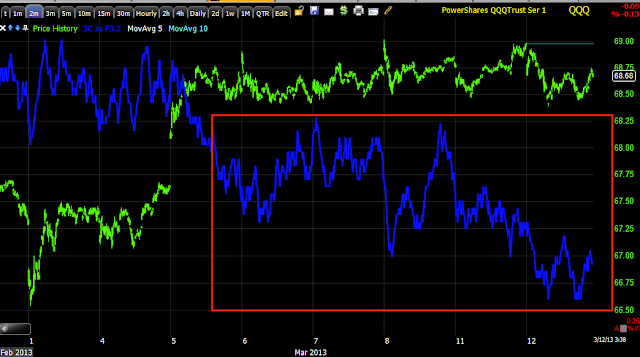

OK, here they are and they show how the market was a bit overdone earlier before we got some upside at 2:15...

*Leading indicators are always compared to the SPX (green) unless otherwise noted.

Here commodities are holding up better than the SPX, this is a short term bullish signal for the SPX, bur very short term and you need to know why, the first thing you want to check with commodities is the movement in the $USD.

Here's commodities vs. the $USD (green), note there's a nearly perfect inverse relationship, typically stocks follow this inverse correlation as well, but today the SPX was even more negative than the $USD correlation would suggest, this is a 180 degree change from recent market behavior related to currencies and especially the $USD.

Here's FCT going negative yesterday in advance of the SPX, today the SPX turns negative, this is why we call them "Leading indicators".

HYG also turned negative in advance of the SPX, longer term credit is way more negatively dislocated from the equity trend, since credit markets are much smarter and larger, they tend to lead equities, equities tend to follow credit.

I mentioned I thought HYG was seeing a short squeeze bounce recently, this 15 min chart is showing the end of that move, the yellow area is a head fake move.

Intraday before the SPX moved at all at 2:15, HYG's 1 min chart was slightly positive, suggesting the SPX would see some upside intraday.

Junk Credit trades a lot like High Yield, it too went negative and broke down to the left and saw what I believe to be a short squeeze bounce to the right that saw distribution and is ending as price starts to roll back over.

Looking at currencies intraday, the Euro which has a pretty tight correlation with the SPX was showing support well before the SPX (as it was making a new low), this suggested the SPX see some intraday upside as well, this is a much stronger signal with the $USD also signaling the same.

Longer term, to the left the SPX and Euro are moving together as this is their typical correlation, the break down in the Euro and EUR/USD is quite sharp, this leaves the SPX largely unsupported, it can move higher as it has done,

this is the essence of a divergence and what makes it such a powerful signal.

Intraday since yesterday we can see the Yen moving up while the SPX moves down at the same time, this is one reason I have been watching the Yen so closely. I do believe some of the upside in the Yen is due to China, but I think some is due to carry trades being closed out, which is a red flag warning for the stock market as carry trades typically finance equity positions, so equity positions would be closed out first. If you don't believe 3C is showing that, then look at market breadth, it was down yesterday in to a market that was largely up-

how can you argue with that?

The Yen on a 5 min chart also showed earlier at 1:15 the SPX was lower than the Yen correlation, also suggesting some upside intraday for the SPX.

Treasuries are the flight to safety trade, look at the 30 min leading positive divergence , with the market's price pattern looking so strange, 3C signals and breadth, I'd be taking this chart seriously as well.

Near term the 5 min TLT chart continues to see positive divergences