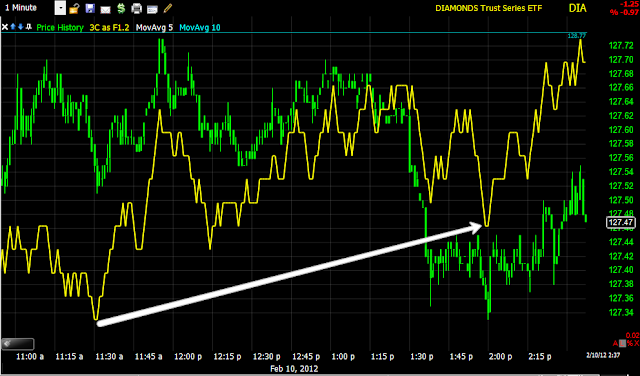

In the afternoon, intraday, the DIA has a small 1 min positive divergence, maybe it tries to fill some of the gap from today.

The IWM shows the same small positive divergence.

The Q's look like they had their best chance early today, there is a positive, but not like the early one.

And a slight positive in the SPY.

It will be interesting if they do move to see whether they move in correlation with the EUR/USD or against it and how far they can get if they do make a move here. Remember a break away gap left unfilled is bad news for the market.

If the Euro can find support at it's intraday lows, it may help the market, if not and slices through to the downside, the market will be trying to swim upstream. One thing is clear, there's no strong underlying support, at best maybe enough to get a gap fill attempt started, maybe.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment