More bad economic news today, other than Initial Claims, US factory orders have now declined for 6 months in a row.The St. Louis F_E_D said the two previous times US manufacturing orders declined at this rate on an unadjusted (or adjusted) basis, the US economy was already in a recession. Then we have the yesterday's report of the Atlanta F_E_D's GDPNOW modeling (in real time) that is pointing to US GDP crashing to 1.2%. It's difficult to imagine the F_E_D hiking rates in this environment, I never have understood how they could get away with it the way macro data has been coming in, but perhaps the fact they have little if any slack, as the BIS (Central banks' bank) said in their annual report, "Leading central banks are stretched so thin" they doubt they have the ability to deal with even a "Garden variety recession". Things aren't good here, things are horrible in China, the market may just be looking at what the F_E_D is going to do too close and maybe should be more worried about the economy.

This isn't immeasurable opinion, it's fact. Bloomberg's Macro Surprise Index is now at low levels not seen since just after Lehman and is falling at the fastest pace since the summer of 2012. Since the start of February we've had 56 Macro data points, only 8 beat, the rest came in below consensus.

This chart is simply stunning, remember the F_E_D ended QE at the end of October, whether that's a factor or coincidence for anything other than banks I have no clue...

Bloomberg's Macro Surprise Index vs the SPX, but all is well because, "It's different this time" (sarcasm).

Friday’s non-farm payrolls will be the key report that traders are focussed on. There seems to be a perception that tomorrow's NFP may be the make or break June F_E_D Rate Hike Data point, although I doubt that and I suspect an organization that big, making a choice that influential, has had it planned w(either way) for quite some time. However, for the market, the NFP will be tomorrow's fulcrum event.

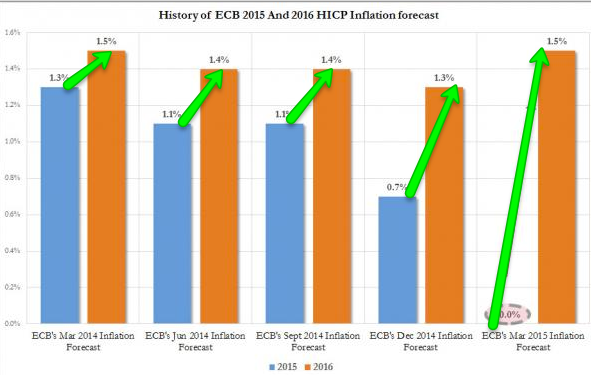

As already discussed, overnight, China lowered its GDP growth target to 7%, which marks the country’s lowest growth target in the last 11 years. It wasn't just the lowering of GDP, it was the somber tone, the laundry list of structural problems China faces that are nearly as insurmountable as the Great Wall of China. This is only 1 of several reasons that Draghi's upgrade of EU GDP was crazy considering China is Europe's largest trading partner, but the inflation hockey stick expectations from 0 to 1.5 between 2015 and 2016, how could anyone possibly know what's going to happen with crude which is what was cited as the reason for cutting the inflation forecast twice in about 2 months down to zero, but the GDP projections really take the cake.

What happens if Greece does fail (things are not looking good since the "DEAL" in Greece" As you might have seen earlier, one of the IMF's directors said the Greek bailout was really a German/French bank bailout which I think most of us already knew, but a member of the Troika actually said it.

I'd like to share with you my sentiment as posted numerous times around the late September to early October bottom of 2014, this is just one post as it takes a while to find all of them as much as I post. The excerpts below were posted when the market was exactly right where the white arrow is, October 2nd...

"I'd say about a week or so ago I said, "I don't like it when too many people are calling for a top at once", bear markets surprise, often they decline sharply on what is otherwise good news, a testament to how important market breadth is as even good news can't sop the rot that has set in from turning to an all out collapse.

I made mention of Elliot Wave International's Robert Prechter, even though I personally don't follow Elliot Wave Theory (as I notice many practitioners son't agree on the count and they always have the fall back "Alternate Count", like saying the day will be partly cloudy so if it rains you are right, it if doesn't you are right.

There were also two Hindenburg Omens which generate a lot of talk, but we've seen numerous clusters and while I don't doubt they are a condition that precedes a bear market, I do not believe that they are in and of themselves a harbinger of a bear market.

In other words, there are too many people bearish right now and that includes even retail. Since I've had an intense interest in the psychology of bear markets and how investors that made a killing on the way up so often lose it all on the way down, a member sent me an article that touched on some of this.

NASDAQ Market Timers represented by Halbert NASDAQ NewsletterSentiment Index is interesting as a contrairian indicator. Since the Sept. 19th high, HNNSI has declined 75.5 percentage points from a net long 68.8 to a slightly short positioning of negative -6.7% so the typical "Buy the Dip" crowd, is not in fact buying the dip and this on an approximate -2.85% decline.

What I found interesting was the same indicator back at the Tech Bubble top of March 10th saw a n 18% decline over the next 3 weeks and during that period HNNSI actually rose, even though the -18% was 2% away from a media's definition of a bear market, the longs saw it as a buying opportunity and from there, it's easy to see how small bear market counter trend rallies can keep their sentiment bullish as a new low is made which they then swear they'll exit the position once price reaches the area in which they entered long, of course it never does, but each bear market rally gives them hope that "this time the market will get to my entry", even though the market knows nothing about your entry and as easy as that, you can understand psychologically how people lose it all in a bear market. After 5+ years of one scenario, it can be difficult to adjust to a totally new scenario, in fact most don't believe it's possible, that's the "New Normal" crowd or the "F_E_D has our back" crowd, both are desperately wrong as history has proven over multiple centuries and all kinds of bubbles."

I posted that which is far from how seriously I made the argument at the time which included sentiment indicators hitting all time record highs of BEARISHNESS. You know how I feel about the big picture of this market, some might expect me to jump on the bandwagon and post all of these experts calling a top back then, but in fact just the opposite which eventually led to our calling the October bottom days ahead of anyone and at a time when no one thought the market could do so much as bounce, we were calling for a "Face Ripping Rally" that would entirely change sentiment.

I mention all of the above to show you the latest Investor's Intelligence Bull/Bear Ratio at record highs (granted this doesn't represent people like the best paid fund manager for the last two years, Appaloosa's David Tepper who sold 60% of his equity exposure in Q4 2014 alone and had been quoted a year before as saying at an investment conference that they had been selling EVERYTHING not nailed down for the last 15 months)....

You can probably see the 2009 reading at all time lows when the market was actually basing and starting its run higher so this group isn't historically known for being right, but this is the point of mass psychology and market sentiment. The job of the market is to make the largest segment of investors wrong at once.

Now at record highs, this is the kind of environment I like, even though there are those out there hitting the air raid siren, most recently Tech guru of the Dot.com era, Mark Cuban. However it's not the 1 guy that I'm concerned about or the 600% increase in George Soros' put position in SPY, lifting it to levels he hasn't held since 2008. The crowd forgets or rationalizes away that stuff quickly.

I have little things I remember about bubbles and bottoms, things people said or did or what was being said on CNBC at the time. I often mention the 2008 top in oil we had been calling and the same week Cramer out there telling what I'm guessing is millions of viewers, to buy oil on the next bad EIA report as a contrarian trade. Not only was oil in a parabolic bubble and showing all kinds of red flags, but the very notion that millions of people doing the same thing at the same time on the same day was contrarian blew my mind.

I suppose one of those moments just came with the CNBC panel talking about the mess in subprime car loans and taking out a 7 year loan to take cash and put it to work in the stock market. Now I understand that it's a smart thing to do to pay down your highest yielding interest rate debt first or to use assets to get a higher yield, but this 74 month car loan thing sounds a lot to me like EVERYONE out there should be in the market right now and here's how you do it. Can you imagine the depreciation on that car in 4 years? Just the fact this was a segment with a panel was enough for me to log that one in the memory banks for 2015. Why even talk about cars and 7 year loans as it relates to the stock market? The whole thing reminded me of the property bubble in which friends of mine, housewives became real estate speculators almost overnight or the gold bug era before the top in gold in 2011, I had friends who knew nothing about gold buying it hand over fist on the internet. I explained to one of them that a gold coin shouldn't have a seam on the edge, they are struck from one piece, not a front and back fused together (fake coins). In any case, if I'm getting of track, charts are worth a thousand words...

RIPE ENVIRONMENT

On to internals and indications. Today our Pro Sentiment indicators that have been slightly biased to the downside and the other in line saw a decline that started at the European close and accelerated in to the US close, divergent with the SPX.

HYG which is divergent with the SPX did move higher intraday as mentioned in a couple of market updates, I'm not sure if that was as support for the market in to the close or not, it wasn't anything big considering.

HYG is still plenty divergent and we've seen declines like the October lows on smaller divergences than this.

TLT which I have covered over the last 2 days, looking like it's getting ready for a move higher also declined at the close, so it almost looked like a SPY arbitrage to ramp the close or keep the market in the green, but VIX didn't participate. Remember, typically op-ex Friday's have a pin near Thursday's close.

Yields intraday looked like they were dragging on the market a bit, but they haven't moved enough to make a real difference, but don't forget the TLT and Treasury Futures positive divergences, those will send T's higher and Y's lower.

The Dominant Price/Volume Relationship was in 3 of 4 of the major averages, the Russell 2000 was the only one that didn't have one. The Dow (13 stocks), the NDX (51 stocks) and the SPX (218 stocks) were all in the Close Up/Volume Down relationship. Of the 4 relationships, this is the most bearish and typically has a 1-day oversold condition that follows the next day with a close lower, but I suspect this is part of something larger especially with all the central bank action the last 2-days, that keeps sticking with me just from seeing the market make obscene moves on small easing in the past.

Six of nine S&P sectors closed green with the defensive Utilities leading at +.79% and Energy lagging at -.60%.

When I look at the same on a 21 and 31 day basis, we have 7 of 9 and 8 of 9 closing green respectively, that is what I'd consider an overbought condition on a larger scale like the current cycle.

As for Morningstar groups, 149 of 238 closed Green today, nothing too special. However on a 21 day and 31 day basis, 184 of 238 and 200 of 238 respectively, that second one is definitely on the overbought scale, although you can see that with conventional indicators.

breadth indicators are rolling over, in addition to the McClellan Oscillator, Cumulative Volume Index and Absolute Breadth Index I mentioned yesterday, the New Hi/New Low as well as the 4 week, 13 and 26 week versions are all rolling over and the one that I watch the most, the Percentage of NYSE Stocks Trading Above Their 40 and 200 day Moving Averages and the 1 and 2 standard deviation above those averages are rolling over as well, those are actual percentages of stocks, for example...

This is the 2 standard deviation above the 40-day, momentum stocks in green vs the SPX, you can see it taking a sharp decline. In addition, this is usually around 37%, it's at 10.6% after the market just made a new high, pretty poor breadth.

Finally as for futures tonight, you recall earlier I told you we only had 1 real divergence today that was about 11:15 or so and the rest of the day was nearly perfectly in line?

Well since the close or in to the close, Index futures have broken that trend and are looking a bit worse, of course I'll check up on them later and report back if there's anything jumping out, but here's an idea...

ES 1 min, note the in line messy status all day and since the close.

You can see it even better on NASDAQ Futures.

I'l keep an eye on them, you have a great night!

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago