The G-20 meeting produced in practical terms, nothing. Even deals that were supposed to be done before the meeting started, like the the South Korean trade deal, were a total dud. Obama went home empty handed and the G-20 issued a farce statement that in practical terms said, “we accomplished nothing but look forward to working together to accomplish nothing in the near future”. The Fed's QE2 probably didn't help the US side of negotiations as countries all around the world expressed their anger in sometimes demeaning terms toward the Fed's action before the meeting even started. So what does this mean in practical terms? Fundamentals aren't my thing, but understanding what is going on in the world is something that even technicians need to pay attention to. If the G-20 can't talk and negotiate at a time like this, the time for talk may be over. Some of the things I thought were possible unintended consequences of QE2 included currency manipulation/retaliation, currency wars and possibly protectionism or trade wars. The bottom line is the path toward progress has detoured if it ever really began. Europe is in the spotlight, emerging economies are preparing for inflows they don't want and China, as they did on Friday, may turn the markets on their heads with new monetary rules and provisions.

The US macro-economic releases of late, whether they can be trusted or more cynically can simply be expected to be revised down to something worse in the weeks ahead, have come in fairly strong, especially compared to what's coming out of Europe; it doesn't seem to bode to well for a stronger Euro vs the Dollar, despite a solid week of POMO. In fact the recent stronger results taken with the “Walmart Inflation Index” (a secret survey showing inflation is here) that shows inflation (taken from a shopping cart of the usual stuff Americans would buy at Walmart) inflation is headed to 4% a year from now. The Fed, in it's “Dual Mandate” (sorry, I almost typed a LOL as their mandate may be dual but their actions suggest it's a bit more then that) said the second round of Quantitative Easing was needed to boost inflation to their target rate of 2%. So if the Walmart Index is on the path toward 4% on it's own, then either the Fed's reason for QE2 is off base or they may create an inflationary environment that they won't be able to get back in the bottle. Now do you understand what I mean when I say this market at any time is a press conference away from an avalanche?

And then there's the wild card, Ron Paul who will become the Chairman of the House Sub-committee on Monetary Policy. The committee that has dealt with commemorative coins is about to get some real teeth and Ron Paul thinks American are ready to listen. Paul is about to be a major thorn in the side of Bernanke as he's like to abolish the Fed. That may not happen any time soon, but auditing the Fed is a more reasonable goal that he may very well accomplish. Again, tides are turning.

“While the Fed policymakers will try to resist pressure from Paul, they won't be able to ignore it, said John Silvia, chief economist for Wells Fargo Securities. And he said there's a potential for that pressure to influence Fed policy.”

Back to this week's POMO, traders must be a little nervous on the bull side-go figure, 5 days straight of POMO and the bulls are worried? Well thus far it's for good cause with the first operation of QE2 on Friday with a bullish accepted to submitted ratio lead to a loss of 1.18% on the S&P and on increasing volume and a loss of 1.68% on the Russell 2k, nearly the same on the NASDAQ 100, with the Dow-30 fairing the best at -.80%. This week should clear some of that up with 5 straight days of operations, but it wasn't a good start. Are they taking away the “Punch Bowl”?

To the charts...

Remember that article, “What if the market turned and nobody noticed?”. It's simply all too easy to create the illusion of healthy stock markets. If you dig a little though, not even very deep, you can see the underlying trends developing and new ones quickly emerging that argue against the pump of cash into a few select, heavily weighted stocks and select ETFs. It's called looking at market breadth and here's the most current look.

Starting with the New High/New Low Indexes (This is the number of stocks for a particular time period making new highs, minus the number of stocks for the same time period making new lows. For a healthy rally, the index should rise with the rally). The index is in green, the NYSE composite is in red.

The 4 week New High/ New Low Index

There are 3 white arrows showing where the index was at 3 recent rally tops. You can see the current rally is showing the lowest reading of all, meaning fewer stocks in the 4 week period are making new highs and more are making new lows then previous readings. It's not good.

The 13 week New High/ New Low Index

We see the same thing on the 13 week index and this is a significant new low to be made.The 26 week New High/ New Low Index

The 26 week was nearly cut in half in just the last 4 days.

The Cumulative Volume Index.

This is the 2007/2008 period when the Bull market topped out. Look at the NYSE making new highs in October, and then look at the path of volume (red) in a negative divergence. Again, money fleeing the market before the crash.

The Advance Decline Line (advancing issues minus declining issues-a healthy market should see the A/D line rise with prices)

The NASDAQ Composite (all NASDAQ stocks) A/D Line

For whatever reason, the NASDAQ looks like one of the worst, along with the benchmark Russell 2000 below. Clearly there's a negative divergence between price of the composite in red and the A/D line in green even though the Composite is higher then it was in April. Again, the Russell 2000 (which is a great benchmark because of the diversity and number of stocks in the average) is showing a bad negative divergence between the A/D line and price.

Stocks Above their moving averages.

Here we see the % of stocks 1 channel above their moving averages, meaning they are doing well. You can see at the start of October that % was 75.5%, now as prices are even higher, you'd expect to see more stocks above their moving average, not so. The % has been nearly halved at nearly 38% as the market is higher. Here we have the % of stocks trading 1 channel above their long term 200 day moving average. In April it was 76%, now at higher prices it's dropped to 57.7%.

Stocks trading 2 channels above their 200 day moving average. This % has gone from 43+% to less then 26% in 5 days!

Stocks trading above their 40 day moving average (no standard deviations above, just above the 40 day average). You can see what past negative divergences have done to rallies at the top, now we see another dramatic negative divergence.

Now the % of stocks trading below their moving averages. In a rally you want to see this % move down as more stocks participate in the rally and cross above their moving averages.

% of stocks trading 1 channel below their 40 day moving average. From September through present this % has risen from 6% to 22.5%-nearly 4x higher.

% of stocks trading 2 channels (or 2 standard deviations) below their 40 day moving average. This percentage has gone from just over 1% to over 12 % in 2 months.

3C Daily charts for the averages and underlying ETF's-All are in negative divergences.

The DIA

The Dow-30

The NADAQ 100

The QQQQ

The S&P 500

The SPY

Other 3C charts...

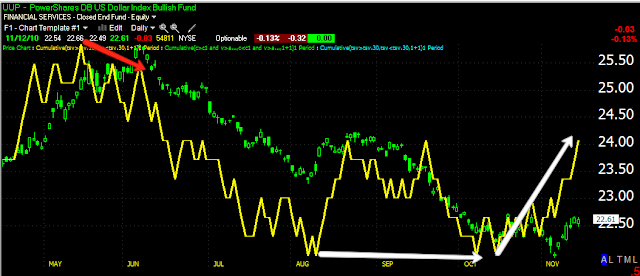

The U.S. Dollar Index in a positive leading divergence

UUP also in a positive leading divergence

XLF in a negative divergence, even as it traded in a lateral channel.

Here is USO (oil) recent trend change...

USO daily chart is confirming the uptrend, but....

The recent hourly chart is showing negative divergences as the uptrend has progressed.

The 30 min chart shows the recent breakdown in USO

Finally, GLD and SLV...

I've been seeing recent negative divergences in GLD, here you can see one at the end of the day Friday

At the same time on Friday, SLV has looked much stronger.

Last on my update... When I started writing this update, the dollar was trading down as the FX markets are now open, when I looked just now, the dollar is trading up against the Euro. Remember that the dollar has an inverse correlation with most asset classes, most commodities, PM's, and stocks. Her is what the FX EUR/USD market looks like as of this moment, although much can change overnight.

This is a 5-min chart, the red arrow is where the FX trading week began.

So tomorrow is POMO and the results of that will be probably the most important thing going on this week in the market. Time to see if the Fed s truly ready to "Take away the punchbowl".

Have a great week. Ideas will be out as the market progresses.

No comments:

Post a Comment