AAPL is still lingering around that resistance level (now technically support).

Commodities are falling out of sync with the SPX's relative performance, I believe commodities are more in line with the currency correlations.

Longer term Commodities vs. the SPX, note they have warned before with negative divergences from the SPX.

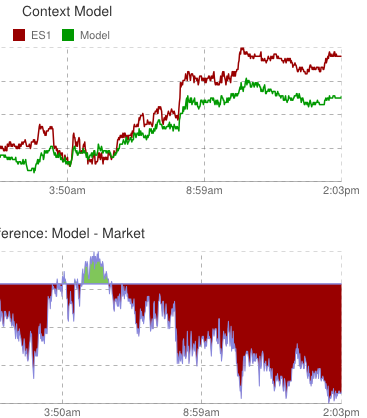

The ES CONTEXT model is sowing ES overvalued vs their model.

Yields which have worked well for divergences also are way out of sync with this SPX move.

Intraday yields started off stronger relatively vs the SPX, since they have fallen way off.

And the FXA/SPX correlation which is now out of sync, thus one of the reasons commodities are diverging. This last hour should be interesting.

No comments:

Post a Comment