USD/JPY saw a small bump up off last night's positive divergence and headed lower with 3C in line on the move lower, now closing in on $101, $102 is no longer visible on my normal price scale.

And ES has been following USD/JPY tick for tick so it seems our question is answered, the correlation is still there, even if it breaks for a day or two to accomplish Wall Street goals in running these set ups/ cycles.

This is ES intraday 1 min overnight, divergences are causing very small moves, USD/JPY remains in control.

TF has the best looking positive divegrence, but it's only 1 min, it's not that impressive considering the overall situation.

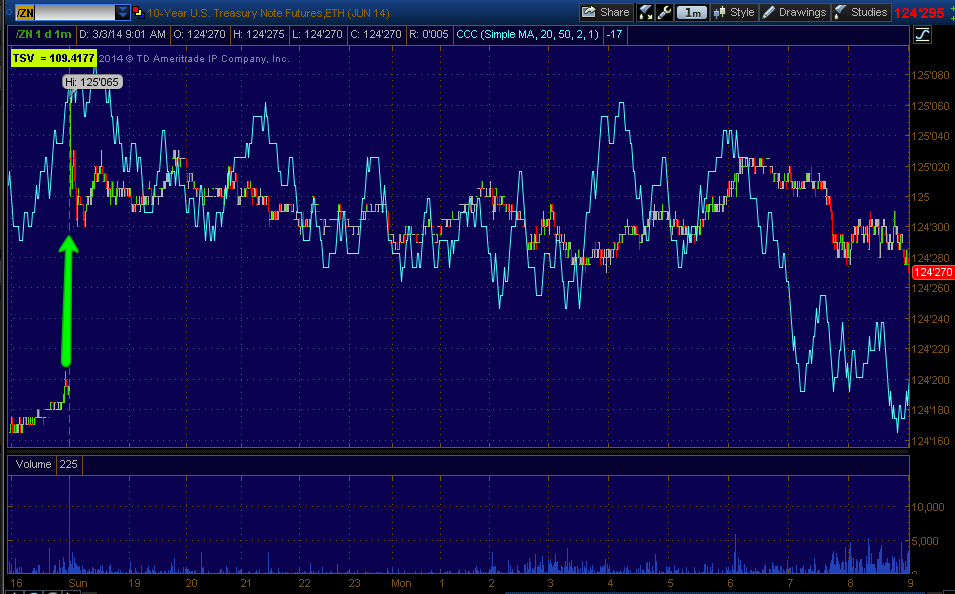

The safe haven bid in treasury futures has dropped off as mentioned last night in a thin market with the underlying market not even open, however we have seen flows to Bunds in Europe and safe haven currencies as well so the flight to safety continues worldwide.

Perhaps the biggest news is in Russia itself where the MICEX Index of Russian stocks has fallen -11% with major banks leading the way with losses between -10% and -20% on the day and this coming after an astonishing 150 basis point hike in rates from the Russian Central Banks to try to halt the devaluation in their currency, the Ruble which is at all time lows vs the $USD and to stem the outflow of funds from Russia.

For perspective, this is the biggest Russian CB rate hike since 1998 two months before the Russian crisis saw them default on their bonds with massive currency devaluation, THIS WOULD BE THE SAME CRISIS THAT ALMOST KNOCKED THE US ECONOMIC SYSTEM ON ITS BACLK WITH THE COLLAPSE OF LONG TERM CAPITAL MANAGEMENT...

You may recall LTCM, the smartest guys in the room including founding members such as the head of bond trading from Solomon Bros. as well as not one, but two Nobel Prize Winners in Economics, yeah, it was the Russian crisis that took LTCM from the hottest management company to the biggest flop we have seen, eclipsing even Lehman and Bear Stearns.

Volatility should remain high, lets see what this week brings, I'd encourage you to look at the trading in terms longer than just a day, volatility should be high and falling for every shake on this kind of volatility will have you in and out of good positions, but it's also a sign of changing character and those precede changes in trends as we can now see clearly.

No comments:

Post a Comment