I put together a watchlist of different treasury funds and ETFs, most have extremely low volume, so I picked one that had some decent volume which happened to be an ultrashort and it's counterpart, the ultra.

Remember, we are looking at a VERY recent change in character (also recall Bill Gross's very recent change in stance as if he was hedging against the opinions he's been rather vocal about lately).

This is TBT an Ultrashort 20+ Treasury ETF, it had the biggest volume.

Here's the recent long term outlook which suggested TBT was in for a move higher (same as we saw in silver and commodities, but to a lesser extent in those two-then we saw a change of character in that cycle yesterday)

Here's TBT on a 5 min chart going from bullish to a negative divergence.

The 1 min chart shows this much more clearly.

And here's this morning's price action in TBT on a 5 min chart, that's a pretty steep dive. This would be a candidate, although not too exciting, but it's not the only candidate.

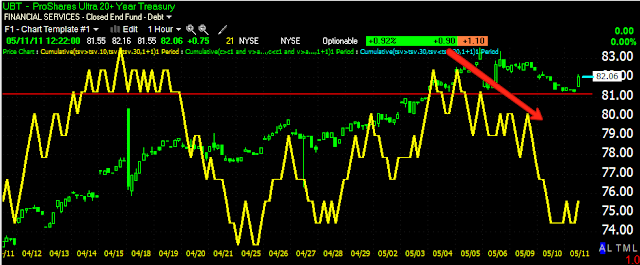

Here's the counterpart, the Ultra or bull 20+ year treasury. First note there's that same long term bullish pattern seen in TLT, with a breakout and a benign pullback.

The long term 3C suggested it was prepping for a decent cycle lower.

The 5 min however has had a recent change in character toward the bullish side with a positive divergence. It should be noted that although this is the same fund, only the inverse, the volume here is much, much lower.

Here's the 1 min chart.

And this morning's price action.

Of the two, I'd chose the higher volume TBT Ultrashort, but as I mentioned, these are not your only choices.

If money is indeed flowing out of commodities and stocks and toward treasuries, then you have significant short sale opportunities in commodities and equities.

Remember late yesterday the breakout in the SPY and I said, "we need to watch this for negative divergences and a breakdown " as it's likely a false breakout?

Well, I'm pretty sure we can call that white box from yesterday a false breakout. Remember the reasons I gave as to "why" they create false breakouts, "the snowball effect", I think that's pretty clear to see as well today.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment