Index futures start mixed. Most have been edging slightly lower, NASDAQ futures have been edging higher in follow-through from yesterday's NASDAQ led gains.

The latest weekly initial jobless claims fell below 1 million for the first time in 21 weeks. Claims totaled 963,000 (consensus 1.150 million). Today's tally was below the prior week's revised count of 1.191 million (from 1.186 million). Continuing claims decreased to 15.486 million from a revised count of 16.090 million (from 16.107 million).

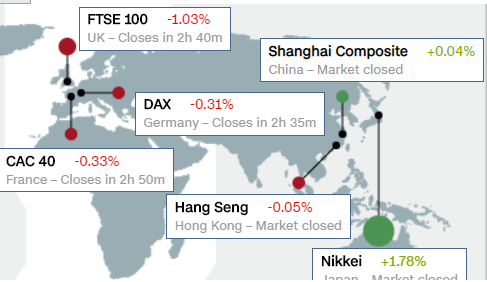

Asia closed mixed, while Europe trades lower.

China's aviation regulators announced that passenger traffic in July was down 34.1% yr/yr after being down 42.4% in June. Australia reported better than expected employment figures for July, but the report does not reflect the impact of aggressive lockdown measures taken at the end of the month.

- China's July FDI 0.5% (last -1.3%)

- Japan's July PPI 0.6% m/m (expected 0.3%; last 0.6%); -0.9% yr/yr (expected -1.1%; last -1.6%)

- Australia's July Employment Change 114,700 (expected 40,000; last 210,800) and Full Employment Change 43,500 (last -38,100). July Unemployment Rate 7.5% (expected 7.8%; last 7.4%) and July Participation Rate 64.7% (expected 64.4%; last 64.0%). August MI Inflation Expectations 3.3% (last 3.2%)

- New Zealand's July FPI 1.2% m/m (last 0.5%)

European officials welcomed the U.S. decision to hold off on imposing additional tariffs over subsidies to Airbus. The two sides will begin a new resolution process. Wirecard will be replaced by Delivery Hero in the DAX. Italy sold 3-, 7-, and 30-yr debt.

- Germany's July CPI -0.5% m/m, as expected (last 0.6%); -0.1% yr/yr, as expected (last 0.9%)

- France's Q2 Unemployment Rate 7.1% (expected 8.3%; last 7.8%)

- Spain's July CPI -0.9% m/m, as expected (last 0.5%); -0.6% yr/yr, as expected (last -0.3%)

S&P futures got a little upward boost from Initial Jobless Claims coming in better than expected, and trade just fractionally above the flat line. NASDAQ 100 futures display relative strength up +0.55%.

U.S. Treasuries trade near their flat lines. The 2-yr yield is flat at 0.16%, and the 10-yr yield is flat at 0.68%.

The U.S. Dollar Index is down -0.4% to 93.07, dipping more on initial claims.

WTI crude futures are flat at $42.67/bbl.

Gold futures are -0.4% to 1940.0/oz., but silver futures are up +1.8% to $26.46. Conversely, Copper futures a down -1.5%- the copper:gold ratio is falling toward the reality of yields.

I'll be watching how HY credit trades today after two ugly days back-to-back.

No comments:

Post a Comment