This may be a continuation of today and run up, perhaps selling into strength as we saw earlier today into the post market earnings tomorrow.

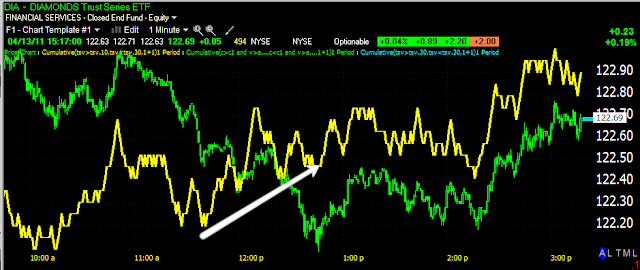

DIA 1 min positive divergence and confirmation since, actually a little bette then confirmation.

DIA 5 min is inline with price.

Here's the interesting chart, the 10 minute with a leading positive divergence.

The IWM selling strength early this morning, a positive divergence from 1-2 pm and confirmation since.

IWM 5 min showing a leading positive divergence.

And the IWM 10 min showing a relative positive divergence at the 1-2 pm area

QQQ 1 min is actually in a leading positive divergence with a slight negative recently inside the leading positive divergence.

The 5 min is inline

And the 10 min is still lagging, but has shown improvement since the last update.

SPY 1 min in confirmation

The 5 min is also in confirmation

The 10 min however is in a nice leading divergence.

I doubt too much can happen in the next 30 mins. to destroy the 10 min positive charts, so I'm assuming we'll see some strength again tomorrow, the question will be whether that is sold into as we saw earlier at the opening gap highs, if so, that may send a signal that there may be a problem with the GOOG earnings.

No comments:

Post a Comment