Since the Pre-Market Update, ES/SPX futures have been in a range off an overnight negative divegrence that they have barely strayed from at all. Since, NQ and TF have been in line with NQ cracking first on an early cash market divergence starting and now TF joins as it starts its own negative intraday divergence which I suspected was inevitable given the very thin range in TICK and the large number of stocks in the R2K.

These were captured about 5 mins ago by the time you get it, however price is already responding on the downside.

ES which was negative almost all night hasn't left the pre-market range.

NQ which went negative for the first time here after being in line all night and...

TF doing the same.

Interestingly...

VIX futures which trade different hours have shown a positive divegrence intraday and...

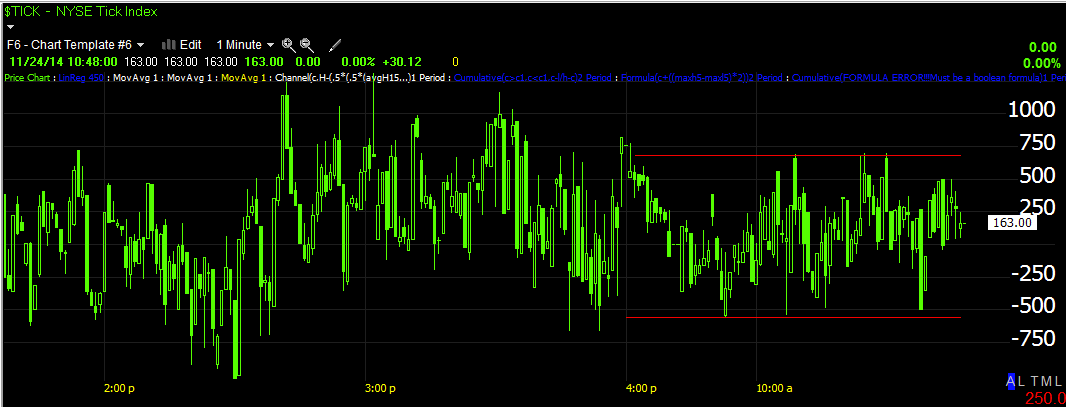

The TICK range has been VERY narrow for an IWM move of 3/4 of a percent, stuck between + and - 600, too narrow a range to support the Russell 2000 for long...

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment