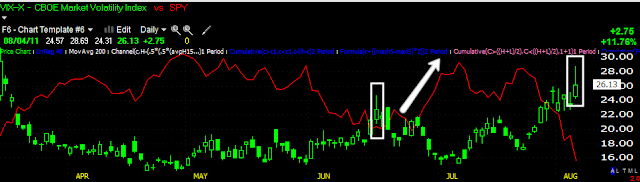

I remember this chart was showing daily accumulation and it was for awhile. I was trading full time back then and remember the environment, every time the market threatened new lows, the Plunge Protection Team would step in (aka The Fed), but still, no one was sure what they were capable of and we had just gone through the nastiest decline is 8 years.

Daily accumulation for nearly 4 months, something big was up.

That period was in the white box, if you bought and simply held (not trading any of the counter trend moves), you made around 75% over the next year holding 1 simple, non-leveraged ETF. This gives you some idea of what Wall Street knew.

This was another tough call, this was toward the end of QE1, most people thought it would be quickly followed by QE2. By the time the divergence was evident, you might have missed 2% of upside, although I believe intraday timeframe helped nail the reversal.

However, you would have had the chance to make a lot of money of the following 16% decline or at least saved money.

This was another controversial call. The dollar had been trending lower for 10 months, there was nothing on the horizon that even remotely suggested strong fundamentals for a rally in the dollar.

Yet 3C showed a lot of accumulation, intraday time frames helped to narrow down the best entry, but still no one believed the dollar was capable of rallying. A 19% move in the snail-like Dollar Index, about a month later, the Fed announced a strong dollar policy. Obviously Wall Street knew ahead of time.

This next one was one of the most controversial calls of all. After a 6+ year uptrend in oil that seemed unstoppable (if you think the gold bulls have a strong opinion, you should have seen the oil bulls back then), 3C showed multiple divergences showing a reversal was coming. That same week Cramer told his viewers to buy oil on the next bad inventory report, they bought-at the top!

The next 8 months saw a 80+% decline.

There have been many times when my faith was tested in 3C against what seemed to be impossible odds, yet each time it came through, it just took some patience and faith.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago