This 3C has worked well with positive and negative divergences, you can see into this "Friendly trading environment" we have negative divergences, institutional selling into higher prices, though this is a 1-min chart which is the timeframe of market makers. This would suggest that market makers are closing out their long inventory and or going short into the rising prices. It's kind of like a trap, "Come on in" and then the door is shut in your face leaving you holding the bag. That's the impression I get here.

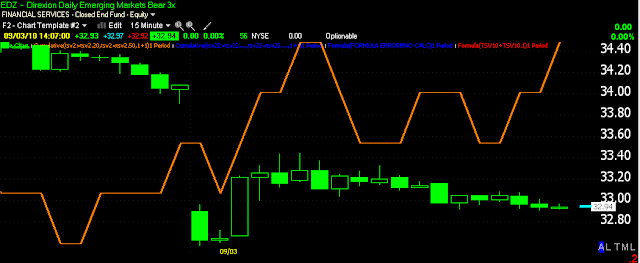

Wy back when we first talked about a malicious bounce, the purpose was to squeeze shorts out, draw in longs and then pull the trap door. Longs are at a loss and sell, shorts jump in and we get a snowball effect. This chart has been extremely accurate in the past on the 5 min SPY. It has shown the initial positive divergence or accumulation that took place at the white arrow to kick this move off, and since, there's been negative divergences suggesting they've been selling and shorting into the entire move.Here we have a long position that is an inverse long-meaning a short on emerging markets, it's under heavy accumulation down here as this 1 minute chart shows. This is a substantial timeframe for Here's the 5 minute-we see the same thing activity.

Here's the 1 minute where market makers operate. Before a big move up they need to stock inventory to sell at higher prices, that appears to be exactly what is happening. A move up in EDZ would suggest a move down in the market. I think we are getting very close and personally we will be buying EDZ here.

No comments:

Post a Comment