AAPL is catching a small positive divergence. Note AAPL's chart just before the breakdown and compare to the Q's and SPY

DIA, several neg. divergences have sent DIA off it's highs and rally attempts, there's a small pos. divergence now.

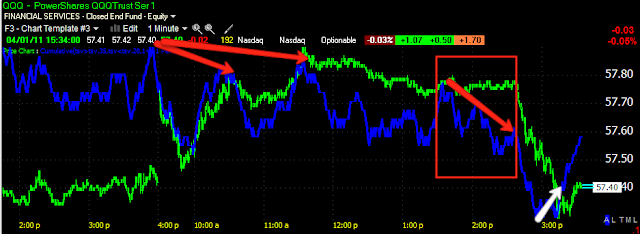

The same is true for the QQQ, but look in the red box, just before the break down, a fairly sharp negative divergence, I'll come back to this.

Here we see the same thing in the SPY.

When market's are through their distribution cycle, there's usually a catalyst or a fulcrum stock for the day that sends them into a reversal, today it appears to be uncertainty about boots on the ground in Libya going into the weekend.

However, the point of those red boxes on the SPY/QQQ are to show what I believe is the speed of the information curve which we are always behind, but it appears that Wall Street got their hands on the information just minutes before it hit the wires and they took action as can be seen by the negative divergences.

Latency is what HFT trading i all about today. As I've mentioned, my Uncle worked for a major Wall Street investment bank and my cousin works on a black box trading system. A few years ago he was telling me about hubs they were installing in different cities (they are based in Atlanta) and they were spending millions of dollars to reduce latency, by nano-seconds. That's how important that edge is and they aren't one of the bigger Black Box firms.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment