Here's the DIA going back to the March 2009 bottom , the second set of arrows from the left are the end of QE1 and after the announcement of QE2. Now we have a fairly strong 3C reading as well as in the depth charts, but I started talking about this before I created the depth chart, it was apparent on 3C alone. I speculated that we'd most likely make a new low and then see an extended rally, the duration of which would depend on what the catalyst was. I had mentioned QE3 in a tongue and cheek manner, but I was certainly hinting at some sort of FAD policy as that's about the only thing that has moved the market up since March 2009.

A closer look at 3C at the top and the current reading which is stronger then it should be.

As for the long term prospects for this market, more QE=Taller House of Cards. This current long term reading is worse then the 2008 top. I have compared this long range top to every top since 1929 and see this as the worst so when it falls, I think my 2007 prediction of "When this is all over, look for Dow 5,000" could be conservative.

Here's the strength in the shorter term again in the IWM, note this is the strongest period since the launch of QE 2.

A closer look at 3C, which should be at least in line, which would be much lower.

And the long term bearish outlook, a top worse then 2008.

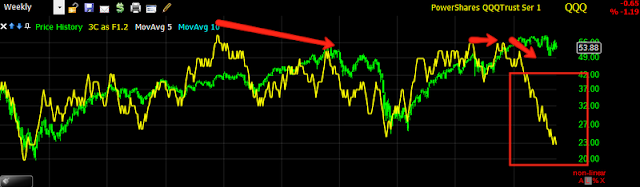

QQQ near term strength, this is the weakest of the averages in this sense.

The close up of 3C now which looks a lot stronger then it should

And the long term projection which is VERY bleak

SPY short term 3C outlook

SPY compared to QE2

And the long term out look compared to the 2008 top.

Now the missing link, very few people picked up on this yesterday.

"Fed’s Bernanke said the central bank might need to ease monetary policy further if inflation or inflation expectations fall significantly."

From Reuters yesterday:

It is something that we're going to be watching very carefully,"

Bernanke said in response to questions from the audience at a forum

sponsored by the Cleveland Fed.

Bernanke said in response to questions from the audience at a forum

sponsored by the Cleveland Fed.

In an effort to stanch the deepest recession in generations and help the recovery, the Fed not only slashed benchmark interest rates to effectively zero, but also more than tripled its balance sheet to around $2.9 trillion.

Despite these measures, growth has remained quite soft, averaging less than 1 percent on an annual basis in the first half of the year. Bernanke signaled he remains concerned about risks to the economy, which the Fed described as "significant" in its September policy statement.

"We have a lot of problems both in terms of recovery and in terms of longer-term growth," he said.

So, do we have Bernanke hinting at further monetary policy? It would behove him to make some progress before the elections because if any Republican is elected, he's out. Sounds to me like this could be the tongue in cheek catalyst I mentioned.

No comments:

Post a Comment