Shifting gears, when I originally wrote the articles, Understanding the Head-Fake Move... How Technical Analysis Went From an Asset to a Trap and Understanding the Head-Fake Move... Motivation (both of which are always linked near the top right side of the members' site), I intended to write a 3rd article for the series that consisted mostly of examples.

You may know I had a partial FAZ long position (3x short Financials) which I wanted to fill out on a move in XLF above the range that persisted from June to late July as it would have made the perfect head fake move and entry which I'll show in a moment. I closed the FAZ long on August 1st in an effort to keep the gains it had made and because I suspected we'd be forming a base (based on both 3C charts and the deeply oversold market breadth ) and I also thought, "Why not just add the entire position where I initially wanted it. If you saw XLF on 8/1 when I closed the 3x Financial short (FAZ), you probably wouldn't have looked at it and thought I'd ever get close to the entry that I wanted, but I viewed it as a very high probability which is half the reason I closed the position (hold on to the gains made and re-enter at a better price with less risk and suffer no drawdown in the FAZ long as well as have a prime entry for a full size position.

Fast forward through the formation of the base (8/1 through 8/8) and the bounce off the base expected since then and suddenly XLF/FAZ are MUCH closer to the entry I wanted.

The point being, XLF is an excellent example of a head fake move and if you read the two articles you'll probably understand why and why there was a head fake move in XLF to start with. For those less interested in Financials, XLF is still an excellent barometer for the broad market and target for a pivot reversal area.

As you see, that move never materialized, but rather XLF broke down below range support and rather than sticking with FAZ, I recognized what was going on and closed it the first day below the range, as you can see, I didn't leave much on the table as price moved sideways (forming a base) for the next week and then set off higher.

XLF didn't have the strength to make the head fake move on its own. Wall St. firms could have bought XLF and sent it above the range as they likely want the exact same thing I want, to short Financials above the range and for a specific reason. For smart money the breakout above the range means retail buying which means demand which means larger Wall St. firms can sell or sell short in to price strength and demand, both of which they need when trading positions of their size. I want to do the same because I know that's where the big boys will be doing it and I want to follow those who move the market.

However, buying XLF to soak up enough supply to send prices higher means spending a lot of money when in fact you want to do the opposite and sell/short XLF so that method doesn't work well for the objective as they just have more XLF to get rid of.

This is where the head fake move comes in and this is where XLF's probability of a head fake move became a high probability on 8/1 when I closed the position, here's the link to that day... Closing FAZ Long and here are a few excerpts from that post on 8/1, the day XLF broke the range (which would normally appear as a good thing for an XLF short like FAZ)....

"This is just for now to lock in gains, I'll decide later if I'm going to add a long like FAS for a bounce."

I wanted to lock in gains because I didn't expect any more on the downside in the very near term. I hadn't decided whether I'd enter FAS, 3x long financials, for a bounce because the base had not formed yet (it formed from 8/1 to 8/8 not only for XLF, but the entire market). Whether I entered FAS long as a piggy-back trade until XLF got to where I wanted to see it go, all depended on how strong and reliable the bounce looked. As stated many times before, the probabilities of a bounce were good, but there's a difference between probabilities and high probabilities/low risk trades. If there's not a strong 3C divergence for the bounce, then even though probabilities are for a bounce, I put the position at risk of a sudden decline that can wipe out the entire position on a morning gap, that's not worth the risk without very strong charts to back the trade.

Now, here are the charts which will hopefully show this entire process, probabilities, where the strongest trade is and why XLF is an excellent barometer for the overall market and its reversal point although as we saw yesterday, there will be differences in relative performance , for example Financials could be one of the only sectors really performing while the rest are mediocre as we arrive at the end of this bounce move.

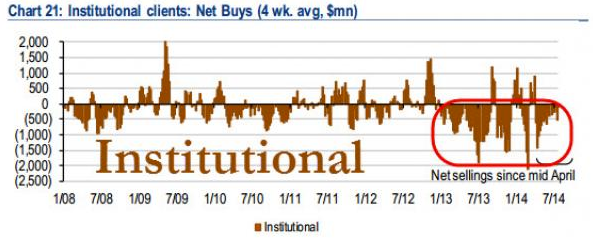

Clearly the long term 4 hour XLF chart shows distribution on large size, it's not really that much different than the Institutional net selling charts I've posted such as this one from last night...

Without even considering Apollo capital's manager at a financial conference last May saying, "We've been selling everything not nailed down for the last 15 months", you can see in the client type net buy/sells that institutional money has been actively selling and handing the bag off to retail in a classic market top since 2012.

Market breadth and 3C have shown the same things. This is just no ordinary market though, it's a F_E_D construct and smart money knew the party wouldn't last forever and started dismantling their huge positions a while ago while there was still demand by retail (who picks ups the supply -see the green line).

One thing 3C has taught me is the major volume spikes and big price declines are not smart money selling, they are long gone before that happens and positioned to take advantage of the decline, retail has been taught by T.A. that this is smart money selling, they just don't operate like that.

Here's another Institutional net buy/sell chart...

Here it's very clear that the trend has been distribution since Jan 2013 in size that's even larger than the 2008 decline.

The point being, the 4 hour XLF negative divegrence above is right in line with what we know about institutional selling in size, we just knew it long before these two charts came out in the last couple of months/week.

Here's where the head fake move and Wall Street abuse of Technical traders' predictability comes in.

The 15 min chart showing more recent action went leading negative at the far right of XLF's range, it was apparent then that I would not see my head fake move above the rnage so I just held the FAZ long (3x short financials) for the time until it broke below the range.

The range was very well defined, this means a break below it is going to hit all kinds of stops right at the range's support and retail short sellers will enter the trade on what they consider to be "PPrice confirmation", this creates huge supply (sellers from stops being hit and sellers from short selling) and at lower prices. In this case Wall Street doesn't need to put a bunch of money in to XLF to push it above the range, they absorb supply on the cheap , create a base to bounce from, trap shorts in a bear trap from which they'll be squeezed and let the market take care of the rest. The resulting short squeeze of brand new shorts pushes prices up without Wall St. having to do anything except sell in to higher prices.

The entire reason for most head fake moves is to create sling-shot momentum without expending a lot of resources, just let the short squeeze do the work and they can make some money on a piggy back long for a week or so until they are at their target short entry which is the same as mine, above the range, which causes new longs to buy the breakout (again price confirmation) creating even more demand that can be sold/sold short in to and at the same time creating a new bull trap that will create downside momentum when price fails back in to the range, hitting longs' stops and creating more supply, forcing prices lower until the range is broken again with new shorts entering with even more supply created sending prices lower, but smart money and those like us who follow got the best entry near the top whole others are entering shorts below the range again.

This 2 min trend shows the far right corner of the range and distribution sending prices lower and below the range where they are accumulated in a week long base, short sellers are locked in and the start of the move up / short squeeze allows smart money to sell in to higher prices as you can see to the far right (red arrow).

This is just confirmation that our original plan and thinking are right on track, but this isn't anything knew, this is a typical head fake move which was predictable sinceBEFORE the base for a bounce even started (8/1 exit of FAZ).

The 5 min chart and XLF range, then the base (white arrow) and as price moves up, distribution in to higher prices which confirms the highest probabilities on the 4 hour chart are being realized as we move higher. I would have said the chances of distribution in to a bounce were 90+% before it even started based on the long term chart's probabilities, so this trade is not that hard to envision or forecast.

The 10 min chart showing the same.

As for a market barometer, the most probable outcome is a move above XLF's former range, it couldn't be accomplished before until this head fake/sling shot momentum move was set up, now it has a good chance and that's where I'll be looking to add FAZ back, although I'm monitoring it just in case it can't make it all the way to the intended target, volume has been very weak.

As you know, we use multiple asset and multiple timeframe confirmation for the best signals, I'd say you can use XLF and a move above the $23 range as a signal that we've arrived at our destination and therefore very close to our downside pivot which is the area where we want to take our most significant actions in entering or adding to trades (mostly shorts). Thus last week's "Patience"post was right on and based on this entire scenario that was predictable as a high probability before it really ever began.

No comments:

Post a Comment