I received this email tonight and thought, a lot of people are probably thinking something similar and I just wanted to take the occasion to use this email to comment on the question.

"With the headlines prepping everyone for a lack of action from Bernanke when he speaks on Friday; are you suggesting that despite that lack of action, you wouldn't be surprised to see the market blast to the upside much like the day the FED announced their recent policy stance?

thanks,"

I think from my posts, people could very well draw that conclusion. However, I don't quite know what to expect from Jackson Hole, I do know however that the big banks have all commented on the scenario, offering free information and analysis at the same time they try to pick your pocket. Yahoo just carried the headline, but Zero Hedge Commented on it, CitiGroup commented along the same lines, I believe GS also commented on the disappointment of Jackson Hole as well as Bank of America.

I could point out the simplicity of contrarian thought right now when everyone is setting the stage, however I merely would like to point out that this is a time to keep your minds open, not to buy the dogma that the banks who are trying to take your money are selling or the press that caters to them. I don't know what to expect of Jackson Hole, but I think the market and 3C will give us guidance before the day comes and we will have an idea of which direction our toes should be pointing in.

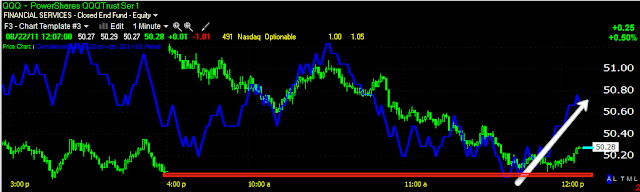

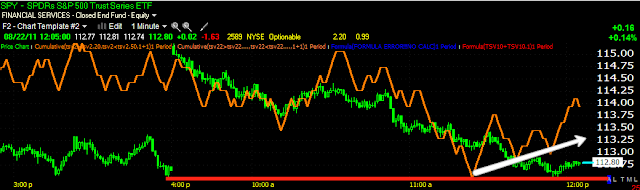

What everyone knows is not worth knowing, to make money in this market you have to see what the masses have missed and that's exactly why the SPY looked like this last week, because of crowd think and herd mentality.

A smooth curve in the market sees an abrupt change of course, all connected to crowd/herd mentality on options expiration. The market will always surprise you.