OK, I'm headed back home where my internet should be back working in a few hours. As for today's close, in my opinion, considering the breakout and the intensity of the breakout yesterday, the fact there was no follow through today is not good for the bulls. Any manor breakout should always see follow through buying the next day, from the close I don't think you can say we say follow through today.

The Dow closed up .23%

The S&P-500 closed down -.06%

The NASDAQ 100 closed down -.89%

Here's what the end of day 3C charts looked like:

The DIA 1 min chart showing a pretty consistent larger 1 min negative divergence

The Q's showing 2 larger (white ) positive divergences, although the smaller red arrow divergence can be seen working effectively as well. Again, end of day there's a consistent negative divergence.

As I mentioned earlier, the SPY got taken down (3C) quite far yesterday, so all of today's action occurred in a negative 3C posture. The negative divergence at the end of the day is not as bold as the others.

Taking a look at the 5 min chart, you can see just how much damage was done yesterday. Apparntly there was a lot of distribution into higher prices.

Although scaling is not perfect, you can seeAAPL had a lot of influence on the market in the early going.

Later SMH-the semi-conductors took over. AAPL simply did not make the higher highs into the close that SMH did. We have seen this pattern of using one or the other for a few weeks now to juice the market.

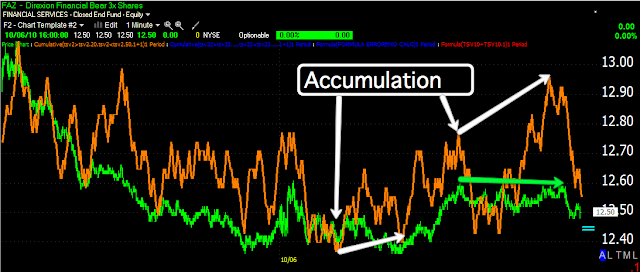

This is the 1 min FAZ chart. The first arrow at the bottom shows the first pocket of accumulation. The green arrow shows price staying locked in a range, but 3C moves higher, again this is accumulation.

To get a better view of the trend without the gyrations of market makers/specialists, the 15 min chart is presented above. The first white arrow is where 3C closed yesterday. The second, where it closed today. Prices were up slightly today with the XLF flat, but the scale of the divergence in quite impressive.

Here is UUP's 15 minute chart. There's an apparent bullish descending wedge and a trend up in 3C. This loks like a very miniature version of the October -December 2009 reversal in te dollar, which was quite a bit bigger.

This is XLF's 1 min with what I believe to be a slight positive divergence at the end of day, we may see early strength in financials tomorrow. It is a difficult divergence to make out though when compared to prices.

The 15 minute chart shows the distribution as of yesterday's close and today's close so the trend has continued, again in the white box, is what I believe to be a small positive divergence.

I'll update more when I get my internet up and running at home, until then I twiddle my thumbs by a candle light. It's amazing how much we rely on the internet.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

6 comments:

Brandt,

So, is the 1min 3C negative diversion we have seen on the SPY, DOW, etc, yesterday and today now null and void seeing as it hasn't carried through to real market action? or do we give it another chance to follow through into tomorrows market action?

Personally, i'd like to see all this criminally fraudulent foreclosure business in the U.S. by the big lenders knocking a few 100 points off the market...

... and by all rights, it should... we certainly need some kind of catalyst. Because all these 'bad employment numbers' just get ignored and the market goes higher.

Mr Pink, forget 3C, what would your expectations of today have looked like last night with today being a POMO day and a huge, strong breakout day? I'm sure you would have expected a bullish day today, most people including myself would.

What did we get today, even with POMO? Almost no movement in the SPY and DOW and the NASDAQ eating into a good chunk of yesterdays intraday gains. That doesn't tell you something about demand? As for NYSE stocks there were 3519 that closed down , there were 2978 that closed up, but of that 2978, there were 1826 that showed the most bearish price/volume combination of the four. So, as far as that group of stocks, only 1152 of 6497 that closed bullishly and that doesn't account for the % gain, a .01% gain on rising volume-which is really nothing, would fit into that group of 1152.

If you think that 3C did not do it's job an call the character of that rally (assuming we agree that you can have two rallies, one that is bullish and one that is less bullish according to internals and breadth) then I think you are simply either not understanding the indicator or are not being fair.

3C is a reflection of the market, what is going on under the surface, much like advance decline lines or other breadth indicators. If smart money is taking their time or doing whatever they are doing, it does not invalidate the readings. For example on a much bigger scale, housing was accumulated for a year plus during the tech melt down. Whoever would have thought homebuilders were going to the next rally's hot ticket item? If we look back over that period of 5 or 6 years, 3C made an excellent call that would have made an investor who doesn't worry about every gyration in the market, a lot of money. However, by your logic, because there was a positive divergence and it didn't move in a certain amount of time, then the indicator is useless. I know OBV and Money Flow didn't pick up on the accumulation, 3C did. So you would never have known about housing stocks as many didn't until they erupted.

If we look at the dollar now, vs the dollar at the end of 2009, we see a mini version of the same thing. that would lead me to believe that the rally won't be as big, but it also tells me that it's not likely to take months of accumulation, it should occur in a shorter period of time. If that is not useful information, because I guarantee you won't find it in too many places, then I don't know what is. No indicators can call the start of a move consistently, not MACD, not RSI, not Stochastics. That is why 3C is used as a piece of the puzzle, not the end all of signals. If you want to compete with Wall Street you have to do your homework. Take a look at some of the big market stocks today and see how they acted.

Also realize that moving the SPY, QQQQ or DIA can be done with a handful of stocks. If it's done with 10% of stocks and the averages are higher and 90% are down, is that a bull market? Is that a strong market? Is that a market in which you want to take a long position?

It seems you spend a lot of your time knocking the indicator, if you find it to be not useful then why bother with it? Some calls are really easy, especially on individual stocks, some we have to wait out, but when 3C started showing accumulation in the dollar in October, if you bought then, you still would have made money when the dollar finally reversed months later. That's a very long term view, but an example.

Hi Brandt,

All i am doing is checking for credibility, and credibility comes from reliability... and 3C has been far from reliable recently in my view.

I only judge based on the information you have provided. You have stated that 1min 3C charts normally follow to real market action the same day or within, say, 24 hours. So, that's why i questioned yesterdays and todays 3C negative divergence charts that you posted.

You also said that the powers that be not allowing the market to go above $150SPY approx. 14 times was significant, and yet it has done.

You also said the SPY 'broke' on the 23rd of September (2 weeks ago now)... and we are still higher.

I only question and check for reliability on what i am told.

Without 3C, today, i expected the market to rise in the morning as POMO monies were pumped into the market and then tail off after it finished, i didn't expect a crash, and that's basically what happened.

You posted this last night which you wanted to get out ASAP after market close:

http://wolfonwallstreet.blogspot.com/2010/10/update_3075.html

Now, tell me, did these 'severe' 1 minute 3C charts deliver on their predictions today? I would say not. The market started up and closed up.

I'm a free thinking, critical thinking human being, i see it the way it is.

Is it not good to question? Do you not admit that 3C has called GOLD and Silver very wrong?

Care to comment on, based on 3C and your experience, when you think this 'mature top' will finally turn? After all you say 3C has successfully seen you through major top and bottoms before? oil, 2009 bottom, etc...

... so you must have some idea? And i'm not buying this 'they need to distribute some more', or 'more retail longs need to be trapped', before it reverses, after well over a month and a 1000+ point rally on the DOW, that doesn't wash anymore.

As zerohedge states... retail are well out of this market, and have been for a long time:

http://www.zerohedge.com/article/22nd-weekly-outflow-mutual-funds-contradicts-earlier-statement-bob-pisani

Also, can you give us an update on what you have advised your 'high roller' client after the recent spurt up in the markets. You said they were close to covering shorts already and i think that was when the SPY was around $140? and DOW was in the 10840-ish?

Much appreciated.

OK, well I have 60+ members and spend 1/3 of my time answering your questions about credibility. I'm hereto help if I can, but if it's credibility you be the judge of that. You did hedge your shorts right? And that was because....?

As far as my "high roller" I told him what 3C looked like yesterday, he was ready to pull the plug, when he heard what I told him he did not. He thanked me today.

Post a Comment