One of the issues I mentioned in last night's post is the EU's permanent bailout mechanism, the ESM and particularly how Finland, Germany and the Netherlands may handle certain issues pertaining to debt seniority in bailouts, specifically the Spanish banking sector bailout which when first announced came along with the caveat that all debt would be subordinated to ESM loans, meaning that sovereign debt holders (bond buyers) would now be subordinated to the ESM. This announcement drove Spanish yields on the benchmark 10-year note through the 7% level (as a reminder 6% is considered to be unsustainable yields and the rate at which Greece, Ireland and Portugal all sought bailouts as the yield was so high it effectively locked them out of the debt markets).

We had overnight news from the EU that Finland and the Netherlands (two of the 3 Northern countries we suspect will be trouble in ESM dealings as the French election have seen France shift alliances from Germany to its mostly southern PIIGS neighbors in what I term, "The north/south divide") are seeking to block any buying of sovereign bonds in the secondary market via the ESM; a role traditionally fulfilled by the ECB, but the ECB has been all but absent in the secondary markets as yields have risen to 7+% for Spain and over 6% for Italy.

More from Reuters:

Finland and the Netherlands will block the euro zone's permanent bailout fund from buying bonds in secondary markets, the Finnish government said on Monday, despite European leaders' decision last week that rescue funds be available to stabilise markets.

Euro zone leaders agreed at the summit on steps to shore up their monetary union and bring down borrowing costs for Spain and Italy, but they had given few details on the use of the temporary EFSF and permanent ESM rescue funds.

ESM bond buying from secondary markets would require unanimity and that seems unlikely because Finland and the Netherlands are against it, the Finnish government said a report to a parliamentary committee.

The German lower house passed the Fiscal Compact, but since passing it Friday there have been 6 appeals to the German Constitutional Court. As mentioned last week, the headlines and intentions that were born of last week's EU summit are a totally separate issue when it comes to actually passing those proposed measures; to this date Germany still has NOT ratified the ESM and now there may be required changes that stem from the EU summit proposals which could force more countries, such as Finland and the Netherlands to vote on the ESM again - Proposals vs. Reality, this usually does not work out well for the EU.

Germany, AGAIN, for good measure, once again reiterated over the weekend that they are against Euro-bonds any time soon.

The Economics Minister from Spain also said that they expect a slightly deeper contraction for Q2 as compared to Q1 which has seen Spanish 10-year debt rise from the best levels of the day.

Both Chinese official PMI and EU PMI came in weaker than expected with the pan-European PMI below the 50 level signifying contraction and the 11th consecutive month of declining manufacturing readings. Production and New Orders were hit especially hard leading to the sharpest job-losses since January of 2010. The rate of decline in the German numbers was the worst in 3 years with this being the 4th consecutive dip in German Manufacturing PMI (as we all know Germany is the manufacturing powerhouse in Europe).

From the Markit report:

"The Euro-zone Manufacturing PMI suggests that the goods-producing sector contracted by around 1% in the second quarter, with this steep rate of decline looking set to accelerate further as we move into the second half of the year. Companies are clearly preparing for worse to come, cutting back on both staff numbers and stocks of raw materials at the fastest rates for two-and-a-half years.

From Reuters:

"Joblessness in the euro zone rose to a new record high in May, pushed up by lay-offs in France, Spain and even stable Austria, as the 2-1/2 year debt crisis continued to eat away at the currency bloc's fragile economy.

Around 17.56 million people were out of work in the 17-nation euro zone in May, or 11.1 percent of the working population, a new high since euro-area records began in 1995, the EU's statistics office Eurostat said on Monday.

"Unemployment will continue to rise until we see an improvement in the economy, and that may not be until next year," said Steen Jakobsen, chief economist at Saxobank. "The next few months are likely to constitute a low in the growth cycle," he said, predicting the euro zone's economic output to show a contraction in the July-to-September period.

Economists at ING see unemployment reaching as high as 12 percent if European manufacturing does not stage a recovery."

On Chinese Manufacturing PMI...

"Chinese manufacturing indexes slipped to seven-month lows as overseas orders dropped, andSouth Korea cut its estimate for exports this year, underscoring risks to Asian economies fromEurope’s debt crisis.

A purchasing managers’ index for China fell to 48.2 in June from 48.4 in May, HSBC Holdings Plc and Markit said today. A similar measure released by the government yesterday also slid. South Korea yesterday lowered its export growth forecast to 3.5 percent from 6.7 percent.

China, the world’s biggest exporter, may need to add more stimulus to arrest an economic slowdown after the HSBC report showed the steepest decline in overseas orders since the global financial crisis. The nation’s weaker growth is rippling through Asia, with South Korea’s sales to China, its largest market, failing to increase in the first 20 days of June."

Additional Manufacturing PMI released overnight and this morning saw Japan, Korea, Norway, South Africa and Taiwan all dropped below 50, which is contraction.

In the US...

Just moments ago at 10 a.m. US ISM Manufacturing was released....

| Released On 7/2/2012 10:00:00 AM For Jun, 2012 | ||||||||||

|

As you can see, the print came in at a substantial miss to consensus of 52 with a contractionary reading of 49.7 from a previous print of 53.5 in May and 54.8 in April. This is the first sub "50" print since July of 2009. Corp. margins are once again being squeezed as prices which were expected to come in at 57 came in at 37! The Employment sub-index was down from 56.9 to 56.6, and New Orders dropped sharply from 60.1 to 47.8.

Here's the market's response this morning to the US ISM...

The sharp intraday drop is at the 10 a.m. release, bringing the SPX just below the major resistance level.

Gold as a QE/Easing indicator had the opposite reaction as bad news is good news for those looking for the F_E_D to step in with new easing measures and as gold has the most to gain from such easing, GLD reacted favorably to the release.

As for ES and EUR/USD...

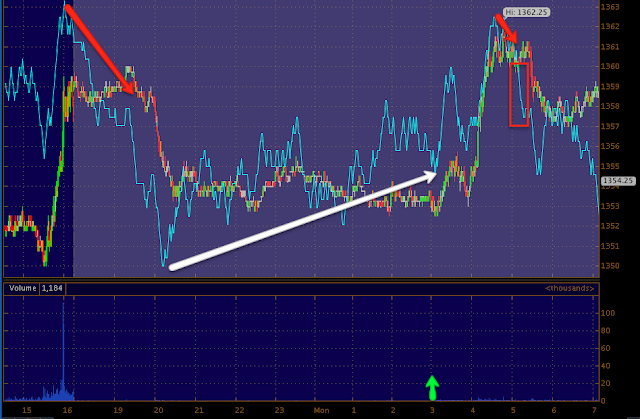

ES when it opened yesterday for the new week saw a negative divergence on the open and lost ground from there. Going in to the European open (at the green arrow) there was a 3C positive divergence which sent ES to the best levels of the start of trade for the week, but soon after saw a negative divergence at those highs.

Here's ES going in to the US open with the European open again at the green arrow, we saw a negative divergence on the open and the reaction to the US data release. We have a possible relative positive divergence brewing right now.

EUR/USD since opening for the week (at the green arrow) as mentioned last night, lost major support/resistance and is now trading under that level.

The FX pair since the US open...

Market Updates coming next....

No comments:

Post a Comment