Well there are stocks everywhere getting slammed today. I'd attribute a large part of it to the Portugese incident, but I'll have to do some dgging later to confirm that.

One thing is for certain, yesterday I told you the Dow was tipping it's hand and showing some negative divergences/distribution. Ironically today it's held up the best.

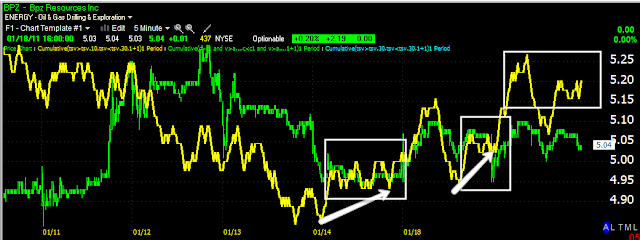

Here are the current charts and if you are a bull, you're not going to like them.

The DIA's negative divergence is now spread to the 30 min chart which means the situation is more serious-but you can see that in the market's action. The last 2 days have confirmed this divergence.

The Q's were coming out of an ascending wedge, I talked about it and knew that we'd see the typical volatility of a very familiar pattern as the black boxes love to make 100 years of technical analysis the weapon of choice they use against you. The 30 min picked up on the divergence late yesterday and is leading today.

The SPY 15 minute, which is a nice timeframe for reversals of the "Swing" magnitude, traced out this nasty little divergence which was relative until today when it went into a leading divergence.

There are some short term positives, I'm not sure what to make of them, but the market has been very "Gappy" lately so a gap in the a.m. would make sense (to the upside). We also haven't seen downside in many of the averages like today in quite awhile. Just looking at the 1-5 minute positives, I see there's a slight bid in after hours, so it could be about that too where the market makers/specialists pick up some shares toward the close and sell them to permabulls who are stuck on the "Buy the dip" mentality no matter what the charts say.

For now, lets take it for what it is, a bad day. I'm going to check the market breadth and the P/V relationships, today could have created a one day oversold like the one day overbought I mentioned last night. As they say, one day does not make a trend. I do believe though we are setting up for some nasty downside. The bases I've seen in some of the inverse ETFs are just too big for them not to pop. If/when they do pop, it's going to be ugly with bases of that size.

I'll be reporting back, I have a lot of charts to look at.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago