When I have more time I'll have to take a look at the options chains and see what the story was regarding an op-ex pin, this is definitely one of the strangest Op-Ex Friday's we have seen in some time.

So I want to just recap what the signals are that suggest we are going to see a monster bounce, while not downplaying the extent of the trouble in the market. I didn't include the ER/USD charts which are a big part of the near term analysis, but they were in the last post.

My gut feeling has been AAPL/Tech would lead a final move. From the start I've felt this move would be the most volatile yet and with the market where it is, it is set up for a volatile move. Right now there are too many people who have it figured out and are short, NYSE short Interest shows it, the huge Put/call ratio shows it and the market action alone shows it. Wall Street doesn't make money by trading with the retail herd, they make money taking it away from the retail herd. I've always asked students/members the question, "What moves the market?" Supply and Demand? That's a mechanism, what moves the market is sentiment, emotion or more accurately Fear and Greed, I think the last several weeks have shown that to be true.

To be clear, any long positions, I have several, are all speculative longs, meaning they are small and don't represent much risk, the larger positions we have been building since the first decent bounce on 3/19, then 3/26, 4/2 and the last on 5/1 have all been short, there's only 2 longs I like for the long run, 1 is still in the oven (URRE) and the other many of us have been in since earlier this year as we saw the change of character and base developing (UNG) is now working and looks to be a secular bull move.

Whether we call a move up in the market, that I feel pretty certain about, a short squeeze, a bounce or a counter trend rally, it doesn't really matter. We know short squeezes produce powerful moves and if you look at counter trend rallies in a bear market, they are typically much stronger than a rally in a bull market, they have to be as their job is to shift sentiment, they aren't there just because, they have purpose.

AAPL was the stock I thought would be the most likely leader of any bounce, that's where most of my speculative longs are, but also a much larger equity short. AAPL also is the 1 stock that can summarize the probability of a sharp bounce and still display the extent to which this market is in trouble and it doesn't take a bunch of chars, really only 1.

As for the 1 chart that shows both, the 60 min is leading deeply negative, below the October lows, yet it has a relative positive divergence as AAPL has declined. Putting in a positive divergence on a 60 min chart is no small matter and suggests something much stronger than just a "bounce". At the same time the position of 3C and how fast it fell apart and how sharply, shows the extent of the trouble in the market. Unless there's Central Bank intervention (and maybe despite it), this market should make short work of the October lows during the summer.

Technology 15 min is still in leading positive position, if 3C confirmed the move down the indicator would be below the blue arrow I placed on the chart.

The bigger picture (and this is why any longs are speculative) can be seen here.

The Dow 30 min is in leading positive territory on the 30 min (the Dow is one of the only averages I can use 3C on intraday, the others I have to use the ETFs).

QQQ 15 min is not looking as great as it was, but it's still holding in a leading positive position, confirmation of the move down would see 3C way below the 3C April lows.

SPY 15 min is also in leading positive position-there's nothing about how 3C and the 3 different versions are constructed that would cause all of these averages to have the same signal.

SPY 30 min is in a relative positive divergence. This would suggest a strong bounce, counter trend rally, etc.

TLT as a flight to safety trade has been seeing negative divergences.

5 min TLT-Treasuies.

A long term view of commodities vs the SPX, something is going on here, this is the first time commods have led the SPX and rallied against the EUR/USD correlation, it looks small on this chart, but it is 5 days of breaking 2 strong correlations.

High Yield Credit isn't overly optimistic, but it's usually lower than the market as Credit is ahead of equities, recently it's been lateral as the market has been down, it even put in a small rally the last hour.

Long Term Yields which have been an excellent leading indicator, you can see where they diverge from the SPX and the SPX falls shortly after, now they are diverging positively, I don't remember ever seeing this big of a positive divergence in yields.

The Euro vs the SPX recently, this correlation is typically very strong, however as we saw something not right early in the week with the currency, it has rallied, broke resistance and the correlation alone would suggest either the Euro needs to fall hard or the market needs to rally, if the Euro breaks $1.30, the short squeeze momentum will be even stronger. The market's break with the correlation today looks like a clear sign of an op-ex related move, there wasn't any news out of Europe worse than what we have seen on much mellower days and the 3C charts were predicting this move in the Euro.

The other side...

I don't want to give the impression at all that this market is bullish, so here are some charts showing how bad this market really is. The DIA 60 min is leading negative below the October lows, WAY below, you can see the distribution at each of the market bounces, as I said back then, "they are selling any strength" and that's why we were doing the same.Although this chart makes it appear the damage started at the top, there were plenty of signs during the rally.

The SPY daily

QQQ daily

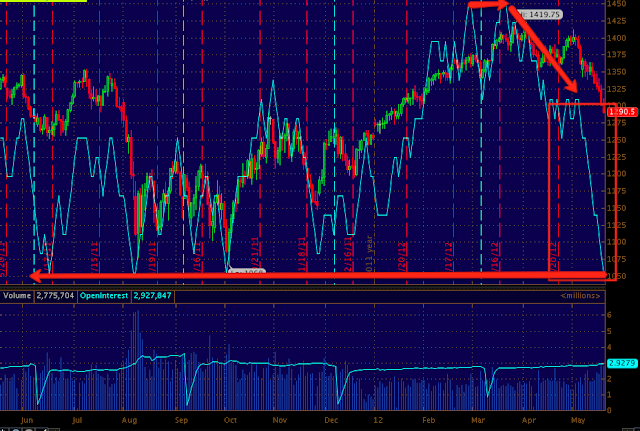

ES daily

I don't think any commentary is needed when viewing those charts.

No comments:

Post a Comment