Futures are sliding just after the cash close, after the NASDAQ was able to hold 5k, with lots of struggle.

Interestingly in bond land, it looks like perhaps the WSJ article by Hilsenrath in which 9 of 17 F_E_D members saw rates at 1.13% at the end of 2005 vs consensus of .50% at the end of 2015 as of the close Friday.

This seems like the market (bond market) is taking this seriously because to get to that assuming 25 basis point hikes, the rate hikes would have to begin very soon.

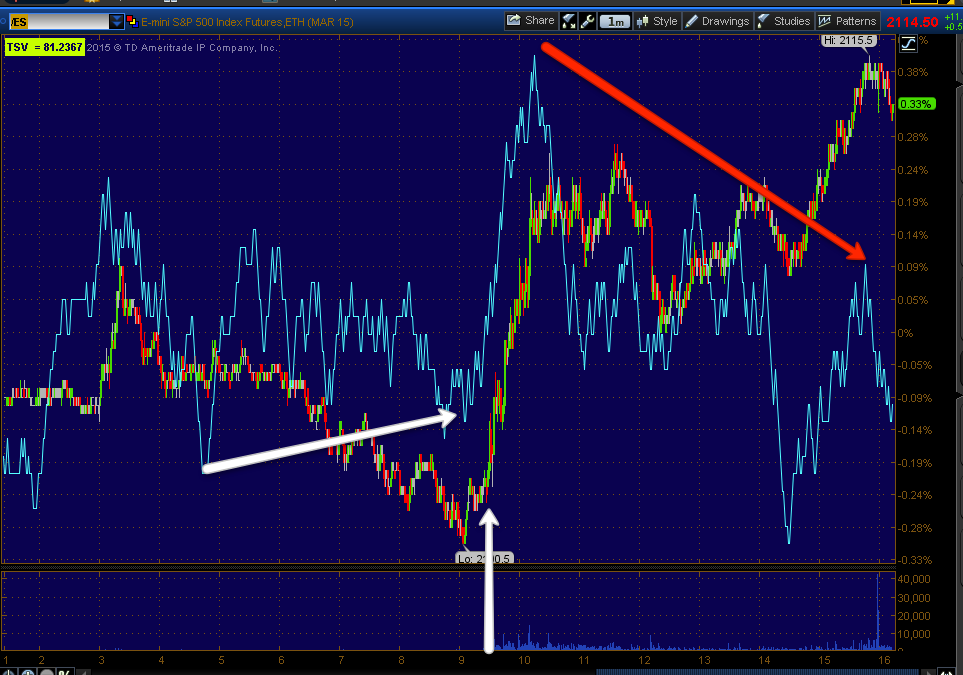

First Index futures which I suspect will look a bit different in a few hours...

ES, to the left there's a positive divergence before the cash open, in line with "Where we would pick up" from the Week Ahead". but also not looking good intraday and losing some ground just after the close.

Dow futures with the same divergence earlier in the morning and the white vertical arrow is the cash open, from there, the divegrence is pretty much downhill with 2 parabolic moves today.

Russell 2000 futures also with a similar divergence pre-market or early morning and a parabolic pop right on the open, but far from confirmation through the cash market.

And NASDAQ 100 futures, also far from confirmation and losing some ground right after the cash close.

VIX futures however remained positive and even more so right in to the close, the bid for protection is stronger than usual, otherwise I don't think I would have put out, Trade Idea: UVXY (VIX Short Term Futures) as these can really move, but are not one of my favorite assets to trade unless the discount and timing look excellent. I think the only asset I like less is Silver, but when VXX hits, it hits.

Interesting the 30 year Treasury futures have a new high on the weak overnight (as short as it is from Sunday night's open) and a negative in to the cash market sending yields higher which helps the market, but a easily seen positive divegrence in to the cash market.

The 10 year also has an easy to see positive divergence, but the 2 short term treasuries that no one is going to want with a rate hike coming sooner than later (and these had been doing well when it was assumed a rate hike was further off)...

5 year Treasury futures have no discernible divergence...

And honestly nor does the 2 year Treasury futures, the two t's that are probably least desirable in a near term rate hike, just happen to look like this after Hilsenrath's piece on where the F_E_D Funds will be, about 2x higher than the market expects for 32015, which wouldn't leave much time to get there, perhaps a hike sooner than expected.

In any case, that's what futures look like right now, I'll check on them again as I suspect they will look different in a few hours now that the psychological magnet of NASDAQ 5k close was hit.

Also of note, although we were expecting the market ramping HYG to come down (see HYG's price action in to the close), it came down a lot more for a single day or faster than I'd have expected, looks like risk off in HY land.

More to come, I'm also going to touch on some position management.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment