Looking at TODAY'S sector rotation, Energy, Tech and Financials are still the main industry groups performing, as many others fall off. So lets take a look at their 3C charts, although it's still early, we have some decent signals.

XLE Energy

1 min chart saw a positive divergence on the open, now moving toward negative.

The 5 min chart shows the running negative divergence I mentioned last night, it is going negative here.

And the 10 min chart looks horrible, this morning it has added to the leading negative divergence.

XLF-Financals

This s a zoomed out 1 min chart showing the running 1 min negative divergence yesterday

Zoom in closer on the 1 min chart and again there was an opening positive divergence, but since it has turned negative.

The 5 min chart is in a leading negative divergence and getting worse this a.m.

That running 1 min divergence I talked about has accrued on the 10 min chart, which is heading in to a leading negative divergence

Even worse, the 15 min chart accrued as well and is in a leading negative divergence. Financials are very important, especially for the S&P.

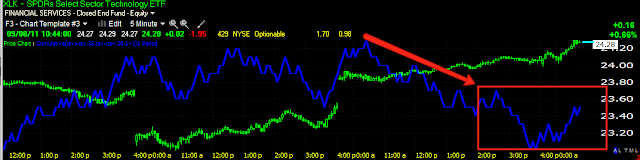

XLK-Technology

The zoomed out 1 min chart with a running 1 min negative divergence yesterday

1 min chart zoomed in and you can see the opening positive and now it has gone negative.

The 5 min chart is in a leading negative divergence.

Here's a closer look at the 5 min chart, negative on this morning's move.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment