At 2:18 I posted a market update showing a positive divergence building which seemed to be a simple oversold intraday correction.

Here are the results and what 3C looks like into the close.

The DIA from the time of the update until the close, this wasn't a huge positive divergence so the upside after the update is about in line with what I'd expect.

Into the close there's a bit of a negative divergence there, it's also not a huge divergence, it's not a leading divergence , but it did fall out of confirmation of the intraday relief move.

The IWM

The IWM posted the weakest divergence, in fact I don't even think you can call it a divergence as price levels were relatively the same, so there's the possibility of some more upside here tomorrow morning.

The QQQ probably saw the most upside of all 4 averages.

The divergence here is a negative divergence, again not very deep, certainly not a leading negative. Note there was an earlier divergence at the previous reaction high so once again, there is the possibility of a continuation of this move into tomorrow morning.

The SPY didn't move much, but it was the biggest relief move for the ETF on the day.

This divergence is probably the most serious of the 4.

The bottom line is that there may be some more intraday upside tomorrow in the early going, so long as it doesn't start to lead price upward, it would probably be a good opportunity to pick up any short positions you may be looking at. I'll of course update any morning action that would help you wit tactical entries or warn of a shift.

What I did find interesting was PSLV's chart today.

There's a pretty strong divergence there, a leading positive divergence actually. When we see these divergences and they don't react (meaning there's no upside move) it suggests continuing accumulation especially in such a flat trading range. It will be interesting to watch PSLV/silver tomorrow to see if there's a decent move up on this positive divergence.

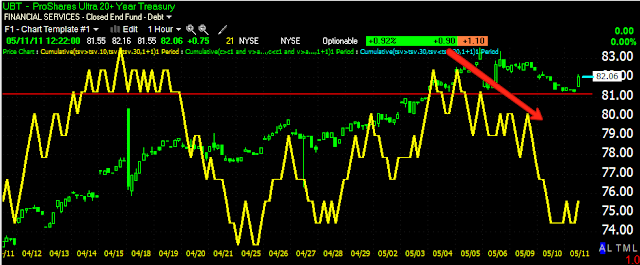

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago