This is a comparison between FXE the ETF for the Euro and The Dollar Index (and UUP and EFT for the dollar Index for intraday charts). The Euro makes up about 50% of the dollar index so it is the most influential currency paired against the dollar, thus they tend to have inverse relationships. Furthermore, when the dollar is strong, generally speaking commodities and the stock market are weak, when the dollar is weak, the stock market and commodities are strong.

FXE daily chart showing a long term negative divergence.

The more important 2-day chart shows an even more pronounced long term negative divergence.

The recent hourly chart is negative suggesting that soon the dollar will rally.

Although there are pockets of accumulation, the 30 min chart is confirming the weakness in the chart above.

FXE 15 minutes suggests some dollar strength soon, which would be equity negative.

The 10 min chart suggests the same.

The 1 min chart is trading a little better then in line, but it's not a strong signal at all.

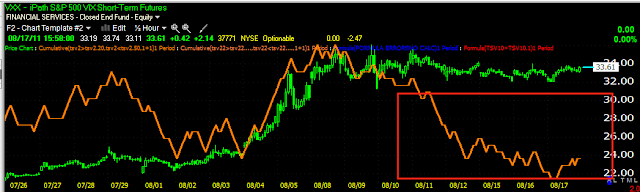

DXY-Dollar Index

Here's the daily chart for the Dollar Index, showing a nice positive divergence.

When flipping to the 2-day chart, which carries more weight, the extent of the divergence is larger, also note the 2011 top.

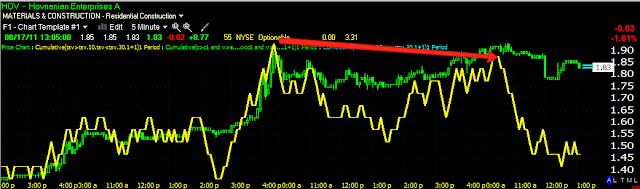

UUP ETF for the Dollar Index

The hourly hart shows some accumulation suggesting market weakness to come. I believe this is a little further off, not right now, at least not from this divergence.

The 30 min, much like the Euro, is confirming the 60 min above.

The 15 min chart is the one suggesting more impending dollar strength, which translates in to market weakness.

The 5 min chart also looks like this move is impending.

The 1 min hart also lends some support to the impending nature of the strength in the dollar.

This sequence fits well with my theory about the market and Op-Ex. That theory basically says that we get some strong market weakness the next two days, which cleans out the calls and they expire worthless, the Puts position in the $120-$130 SPY range is about 60% larger, my thinking is that these shorts who are itching to get back on the short side, exercise their options rather then selling them and next week we see a short covering rally which will take out the PUT holders/shorts. After that, I expect the next leg down to be the worst thus far. With the daily dollar chart looking as t does, if we see massive strength in the dollar, that will be massively negative for equities. That's my take as of this moment.