I haven't said anything about picking up ERY on a pullback because there hasn't been one and I haven't said anything beyond I like this area (that means if I wanted to I'd have no problem buying ERY here, but if I only had a little to add, I'd be more picky and if I miss it, no big deal, I'm already set for the most part).

It does, as of now, look like ERY will pullback a bit, but you have to remember these are short term charts, even though they are bouncing back in the market (remember I said I wasn't convinced about the downside move on the WMT news, meaning I still felt the market had some additional upside intraday), but that is an example of how the shorter term charts "Can" be steam rolled, this doesn't happen often, it happens when we are near a market turn and just as it happened with AAPL, instead of getting that slightly better short sale entry on some short term positive divergences, the Hedge Funds all broke from the normal herd and said, "He who sells first, sells best" and there goes your intraday divergences (1-3 min.)

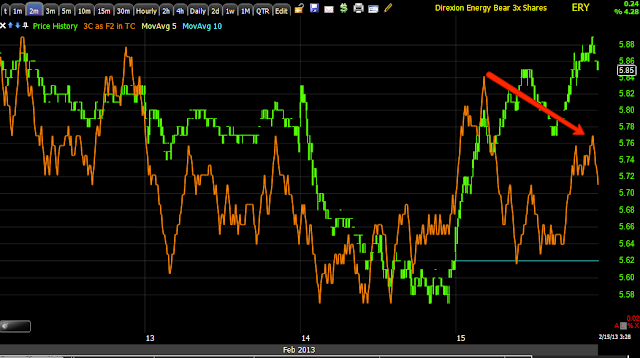

Energy and ERY charts...

XLE 60 min, to the far right, that's the big trouble

XLE 30m, the head fake move, it's already been identified a a head fake, any longs who bought the breakout lost money and many would have been stopped out as they put their stops way too close at "Support", the negative divergence tells us what we need to know about what smart money was doing selling to retail.

Intraday 1 min, positive so XLE can run and ERY pullback

XLE 2 min, intraday the same thing, note the distribution in the head fake move.

3 min XLE, again, distribution in the head fake move, small positive in the area.

ERY 2 min looks like it will pullback a bit, that's why I prefer not to chase if I don't have to.

ERY 15 min on its own head fake move, just the opposite result.

ERY 60 min, al of you who asked for weeks whether it was time to even start phasing in to ERY long and I said, "Be Patient", doesn't this look a lot better?

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment