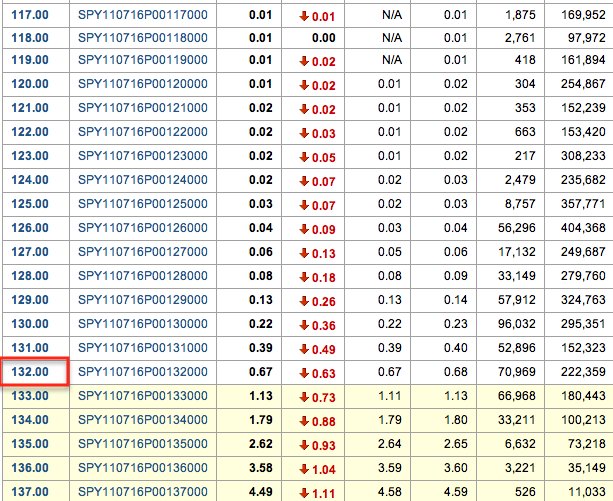

Well we're looking at the options chain again to see where Wall Street plans to pin the SPY. Of course the data can change as we have a couple of days, but here's how it's shaping up and Puts seems to be they key.

CALLS

Looking at the calls, a close around $132 on Friday seems like it will cause the most pain. Remember that even if you own $132 Calls, there's still a $1.11 premium on them, so a close just above $132 doesn't do you much good.

PUTS

There's a lot of open interest in the PUTS, albeit the premium is low in the $120's. It looks like a close around $132-ish ($132.50?) here would also inflict maximum pain when adjusted for the premium. So as of now, I'm looking for a pin somewhere in the $132 range on the SPY. I'll check the chain and see if there has been any significant movement over the next couple of days, but that' where we are right now.

If any of our options traders want to shoot me an email with your thoughts, I'd be glad to hear them.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment