Here's some pretty surprising charts.

DIA 5 min leading negative divergence and DEEP.

DIA 10 min leading negative divergence

DIA 15 min leading negative divergence

DIA 30 min leading negative divergence!!!

IWM 5 min leading negative divergence, also very deep.

IWM 10 min leading negative divergence, also very deep

IWM 15 min relative negative divergence

IWM 60 min leading negative divergence-this is very negative.

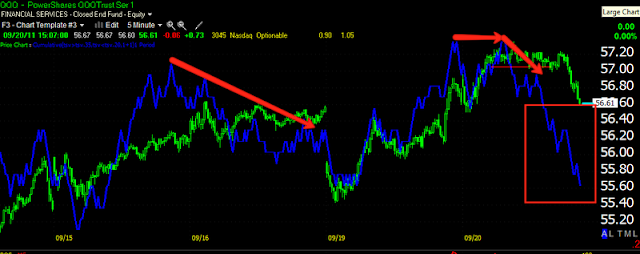

QQQ 5 min leading negative divergence

QQQ 15 min leading negative divergence

QQQ 30 min relative negative divergence-this is a very long timeframe.

SPY 5 min leading negative divergence

SPY 10 min leading negative divergence

SPY 15 min leading negative divergence

SPY 30 min relative negative divergence

When I talked about my theory for this week and the Fed, the important part of seeing a positive divergence build in to the FOMC tomorrow would be a fast drop that is quickly accumulated, that wasn't something 3C could tell us, that was something I thought would need to happen to show a positive divergence in time for the FOMC. However, today seems to have been part of the top (yesterday as well) and we have some very significant timeframes that are negative-30/60 min as well as very nasty leading negative divergences. If we didn't have FOMC tomorrow, I would say including todays action, we'd need at least 3 days minimum to see this move bottom and turn to an up cycle. So this has definitely put a monkey wrench in what I hoped to see. In addition as shown earlier, this is one of the biggest distribution areas, is the biggest, in the entire flag.

So I'll be holding my shorts a bit longer unless we get a huge drop and trying to make some sense out of whatever signals lie ahead.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment