Here's an idea that may play right into your hands. SOME OF MY FAVORITE TRADES ARE THE ONES THAT COME TO YOU. Too many traders chase, they chase moves up, they chase moves down and usually they get in right near the end of the move, but being patient and waiting for the setup to come to you, is by far your greatest advantage as an independent trader, PATIENCE.

Here's CAT on a daily chart forming what may be a H&S top or perhaps a broadening top, depending on how much time it has (largely determined by the market). It's looking a bit oversold in price and volume.

The daily 3C chart moves from the end of a long term accumulative cycle with distribution and then posts a worse negative divergence that sends it lower, in fact a leading negative divergence. STOCH/RSI are on a sell signal of what appears to be a major top as well and it's certainly a large cap.

Here we see distribution and then a new accumulative cycle begin, it's a fairly large cycle in terms of days, but....

Friday on a 30 min. chart it went negative with the rest of the market as you can see. I'm sure word of the S&P downgrade was out Friday. So what can they do? They can sell some shares short, take the hit today and regroup.

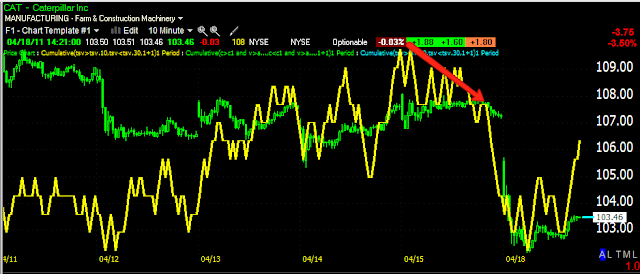

The 10 min chart confirms the same, an accumulative cycle that was confirmed turned in to a negative divergence Friday. Basically, I'd say the cycle was cut short, which tells us something else about the market; as I said last night, they don't usually let these cycles fail, so events may no be spinning out of Wall Street's control or we are seeing the start of that process.

Today's 5 min positive leading divergence suggests they intend to try to recoup a little upside in CAT, so why not let the short come to you? We will most likely be able to see when they have juiced the upside for all they think they can get from it and then we can put on a short at a better price point and a much higher probability with less risk.

The trend channel has tracked CAT very well, so the white box area is the stop, anything we can get as close to that area as possible would give you much lower risk profile.

If you like the trade idea, keep in touch and we'll monitor this one.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment