USd/JPY opening gains quickly lost after the averages filled most or all of their gaps, however I would not write the pair completely off just yet (more on that in a moment).

As you can see, the SPX futures (ES) in purple are tied very tightly to the USD/JPY's movements (green/red candlesticks) on this 1 min chart from the overnight session to present.

Thus what happens in the Carry pair is of importance to the market.

From our perspective, this week has been about nothing more than managing short positions and letting them work, any upside price gains that are useful to enter new shorts have been pretty difficult to come by, thus just letting current shorts work is really all that I would do other than keep my eye on probabilities and outlier assets. Chasing assets or shorting weakness is ill advised unless you have a fairly wide stop and tolerance for risk as volatility in the area is likely to remain high until a more solid break to a new low, below this week's range occurs.

As for the Index futures, they are remarkably in line with 3C on the intraday charts, for instance...

ES 1 min is perfectly in line with the downside with negative divergences at any attempt to move higher (distribution).

TF / Russell 2000 futures look much the same as this morning's gap fill seen above saw distribution in to that minor intraday strength on the back of USD/JPY.

And NQ/NASDAQ 100 futures also saw a negative divegrence after the bell at the gap fill area.

The short term charts of the averages are reflecting the same...

IWM with a positive divegrence and 3C perfectly in line with the trend since.

IWM 2 min trend showing the major 3C divergences with IWM (distribution) in red and 1 positive divegrence earlier in the week.

As the 3 min IWM chart shows the same, 3C at a new low with price.

The Q's have shown every attempt at higher prices met with selling.

As has the SPY.

However, you saw how tight the USD/JPY correlation is... The component currencies that make up the pair are still warning of another upside attempt or a larger building one.

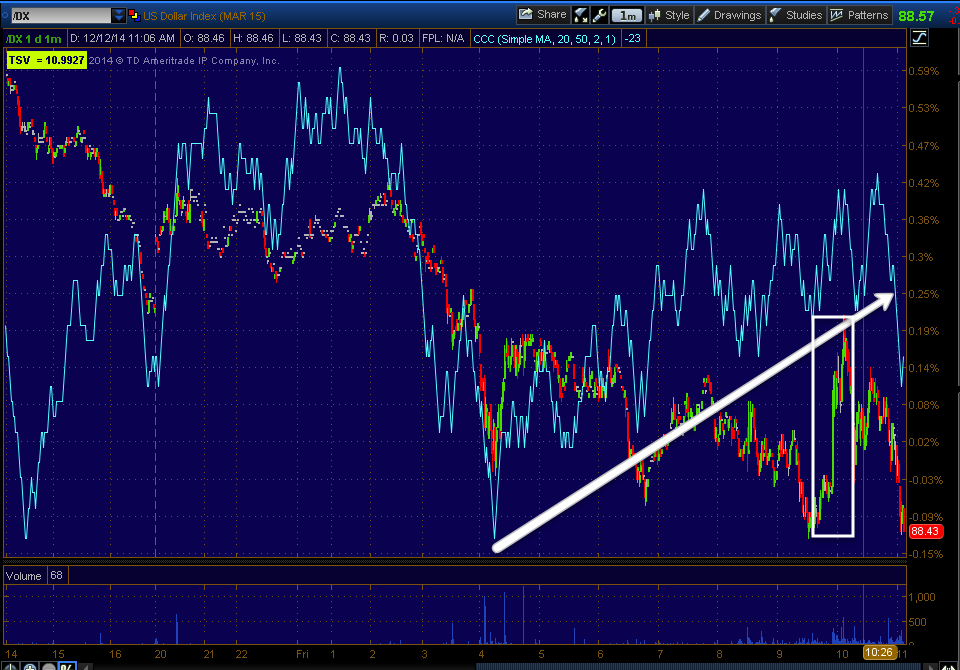

Although the $USD's help pushing USD/JPY higher after the bell to the gap fills was short lived, its positive divergences remains, offering the increasing probability of another USD/JPY move higher and a stronger one.

The other currency in the pair, the Yen...

Saw weakness on the gap fill sending USD/JPY higher after the open and has since found some strength, yet its negative divergence remains as well, both indicating that ?USD/JPY's upside may not be done, in fact it may not have even started in earnest yet.

I'll be keeping an eye on it, however once again, in my view ANY price strength in the market or individual assets you might have reason to sell short should be used for that purpose.

No comments:

Post a Comment