Today's market was more or less a NOTHING day, which after a day up like yesterday is not good news for bulls as it shows no follow through, but as I showed you last night, we had a number of bearish closing candles like shooting stars so today's behavior is not that surprising. What is a bit surprising is that a POMO day like today failed to lift the market unless you consider a .28% gain in the DOW and a -.02% loss in the S&P-500 as significant.

The real action today was in currency, specifically the EUR/USD pair. Earlier I showed UUP (proxy for the dollar) moving up into a technical upside breakout. Apparently a Citigroup note for clients to take profits on the pair sparked selling in the Euro.

Here are a few charts:

Here is today's stock market close to when I captured this image tonight. As you can see, we have seen significant deterioration in the Euro and strengthening in the dollar. Interestingly, the UUP breakout seemed to be a hint this action would continue. In Poker vernacular, you always have to watch the market for "tells".

Here is a longer hourly chart showing the possible Head and Shoulders top in the Euro (base in the dollar), you can see once again the moving averages are crossing and one is left that is almost crossed down into a bearish mode (at the box/arrow).

As I've been telling you, the technical pattern in the pair does not look good (Head and Shoulders top) and we are getting closer everyday to that neckline.

As for GLD, last week I mentioned that traders may watch for a bump in GLD, we saw that Monday, today GLD failed to do much at all. We'll watch it closely tomorrow to see what it's intermediate/short term intentions are. However, the GLD long term negative divergence, which indicates distribution is, still intact in GLD. A member sent in an interesting article that probably explains some... maybe all of the negative divergence we are seeing in GLD. Remember, 3C's job is to show institutional buying (accumulation) or selling (distribution) through positive and negative divergences.

Below in blue is an extra long version of 3C in a negative divergence in GLD.

So this article from CNBC with PIMCO's #2 and a pretty straight shooter, Mohamed El-Erian has some interesting insights, but one of the most interesting comes in the last paragraph:

“El-Erian also explained PIMCO’s significant reduction in a key fund's gold position from 10 percent to 3 percent. He said investing the precious metal “doesn’t make as much sense as it used to.” Because the price has moved so much and the trade is so crowded, he sees potential for a large technical retracement.”

This kind of move from a fund as large as Pimco could easily be what 3C has been picking up on in GLD. Any move up in the dollar should exacerbate the the selling in GLD. As I have always said, some of the biggest and most unexpected, unexplainable 3C reversal signals make absolutely no sense until some time later-this may be that “some time later”.

Still, besides getting your feet wet in the short trade if you like it, I still recommend waiting for a validated price reversal, which arguably we could say we have, I prefer to use the Trend Channel to objectively identify that point.

This is a Swing Trader's stop using my Trend Channel-stop at the red arrow.

This is a Trend Trader's stop-at the red arrow. If you look at the channel of each, you can see how this objective Channel that I wrote does an excellent job keeping you in the trend rather then setting arbitrary stops.

Here's today's upside continuation breakout in UUP (proxy for the dollar)

A bit strange, but the VIX is up both yesterday and today, yesterday was particularly strange as it was a solid close up, today wasn't so solid, but up, still the volatility index is pricing in volatility and acting in a manner in which you'd expect to see in a decline. I've seen this before, a pretty large sell-off occurred soon after.

As I showed in the intraday NASDAQ Breadth charts, the crawl up today was into negative breadth through out-sequentially declining the entire day. The daily NASDAQ Composite Advance Decline line makes this poignantly evident.

While we're on the subject of breadth, the New High/New Low Index is also showing surprising recent weakness.

We're also seeing weakness in the % of stocks 2 standard deviations above their 200-day moving average.

A closer look reveals more recent weakness.

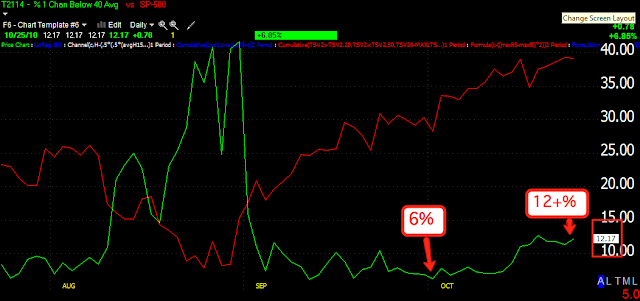

More evidence of recent breadth weakness is the % of stocks 1 channel above their 40-day moving average.

When we look at the stocks that are 2 standard deviations above their 40 day price moving average, we really see a discrepancy. This shows the stocks that were really moving and making extraordinary gains went from 35% to about 7% in a period of about 2 weeks-thus this is probably the reason I'm seeing so many recent bearflags as these once high fliers make their initial breakdown and bounce up slightly in a bear flag. This is a pretty extraordinary reading.

More confirmation of this recent breakdown in market breadth is seen in this chart of the % of stocks trading 1 channel below their 40 day moving average. When prices were lower in early October this number was about 6%, it has now doubled, meaning more even at higher prices, twice as many stocks are trading 1 standard deviation below their 40-day moving averages-this number should be going down into a healthy rally-this is how we can identify bear market rallies, the refusal of stocks to participate into higher prices and fewer and fewer stocks, but heavy weighted stocks, are participating in the rally. The market is essentially manipulated by buying a few heavily weighted stocks on the index. Remember my article a few weeks back, “What If The Market Turned and No One Noticed?”

Again, this is confirmed in the % of stocks trading 2 standard deviations below their 40-day moving averages. Here again, w see that percentage double in the past two weeks.

More confirmation in the Russell 2000 Advance/Decline Line, fewer stocks are participating, especially when you look at equivalent price levels and equivalent A/D levels.

All in all, everyone of these indicators should be going the exact opposite way they are going. They all show a thinning market, more stocks declining then before even though prices are higher, but it is relatively east to manipulate the averages higher using a select few stocks. However, when looking at how many stocks are participating, it is becoming ever increasingly clear that this market is turning or may have turned, with the averages deceitfully making investor think they are missing the buss. By the looks of the flows of fund out of the market, even retail investors aren't falling for it.

I have set more trades for alerts, I have a feeling we'll see some on the last list trigger this week, I'll be adding more to the list in the a.m.