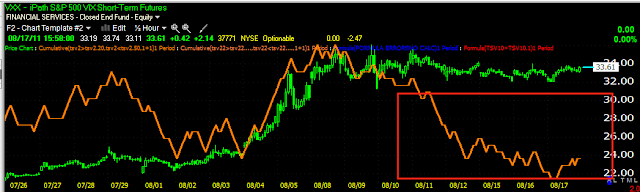

I think the VXX which trades the opposite of the market confirms my general thoughts on how it's going to go down in the market.

First the longer term VXX 60 min is negative, implying a move up in the market as far as the bigger picture.

The 30 min chart is also in a leading negative divergence, again suggesting the bigger picture will include a pretty good rally in the market before the next leg lower.

However, at 15 mins, it is positive and ready to move up, this means the market should move down as I suggested earlier and over the last 4-5 days.

The 5 min chart has some support and is starting to move higher on heavier volume.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment