I was especially keen to see what the levers were going to do today as well as some very important leading indicators and of course the 3C charts for the averages as well as Index futures, not everything was quite on board Friday which is why I didn't put out a short call, at least not a specific one, but broadly speaking, I think this is a fantastic area and time.

Lets get right in to it as there are a lot of charts, but I want you to see the evidence with your own eyes the same way you saw it when such a strong move was forecast on the day in which we ended the week with the worst weekly performance in 3 years. Hopefully these concepts will be a part of your trading tool box.

VIX Futures

This is an intraday chart of actual VIX futures, clear improvement can be seen on the chart, protection is being bid, however the VIX lever, although used, didn't move as far from protection as you might think.

Looking at a longer scale 1 min chart of VXX, short term VIX futures, note how it shows 3C almost perfectly in line with price movement, but on the dip in VIX futures after the F_O_M_C, 3C's fastest chart, the one most capable of confirming the downside move... DOES NOT, rather it stays in a leading positive position suggesting some level of accumulation during the move down which would make sense if the move up in the market were expected to be a short lasting knee jerk move with something ugly following.

There's also confirmation in multiple assets through the leveraged long VIX short term futures, UVXY as well as multiple timeframe confirmation as they look exactly the same after the F_O_M_C push lower of VIX futures.

On a 3rd timeframe (longer 3 min), we have more confirmation using the inverse ETF, XIV which moves opposite VXX and with the market. The chart here shows XIV did NOT confirm the upside move, but rather saw distribution in to it.

UVXY 5 min shows the warnings I was posting before the move that gave us the objective evidence to confirm the Mass Psychology theory put forward for the market forecast of a move above a 6 week range in the IWM, however in addition, almost as soon as the F_O_M_C passed there was near immediate accumulation on this 5 min chart which is the demarcation between intraday charts showing intraday moves in the market and a chart long enough and strong enough to show institutional activity intraday.

That's 4 different timeframes, 4 different assets all confirming the same thing. Why such a rush for VIX protection right after the F_O_M_C, in some cases we can see it immediately after the 2 p.m. policy statement last Wednesday.

Even using relative performance, you can see the same thing. I have inverted the prices of the SPX (green) so you can see what the normal correlation between VXX and the SPX is and as you see to the left, they normally move exactly opposite of each other, however right after the F_O_M_C at the red "F", note the relative out-performance of VXX.

Not only does 3C show positive divergences in 4 assets related to VIX futures , but in at least 4 different timeframes with a strong enough bid that the relative performance of VXX price vs the SPX was effected.

The same is true of spot VIX, note the correlation with the inverted SPX prices (green) and the change in relative performance for the better for VIX as of the F_O_M_C.

Treasuries/Bonds

*This is key- The last 2 meetings in September and October the market saw an upside knee jerk reaction after the F_O_M_C, within that 2 to 3 day period, bonds decoupled with stocks and almost immediately after that happened, the F_O_M_C gains were completely erased and in the September meeting's case, a lot more than just the knee jerk as we headed to lower lows at the October lows.

Bonds and yields are key. We witnessed both 30 year Treasury futures and TLT giving ample warning of a head fake move to the upside, I say head fake because even back then the longer charts stayed very positive suggesting any short term divergence would eventually turn back toward the longer term/highest probability chart which they are doing now.

This is the TLT distribution on a 1 min chart I had posted so many times last week as evidence that Bonds/Yields would be used as one of the 4 main levers (Bonds/Yields/TLT, HYG, VIX and USD/JPY).

Here you can clearly see almost immediately after the F_O_M_C on the 17th, we have TLT accumulation that has already led to a move higher in the 20+ year bond fund, thus bonds have already come unglued from equities just like the last two F_O_M_C meetings, IN WHICH BOTH CASES, THE DOWNSIDE SPX REVERSAL TOOK BETWEEN 2 AND 3 DAYS, WE ARE ON THE 3RD DAY NOW.

TLT 2 min also showing the same exact thing, distribution to send TLT lower in to the F_O_M_C (with a small head fake move in yellow as these appear on virtually every reversal in every time frame and every asset). Again the very next day we have TLT accumulation and a move higher with bonds dislocating form equities again. This is one of the key things I was looking for to not only verify our forecast was correct, but the timing of the reversal.

Here the stronger TLT 5 min chart has a much smaller negative divegrence because the distribution to send TLT wasn't strong enough to make it to this chart, in other words they only did enough to ensure TLT would act as a lever as they needed it to until the short squeeze could take over, but apparently they are not willing to part with too much of their safe haven assets in Treasuries which is interesting because at the same time I was pointing out this distribution and thinking something was up well over a week ago, we had just had a scorching 30 year auction with some of the best internals seen in a long time, yet there was distribution in TLT. At the time I thought it's either a shakeout to take those shares from weak hands as there was certainly overwhelming demand for the 30 year auction or something else was going on in which TLT was being used as a lever for a possible market bounce as we had been thinking of a market bounce that week ( the week of the worst weekly performance in 3 years) because of signals like this.

As for the long term or the highest probability directional move , I may revise treasuries at some point, I'm still gathering some new data, but for now, the 60 min chart is confirming the uptrend very well despite some minor divergences here or there that caused pullbacks and rallies.

Here's a closer look showing exactly where the F_O_M_C Wednesday ends at 4 p.m. and where bonds start diverging away from the SPX like last time.

As for actual 30 year Treasury Bond Futures, today as I was hoping to see, they are under accumulation, again, dislocating from their normal relationship with equities.

If we look at one of my favorite Leading Indicators, Yields which move opposite bond prices and thus have a tendency to lead the market and pull market prices toward yields, we get an even clearer picture.

10 year yields in red vs SPX in green

(normal prices-not inverted)

Note how the SPX and 10 year move together, often Yields will lead the market before a new move. Right after the F_O_M_C (white "F") note the failure in yields, this typically acts like a magnet and pulls equity prices toward yields, meaning down.

Over a longer period you can see what happened the last time the 10 year yield and SPX diverged, we saw the worst weekly performance in the Dow in 3 years and 2.5 years in the SPX. Now note the same dislocation of the 10 year (red).

30 year.. I find the 30 year more important in this regard...

You can see that the 30 year yield not only moved with the SPX off the October lows rally, but even led at the lows, making a higher high and low before the SPX had made its low.

Yet again, look what happened at the last divergence between yields and the SPX, the worst weekly performance in 3 years and now look to the far right and see how massively the 30 year yield has dislocated from the SPX and THIS ON TOP OF AN ALREADY HUGE NEGATIVE SIGNAL.

THE OVERALL 30 YEAR VS THE SPX SINCE THE OCTOBER RALLY!

Thus I think you might see how I view this as a piece of the puzzle confirming the move last week was indeed a head fake move intended to set up downside momentum and a lower market low (below October).

HYG-High Yield Corp. Credit, one of the 4 levers most often used. HYG is so often used , as soon as I see a 3C divergence in HYG I know something is up.

So I'm glad to see last week's late distribution in HYG and this morning's continued trend.

The 2 min HYG trend showing 3C migration through longer charts and leading negative. Thus the positive divegrence I saw the week of the 12th and last Monday and Tuesday in which I said, "There's only 1 reason to accumulate HYG", that reason is being put to bed and HYG should continue to lead the market to a lower low as it is severely dislocated and calling for a massive move down in the market.

HYG was in line (green) with it's downtrend until accumulation which on this chart is seen Monday and Tuesday before Wednesday's F_O_M_C.

So again, I ask was it the F_E_D that really moved the market or as we see everywhere and forecasted almost a week before, was the knee jerk reaction just cover for this move, which has a psychological effect of its own. Not only do traders believe the Santa Claus rally is starting, but that the F_O_M_C was dovish, which it was not. The F_E_D just painted themselves in to a tighter corner that is going to cause a more severe market disruption when they are forced what they know they must do.

However the main point is the institutional 5 min timeframe is showing a strong leading negative divegrence right now,

As for the trend and highest probabilities, HYG has been in a confirmed downtrend and as you can see on this 4 hour chart, there's nothing remotely close to positive here.

HYG's (blue) relative performance vs the SPX (green). Note HYG's leading price move at #1 as it makes a higher low and is moving up as the SPX is finding its bottom. As usual, "Credit leads, stocks follow" At #2, you can see HYG has failed to make a higher high like the SPX between the two relative points of the start and end of the trendline. No longer is HYG acting as a market ramping lever, but instead being abandoned as traders don't want to be caught long HYG when the music stops.

Here, even PIMCO's High Yield fund is showing HY credit was not as exuberant as equity and failed to follow it higher leaving it at a deep negative dislocation, although not nearly as deep as HYG's longer term chart.

FX /USD/JPY the 4th ramping lever...

This is the USD/JPY carry pair in red/green candlesticks and the SPX futures (ES) in purple, note this morning and overnight the two were inseparable as algos followed the USD/JPY's lead with ES, however that all changed on the cash open this morning with ES lagging behind USD/JPY intraday .

Furthermore, I believe in addition to the longer term dislocation of SPX above USD/JPY's correlation, we will soon see USD/JPY pull back and all support for the market will fall away, making it impossible to hold even at these rather flat gains today.

Not even considering the macro trends as this post is not about that, you can see $USDX 3C accumulation JUST BEFORE the F_O_M_C. A LEAK Perhaps? We have caught 3 leaks that were blatantly obvious in the past, the F_E_D was caught leaking the F_O_M_C minutes to 154 Institutional and Private Equity firms by email a day in advance of their release (why would the F_E_D email these even if it were an accident when the fastest dissemination of the information is at the actual release?). The F_E_D was caught red-handed helping the banks and out of the 154 firms that received the information, guess how many came out and said, "Excuse me, I think you may have made a mistake in sending us this early?" NONE! AND JUST HOW DOES ONE GET ON THE F_E_D'S MAILING LIST OF THE MINUTES WHEN ALL INFORMATION IS SUPPOSE TO BE RELEASED TO EVERYONE INCLUDING YOU AT THE SAME TIME?

In any case, of the 3 leaks we caught in the past I doubt this is one as it would have been well before the policy meeting even started and there were 3 dissents so things were not in the bag for Yellen.As for leaks, you have to remember the Financial media already have the policy statement hours in advance on embargo so they can write their articles or talk intelligently as soon as the minutes or policy statement are released. How else do you think Jon Hilsenrath of the WSJ writes a 500 word op-ed released 3 minutes after the F_O_M_C minutes or policy statement? The point being, there are plenty of potential leaks out there and I'm sure a Goldman would pay handsomely for the information, but it seems from recent events they don't even have to do that as one of their employees, a former F_E_D employee , routinely received inside information from the NY F_E_D, just out over the last couple of weeks in addition to over 40 some odd hours of tape from a F_E_D employee/whistle blower, but I don't think this was one.

The Yen macro trend looks to be up , but nearby the 5 min chart remains positive as it was lat week.

As is the 7 min chart which was conveniently trashed just before the F_O_M_C leading USD/JPY and index futures higher, The Yen moving up does the opposite, thus recent accumulation after the F_O_M_C increasing in strength suggests the 4th lever, USD/JPY will also fail soon.

As for Index Futures...

This is NQ/NASDAQ 100 futures this morning on an intraday 1 min chart, clearly negative picking up where 3C left off at the cash close Friday and SPY / QQQ certainly underperformed the IWM in early trade as 3C forecast Friday.

ES/SPX futures looked the same, but...

Note how TF/Russell 2000 futures were at least in line, a better or more positive chart than either NQ or ES as 3C's closing divergences suggested.

And the 7 min chat, from a clear leading positive divegrence before the F_O_M_C, another part of our evidence supporting our forecast, the divegrence is negative now and deconstructed.

I believe we are very close to seeing a downside move of special significance as both the Santa Rally and the F_O_M_C knee jerk would be effected and send the market lower on their own, but the head fake move is the real momentum behind any move lower.

Intraday breadth is also fading.

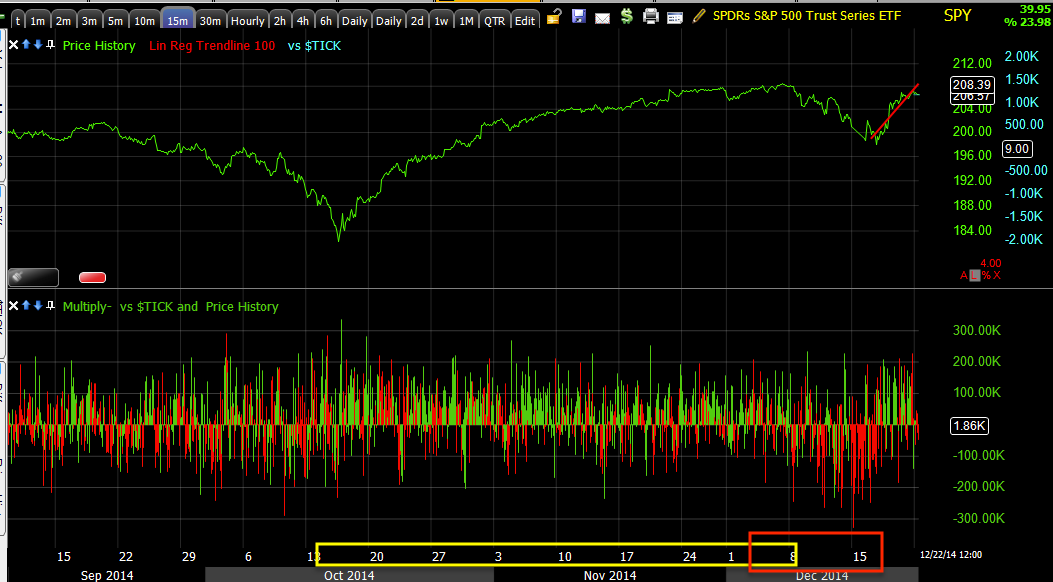

On my custom NYSE TICK indicator, note the fall off of breadth as the October rally advances until the deep red with the former week's worst performance in 3 years, then a head fake move, or the Igloo with Chimney and that is now...

Also fading since the F_O_M_C as you can see on a 1 min chart.

Everything is as I would hope to see it if not better.

No comments:

Post a Comment