERAGE. This is about half of what the percentage was when the market had healthy breadth.

This just shows us again if we are looking at the obscure weighting schedules of the market averages, we aren't too far off the highs, but when looking at the stock market as a market of stocks, you might say we are already in a bear trend as more traders are experiencing losses in individual stocks as they fall below their 40-day moving average.

This is the Percentage of ALL NYSE Stocks Trading ABOVE Their 200-Day Moving Average.

You may recall my nearly 4 years teaching Technical Analysis for the Palm Beach County School System's Adult Education program where I inadvertently had been slamming Motorola only to find out after class that one of my students was a former CEO of Motorola in the 1980's, thankfully he agreed with me. The point actually being, Dow Theory was a complicated concept to teach to neophyte traders and I had found that the 200-day moving average was "close enough" to represent the Primary trend (bull or bear market) , the 50-day was close enough to the Intermediate trend and the 22 day was close enough to the Dow Theory Short term trend classification so I used these moving averages, whether the asset was above or below the average and whether the average was pointing up or down as a proxy for Dow Trend classification.

Here the Percentage of ALL NYSE Stocks Trading ABOVE Their 200-Day Moving Average fell from a normal average in a bull market of 80+% to the current 50%. Again, half of the NYSE stocks are in a bear market trend despite the market and its obscure weighting (unique to each average and proprietary to NASDAQ 100 which will cost you a $10,000 a year membership to find out the weighting schedule). Take away the weighting schemes and just look at the percentage of stocks above or below and half of the stocks are in a Dow bear market.

The Percentage of ALL NYSE Stocks Trading 1 Standard Deviation ABOVE Their 40-Day Moving Average declines from 70% to 60% in 2013 to 50% in 2014 and currently at a mere 25.5%, about 1/3rd of a normal, healthy bull market.

The The Percentage of ALL NYSE Stocks Trading Two Standard Deviations ABOVE Their 200-Day Moving Average , stronger momentum stocks... usually running around 40% of NYSE stocks, currently at less than 12% with clear deterioration through 2015.

This is the NASDAQ Composite and its Advance/ Decline Line. I'm sure you can see the issue here.

However if we look specifically at 2015 alone...

There has been recent and significant deterioration in the number of advancing NASDAQ listed stocks vs declining.

As for Leading Indicators... For several months the Carry trade unwind made our use of yields as a leading indicator useless, however, even if only for a brief time, it seems they are working again as yields would act like a magnet pulling equity prices toward them whether that be up or down.

I can't argue with the recent evidence as yields plummeted last week in to the end of the week and Tuesday caught down to the magnetic pull of yields when acting as a leading indicator, which is a shame with the carry trade unwind as Treasuries tend to fall, making this once extremely reliable indicator useless, but recently it seems to be working if only for a brief time.

Like yesterday when Yields dislocated with the SPX, they have remained as such today, suggesting that perhaps our analysis of a major market shock next week may be reflected here.

Also among Leading Indicators, our Pro Sentiment indicator which looks much worse overall, see last night's Daily Wrap to see how much worse. However the point of this shorter chart is to show how much faster Pro sentiment has fallen off recently, making a new low today.

And commodities which have acted as a reliable leading indicator, once again effected by the carry trade unwind as they tend to appreciate during the process, seem to be acting as a Leading Indicator once again, even if briefly as they led to the upside with the SPX, pulling the SPX back from excesses, but leading negative now which fits with indications of a possible major shock to the market next week.

As for internals tonight, they aren't surprising given that the Options Expiration max-pain pin is usually around Thursday's close at least until around 2 p.m.

Unlike the extremes of Tuesday and its 1-day oversold condition leading to Wednesday's sharp reversal to the upside and last night's 1-day overbought condition, almost as extreme leading to a red close today...Internals are not nearly as Dominant as the last 2 days which makes sense. However both the NDX (48 stocks) and the SPX (196 stocks) both fell in to the Dominant P/V relationship of Close Down / Volume Down which is the least influential relationship of the 4. In fact I've given it a nick-name, "Carry On" as in "Keep doing what you were doing" which would mean little movement in to tomorrow's op-ex pin which tends to be what we have noticed anyway with the pin typically close to Thursday's close. The S&P sectors saw 3 of 9 close green and the Morningstar groups saw 97 of 238 close green, mediocre at best. For future reference I will mention that the most common Price/Volume relationship during a bear market is Price Down / Volume Down, it is the thematic relationship, not that it means anything today in that respect.

The 3C signals will be very important the next few days and any additional price strength should be a gift for any short positions we may find looking appealing as we can enter at better prices with less risk, if only we had a 3rd decent shot at transports!

The $USD trend and whether the counter trend bounce is over or failing as I suspect will have dramatic ramifications for the market. As mentioned earlier, the assets bought with carry proceeds tend to be sold off, those are typically bonds and in the reach for yield in this market, a lot of stocks, but bonds have already reversed trend to the downside whereas stocks are yet to make that move...yet.

Finally as to futures tonight... It may be more appropriate to look at them in multiple timeframes with the $USD once again acting as the hub of the wheel.

Starting with the $USDX, From the looks of the Euro charts (which tend to move opposite the $USD), there are short term negative divergence in the Euro like...

Euro 3 min negative which tends to suggest the $USD will see some near term strength. However whether a head fake or the recent trend of the $USD seeing overnight strength and cash market weakness, I can't be sure, but I suspect the $USD will make a last asp move higher.

The Euro 5futures 5 min chart starts to show developing positives suggesting any near term $USD strength, even a head fake move will not hold for long.

The $USD 15 min chart tends to confirm that view as it should worsen in to any near term strength.

By the 60 min Euro charts we have significant positive divergence suggesting $USD weakness and...

60 min $USD charts also confirming the same.

I suspect the $USD will make a last gasp push higher before failing and ending its counter trend bounce and resuming its downtrend, making a new cycle lower low.

This will have an effect on oil as the two tend to trade opposite each other. We already saw today that USO weakness is being accumulated, but I expect more near term weakness which is why the USO equity short is still open.

The longer term 15 and 30 min Oil Futures are positive. Remember as posted earlier today, we are already seeing signs of oil being accumulated in to lower prices which is what I have expected and will be a prerequisite to any longer term core long position in oil, but it needs to pullback to be accumulated at lower prices. The 15 and 30 min Oil futures seems to tell us that is what is happening.

Oil 15 min futures positive divergence in to lower prices and...

The stronger 30 min chart positive in to lower prices, I expect near term $USD strength will send oil lower and it will continue to accumulate, by the time the $USD turns down, oil should be in a position in which a long term trend long can be entered.

As for gold... It too tends to move opposite the $USD so near term strength in the $USD on a last gasp push, should hold gold back for a short period. However the 5, 7, 10, 15 and 30 min Gold futures are all positive, this may reflect a flight to safety because of Greece as well as inflation expectations related to what I believe will be a much earlier than expected F_E_D rate hike. Whether the projections of higher inflation by the F_E_D are genuine or not, they'll have to make the case to hike rates and as such, gold should appreciate on inflation expectations, real or imagined.

Treasuries (TLT), I have expected a move lower in treasuries and that would be the case on a falling $USD and carry trade unwind. Very near term Treasury charts are negative and I suspect we see the move lower I have anticipated (June TLT puts), here are a few key timeframes...

30 year Treasury futures 3 min near term negative...

3 year t futures 7 min negative

And 15 mi negative.

We'll have to reassess Treasuries/TLT for a counter trend rally upon seeing lower prices. If like Crude we see accumulation in to a decline, then it is likely we get a counter trend rally in Treasuries as I have also expected on a longer term basis, although not a reversal basis. If we don't see accumulation in to lower prices, we just stay away from the trade.

Lastly Index Futures... I can't imagine the $USD making a new lower low, the carry trade turning negative at losses magnified by 100:1 to 300:1 leverage and equities which were financed with carry profits not falling.

Very near term there's not much in the way of guidance which makes me think this is more related to an op-ex max-pain pin than anything else. There are some slight positive intraday divergences in the averages, but nothing I''d consider trading when considering the risk:reward ratio.

Remember the VXX charts today and then the 30/60 min $USDX. This is where the real ugly charts appear in Index futures, shorter term charts are all over the place...

ES 30 min

NQ 30 min

ES 60 min

NQ 60 min

And as a reminder of what I believe is the hub of the wheel...

$USDX 60 min negative.

Once the counter trend bounce fails and $USD starts trending lower, the carry trade losses will be magnified, I suspect this will coincide around the time of the Greek June 5th IMF payment which it seems all but assured they'll miss and be in default as well as other event risk such as the mid month F_O_M_C meeting. I know it's not mainstream thought, but I truly suspect that they'll hike at the June meeting.

Have a great night... Sweet dreams of a lot of great opportunities out there...

I was expecting the market to either pin roughly in place or to see some slight gains as posted in last night's, Daily Wrap...

"Note the second squeeze took place just after we closed the VXX puts, but had waited before entering any assets that would count on market downside as the charts simply were not confirming in enough timeframes to justify such a trade "

and perhaps more telling were yesterday's internals...

"The Dominant Price/Volume Relationship saw 17 Dow stocks, 55 NASDAQ 100, 899 Russell 2000 and 271 SPX 500, a strong Dominant reading and all in Close Up / Volume Down, THE MOST BEARISH OF THE 4 POSSIBLE READINGS.

Also in a polar opposite to yesterday's internals, 8 of 9 S&P sectors closed green with Tech leading at +1.89% and Energy lagging at -0.18.

Even more so, of the 238 Morningstar groups I track, a full 222 of 238 closed green.

As much as yesterday's internals were at a 1-day oversold condition that as I said last night, "This CLEARLY suggests a next day close in the green on a very strong 1-day oversold condition.", today's internals are the strongest form of the EXACT opposite, typically seeing a next day close in the red."

Traders simply don't give enough (if any) credibility to all that volume can tell you.

The averages today stayed fairly well correlated except for weakness in Transports again...

The major averages on the day today with transports in salmon lagging...

The major averages the last 2-days , staying within yesterday's range and all closing red as internals suggested.

And the averages on the week, not much progress with transports slipping more.

Although it seemed like the internals and the gut feeling I had about the market's price action today was based in some objective evidence such as Internals or scattered short term 3C signals, certain other indications seem to show that today's close in the red for all of the averages was not due to the lack of trying...

The same EUR/JPY carry that lifted the market yesterday was in force again today (EUR/JPY CANDLESTICKS VS. ES PURPLE).

HYG, High Yield Corporate Credit was also in lock-sync with the SPX today like yesterday, although both closed red. See last night's Daily Wrap fir the bigger picture with HY Credit leading the market significantly lower.

However on the other hand, there's serious signs of deterioration that are not every day occurrences and in most cases are worse than the 200 or 2007 tops.

For one, the Dow Theory confirmation signal between Industrials and Transports has fallen off a cliff.

Rather than just compare the two averages, I created a custom Histogram on a daily basis showing you the deterioration between the two averages that should confirm each other which is the centerpiece of Dow Theory. Obviously the red histogram crossing below neutral (zero) is the difference between Industrials and Transports... I use to think it wasn't as relevant anymore since the US has transitioned from an Industrial to a services economy, but apparently I was wrong and a lot of those services still require shipping, take something as simple as DHL document deliveries.

In any case, the charts do the talking and as you may recall in recent years, Transports were a high beta momentum group so the fall-off there alone is noteworthy. By the way, our longer term Transports core short is nicely in the green.

As for Breadth Indications which have been steadily sliding for over a year now, in many cases much worse than the 2000 and 2007 tops...

YESTERDAY FOR THE FIRST TIME, THE NYSE ADVANCE/DECLINE LINE WITH A TREND-LINE DRAWN FROM THE 03/09/2009 LOWS TO THE SECOND POINT AT 11/15/2012 DIP AND THE THIRD POINT MAKING THE TREND-LINE MUCH MORE RELIABLE AT THE 10/13/2014 LOWS HAS FOR THE FIRST TIME SINCE 2009 BROKEN BELOW THE TREND-LINE!

This is the first time this has happened since this 6 year trend-line has been in effect.

AS ALWAYS, "CHANGES IN CHARACTER LEAD TO CHANGES IN TRENDS"

I like to update breadth charts every now and then because they aren't open to interpretation, they are math, they are as honest as you get in the market. There's no interpretation, there's no special circumstances, just pure, hard and sometimes cold facts...

*I display the breadth indicator in green vs the comparison symbol (usually the S&P-500) in red unless otherwise noted. The basics of breadth are the same as volume, a rising market should see rising breath indications to match, when there's a divergence between the hard number count of breadth and the market, there's something not right.

The Percentage of ALL NYSE Stocks Trading ABOVE Their 40-Day Moving Average (in green ) vs the SPX (in red). As you can see earlier in the market's trend when internals were still strong, this breadth indicator averaged highs around 80+%. In to 2013 that fell slightly to 80% and in 2014 it fell to a still respectable, but obviously weakening market of 70%. Since 2015 there has been a notable decline in which breadth never recovered from the October lows and the current reading is 42% meaning LESS THAN HALF OF NYSE STOCKS ARE TRADING ABOVE THEIR 40-DAY SIMPLE MOVING AVERAGE. This is about half of what the percentage was when the market had healthy breadth.

This just shows us again if we are looking at the obscure weighting schedules of the market averages, we aren't too far off the highs, but when looking at the stock market as a market of stocks, you might say we are already in a bear trend as more traders are experiencing losses in individual stocks as they fall below their 40-day moving average.

This is the Percentage of ALL NYSE Stocks Trading ABOVE Their 200-Day Moving Average.

You may recall my nearly 4 years teaching Technical Analysis for the Palm Beach County School System's Adult Education program where I inadvertently had been slamming Motorola only to find out after class that one of my students was a former CEO of Motorola in the 1980's, thankfully he agreed with me. The point actually being, Dow Theory was a complicated concept to teach to neophyte traders and I had found that the 200-day moving average was "close enough" to represent the Primary trend (bull or bear market) , the 50-day was close enough to the Intermediate trend and the 22 day was close enough to the Dow Theory Short term trend classification so I used these moving averages, whether the asset was above or below the average and whether the average was pointing up or down as a proxy for Dow Trend classification.

Here the Percentage of ALL NYSE Stocks Trading ABOVE Their 200-Day Moving Average fell from a normal average in a bull market of 80+% to the current 50%. Again, half of the NYSE stocks are in a bear market trend despite the market and its obscure weighting (unique to each average and proprietary to NASDAQ 100 which will cost you a $10,000 a year membership to find out the weighting schedule). Take away the weighting schemes and just look at the percentage of stocks above or below and half of the stocks are in a Dow bear market.

The Percentage of ALL NYSE Stocks Trading 1 Standard Deviation ABOVE Their 40-Day Moving Average declines from 70% to 60% in 2013 to 50% in 2014 and currently at a mere 25.5%, about 1/3rd of a normal, healthy bull market.

The Percentage of ALL NYSE Stocks Trading One Standard Deviation ABOVE Their 200-Day Moving Average, generally stronger momentum stocks. The average percentage in a healthy market was about 60%, although that has fallen to about half that number to a current 31.26%. There's a clear trend of deterioration through 2015 in which it never recovered from the 2014 lows.

This is the NASDAQ Composite and its Advance/ Decline Line. I'm sure you can see the issue here.

However if we look specifically at 2015 alone...

There has been recent and significant deterioration in the number of advancing NASDAQ listed stocks vs declining.

I can't argue with the recent evidence as yields plummeted last week in to the end of the week and Tuesday caught down to the magnetic pull of yields when acting as a leading indicator, which is a shame with the carry trade unwind as Treasuries tend to fall, making this once extremely reliable indicator useless, but recently it seems to be working if only for a brief time.

Like yesterday when Yields dislocated with the SPX, they have remained as such today, suggesting that perhaps our analysis of a major market shock next week may be reflected here.

Also among Leading Indicators, our Pro Sentiment indicator which looks much worse overall, see last night's Daily Wrap to see how much worse. However the point of this shorter chart is to show how much faster Pro sentiment has fallen off recently, making a new low today.

And commodities which have acted as a reliable leading indicator, once again effected by the carry trade unwind as they tend to appreciate during the process, seem to be acting as a Leading Indicator once again, even if briefly as they led to the upside with the SPX, pulling the SPX back from excesses, but leading negative now which fits with indications of a possible major shock to the market next week.

As for internals tonight, they aren't surprising given that the Options Expiration max-pain pin is usually around Thursday's close at least until around 2 p.m.

Unlike the extremes of Tuesday and its 1-day oversold condition leading to Wednesday's sharp reversal to the upside and last night's 1-day overbought condition, almost as extreme leading to a red close today...Internals are not nearly as Dominant as the last 2 days which makes sense. However both the NDX (48 stocks) and the SPX (196 stocks) both fell in to the Dominant P/V relationship of Close Down / Volume Down which is the least influential relationship of the 4. In fact I've given it a nick-name, "Carry On" as in "Keep doing what you were doing" which would mean little movement in to tomorrow's op-ex pin which tends to be what we have noticed anyway with the pin typically close to Thursday's close. The S&P sectors saw 3 of 9 close green and the Morningstar groups saw 97 of 238 close green, mediocre at best. For future reference I will mention that the most common Price/Volume relationship during a bear market is Price Down / Volume Down, it is the thematic relationship, not that it means anything today in that respect.

The 3C signals will be very important the next few days and any additional price strength should be a gift for any short positions we may find looking appealing as we can enter at better prices with less risk, if only we had a 3rd decent shot at transports!

The $USD trend and whether the counter trend bounce is over or failing as I suspect will have dramatic ramifications for the market. As mentioned earlier, the assets bought with carry proceeds tend to be sold off, those are typically bonds and in the reach for yield in this market, a lot of stocks, but bonds have already reversed trend to the downside whereas stocks are yet to make that move...yet.

Finally as to futures tonight... It may be more appropriate to look at them in multiple timeframes with the $USD once again acting as the hub of the wheel.

Starting with the $USDX, From the looks of the Euro charts (which tend to move opposite the $USD), there are short term negative divergence in the Euro like...

Euro 3 min negative which tends to suggest the $USD will see some near term strength. However whether a head fake or the recent trend of the $USD seeing overnight strength and cash market weakness, I can't be sure, but I suspect the $USD will make a last asp move higher.

The Euro 5futures 5 min chart starts to show developing positives suggesting any near term $USD strength, even a head fake move will not hold for long.

The $USD 15 min chart tends to confirm that view as it should worsen in to any near term strength.

By the 60 min Euro charts we have significant positive divergence suggesting $USD weakness and...

60 min $USD charts also confirming the same.

I suspect the $USD will make a last gasp push higher before failing and ending its counter trend bounce and resuming its downtrend, making a new cycle lower low.

This will have an effect on oil as the two tend to trade opposite each other. We already saw today that USO weakness is being accumulated, but I expect more near term weakness which is why the USO equity short is still open.

The longer term 15 and 30 min Oil Futures are positive. Remember as posted earlier today, we are already seeing signs of oil being accumulated in to lower prices which is what I have expected and will be a prerequisite to any longer term core long position in oil, but it needs to pullback to be accumulated at lower prices. The 15 and 30 min Oil futures seems to tell us that is what is happening.

Oil 15 min futures positive divergence in to lower prices and...

The stronger 30 min chart positive in to lower prices, I expect near term $USD strength will send oil lower and it will continue to accumulate, by the time the $USD turns down, oil should be in a position in which a long term trend long can be entered.

As for gold... It too tends to move opposite the $USD so near term strength in the $USD on a last gasp push, should hold gold back for a short period. However the 5, 7, 10, 15 and 30 min Gold futures are all positive, this may reflect a flight to safety because of Greece as well as inflation expectations related to what I believe will be a much earlier than expected F_E_D rate hike. Whether the projections of higher inflation by the F_E_D are genuine or not, they'll have to make the case to hike rates and as such, gold should appreciate on inflation expectations, real or imagined.

Treasuries (TLT), I have expected a move lower in treasuries and that would be the case on a falling $USD and carry trade unwind. Very near term Treasury charts are negative and I suspect we see the move lower I have anticipated (June TLT puts), here are a few key timeframes...

30 year Treasury futures 3 min near term negative...

3 year t futures 7 min negative

And 15 mi negative.

We'll have to reassess Treasuries/TLT for a counter trend rally upon seeing lower prices. If like Crude we see accumulation in to a decline, then it is likely we get a counter trend rally in Treasuries as I have also expected on a longer term basis, although not a reversal basis. If we don't see accumulation in to lower prices, we just stay away from the trade.

Lastly Index Futures... I can't imagine the $USD making a new lower low, the carry trade turning negative at losses magnified by 100:1 to 300:1 leverage and equities which were financed with carry profits not falling.

Very near term there's not much in the way of guidance which makes me think this is more related to an op-ex max-pain pin than anything else. There are some slight positive intraday divergences in the averages, but nothing I''d consider trading when considering the risk:reward ratio.

Remember the VXX charts today and then the 30/60 min $USDX. This is where the real ugly charts appear in Index futures, shorter term charts are all over the place...

ES 30 min

NQ 30 min

ES 60 min

NQ 60 min

And as a reminder of what I believe is the hub of the wheel...

$USDX 60 min negative.

Once the counter trend bounce fails and $USD starts trending lower, the carry trade losses will be magnified, I suspect this will coincide around the time of the Greek June 5th IMF payment which it seems all but assured they'll miss and be in default as well as other event risk such as the mid month F_O_M_C meeting. I know it's not mainstream thought, but I truly suspect that they'll hike at the June meeting.

Have a great night... Sweet dreams of a lot of great opportunities out there...