I was asked if today looked like a typical op-ex pin day as we have been seeing them even on the weeklies, but with volatility so low (I mean record lows, I looked at more than 20 different CBOE volatility indicators, almost every one well below the lowest low on record), I'm not so sure that's what they were, maybe, but maybe not.

So far this morning the market signals are as dull as they could be, they are a bit mixed, the TICK has to be at a record low range and the move in Energy tells me something is up.

Here's what we have so far as a baseline of the boredom factor at 10, but I want to be prepared for a change and when I see it, you'll know what it means having seen the baseline.

DIA1 min-the least influential intraday timeframe has a very slight positive, it might even be left over from earlier.

Since the last respectable 5 min negative, the DIA is flat.

IWM 1 mi trend is going leading negative, this is one to watch.

IWM 5 min trend is also going negative, a more impressive timeframe.

QQQ 1 min has a little strength, not anything I'd bet on here though, not even speculative.

QQQ 5 min is totally flat.

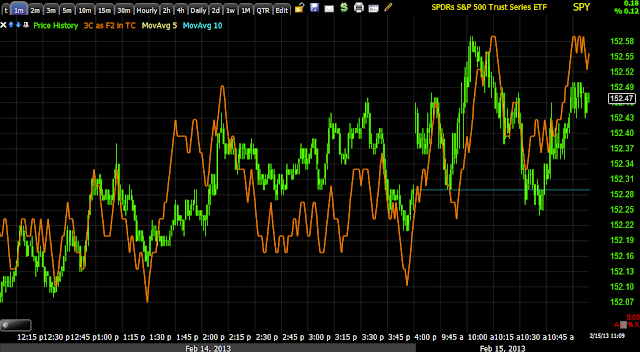

SPY 1 min is perfectly in line, no signal.

But the 5 min is quite negative here. I am glad I didn't endorse the weekly put, the time decay would be eating this alive.

ES with an earlier positive 1 min and a negative currently.

NASDAQ futures are really little better than in line, average trade size is appallingly small.

And the TICK is the cherry on top, it's in the +/- 500 range, this is something you rarely see, to run between the +/- 750 range is dull, but 500?

Yet Energy is quite volatile, pay attention today, this may be more interesting than you might otherwise expect.

Is interest rates about to start going up?

-

Yes, I know - it does not make any sense - FED is about to cut

rates...but....real world interest rates are not always what FED wants it

to be.

6 years ago

No comments:

Post a Comment