Again today, like yesterday, the broad risk asset model, CONTEXT shows that ES (S&P Futures) were rich to fair value, the SPY was a bit closer today, but it also was out of rotation in a way.

FCT has been a great leading indicator, ever since the head fake high in the SPX (yellow) FCT has been diverging to the downside, a leading signal hinting at the direction the SPX (green) will eventually take.

Yields, as I often say, are like a magnet for equity prices so to the left we see confirmation of the downtrend and we see confirmation early in the bounce from November 16th, but since yields have been signaling a leading bearish indication for the SPX (green).

The $AUD is my favorite leading currency, it did see some volatility this week with a rate cut from the Australian Central Bank, but it seems to be on track again, it gave a negative divergence vs the SPX (green) on the 3rd and the SPX fell from there, it gave a positive divergence on the 5th and the SPX bounced from there, it was leading earlier today, but has since lost that momentum and has almost met up with the SPX-Reversion to the mean.

High Yield Credit showed a negative divergence on the 3rd also and sent the SPX (green) lower, then a positive divergence in to the 5th that sent the SPX higher, now both are close to reversion to the mean.

Intraday HY Credit did initially show some positive momentum, but in to the close it went negative and was being sold vs the SPX, this may be the start of the negative divergence in credit I'd like to see.

High Yield Corporate Credit also shows a number of positive divergences starting with Tuesday's, it is still leading and I think the market does have more upside as I mentioned earlier, but this could divergence very quickly, the longer term 3C charts for HYG are negative so I would expect that negative divergence to show up.

As we saw earlier, finally the NASDAQ Futures 3C chart (1 min) is starting to see deterioration that is more than just intraday.

The 5 min chart was strong and leading positive, it was one of the main red flags on Tuesday, that positive divergence is totally gone and it is now negative. It has been the very strong 15 min chart (that developed today as we suspected yesterday) that really will be telling.

This was the earlier first sign of some trouble with 3C making a lower high and low.

Here's the current view of the chart, what is encouraging from an analytical view is that the divergences from the 1 and 5 min charts are migrating in to the 15 min chart.

While the deterioration isn't significant or anything that would cause me to change the near term signals and expectations, it does continue to deteriorate.

Tomorrow we'll be looking for continuations of all of these trends, there is a chance we see some very fast moving developments as well as volatility.

This is not the time to be making big directional bets, but to be patient and let the big directional trade signals come to you, there's no reason to be in a trade if it isn't showing high probabilities and that includes the market showing the same probabilities.

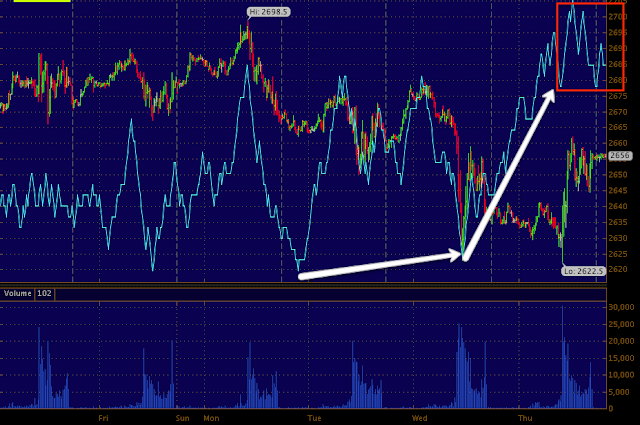

All in all, I think we are still very much on track from the initial analysis on Tuesday which is kind of amazing considering how fast it all happened.

No comments:

Post a Comment